Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

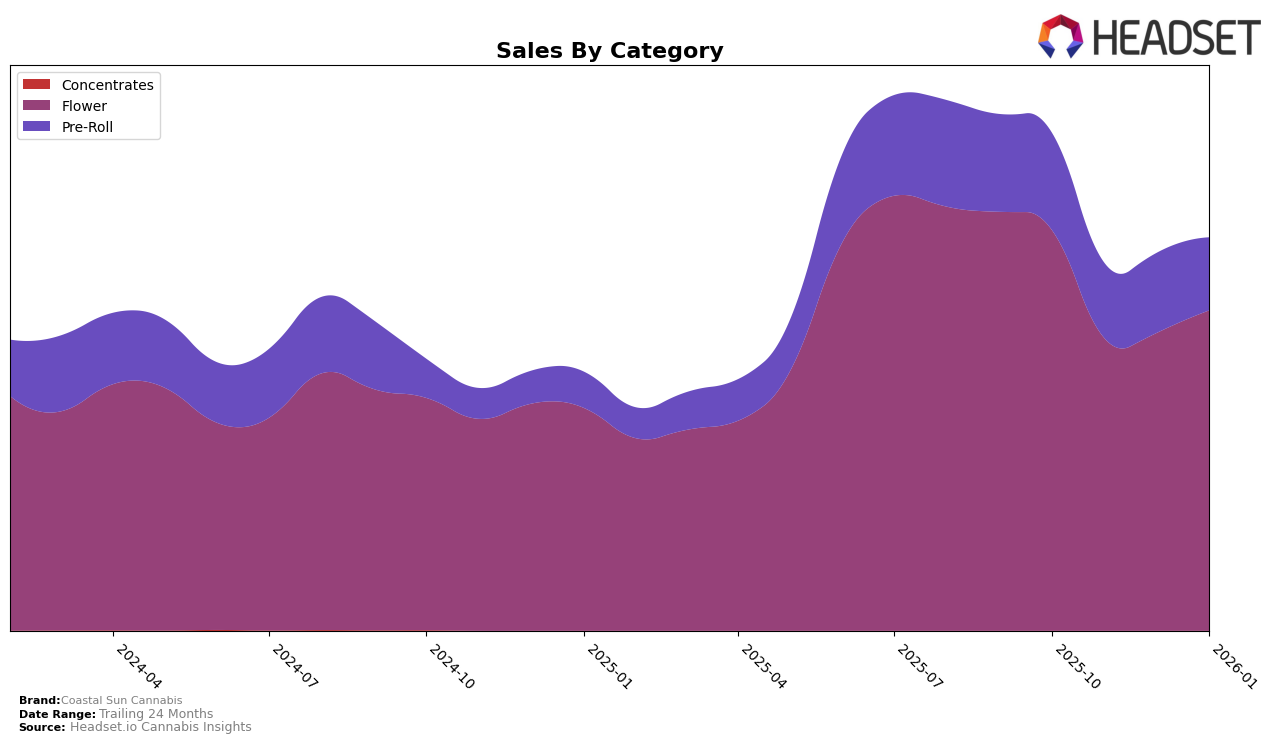

Coastal Sun Cannabis has shown varied performance across different product categories and states. In the Flower category within California, the brand experienced a notable fluctuation in its rankings. Starting at 9th place in October 2025, the brand dropped to 16th in November but managed to climb back to 11th place by January 2026. This movement suggests a resilience and potential recovery in consumer demand for their flower products, reflected in a gradual increase in sales from November to January. However, despite these positive trends, the brand's absence from the top 30 in other states suggests limited market penetration beyond California.

In the Pre-Roll category, Coastal Sun Cannabis maintained a consistent presence in the rankings, although at the lower end of the top 30. The brand ranked 21st in October 2025 and dropped to 29th by November, maintaining that position through January 2026. This indicates a challenge in gaining significant traction in the Pre-Roll category, as evidenced by the declining sales figures during this period. The consistent ranking at 29th place suggests that while they have a foothold, there is considerable room for improvement to move up the ranks. The absence of Coastal Sun Cannabis from the top 30 in other states for this category highlights the need for strategic expansion or enhancement of their Pre-Roll offerings to capture a broader market share.

Competitive Landscape

In the competitive landscape of the California Flower market, Coastal Sun Cannabis has experienced notable fluctuations in its ranking over the past few months, which could impact its market positioning and sales strategy. Starting from October 2025, Coastal Sun Cannabis was ranked 9th, but saw a decline to 16th in November, before recovering slightly to 14th in December and 11th in January 2026. This variability suggests a competitive pressure from brands like Fig Farms, which maintained a relatively stable position, ranking between 8th and 10th during the same period. Additionally, Alien Labs demonstrated strong performance with a top 10 presence throughout, despite some fluctuations. Meanwhile, Pacific Stone showed a consistent improvement, reaching the 12th position by January 2026. The rise of West Coast Treez from 18th to 13th also indicates increasing competition. These dynamics highlight the need for Coastal Sun Cannabis to adapt its strategies to maintain and improve its ranking amidst a competitive and shifting market landscape.

Notable Products

In January 2026, GMO Garlic Cookies (3.5g) maintained its top position for Coastal Sun Cannabis, continuing its streak as the number one product since October 2025, with sales increasing to 5427 units. Banjo (3.5g) also held steady in the second position, though its sales figures showed a slight decline compared to previous months. The GMO Garlic Cookies (14g) entered the rankings at the third position, highlighting a new preference among consumers for larger quantities. Vice City Pre-Roll 10-Pack (3.5g) debuted at fourth place, indicating a rising interest in pre-rolls. Pink Certz (3.5g) rounded out the top five, showing strong initial sales as it entered the rankings for the first time.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.