Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

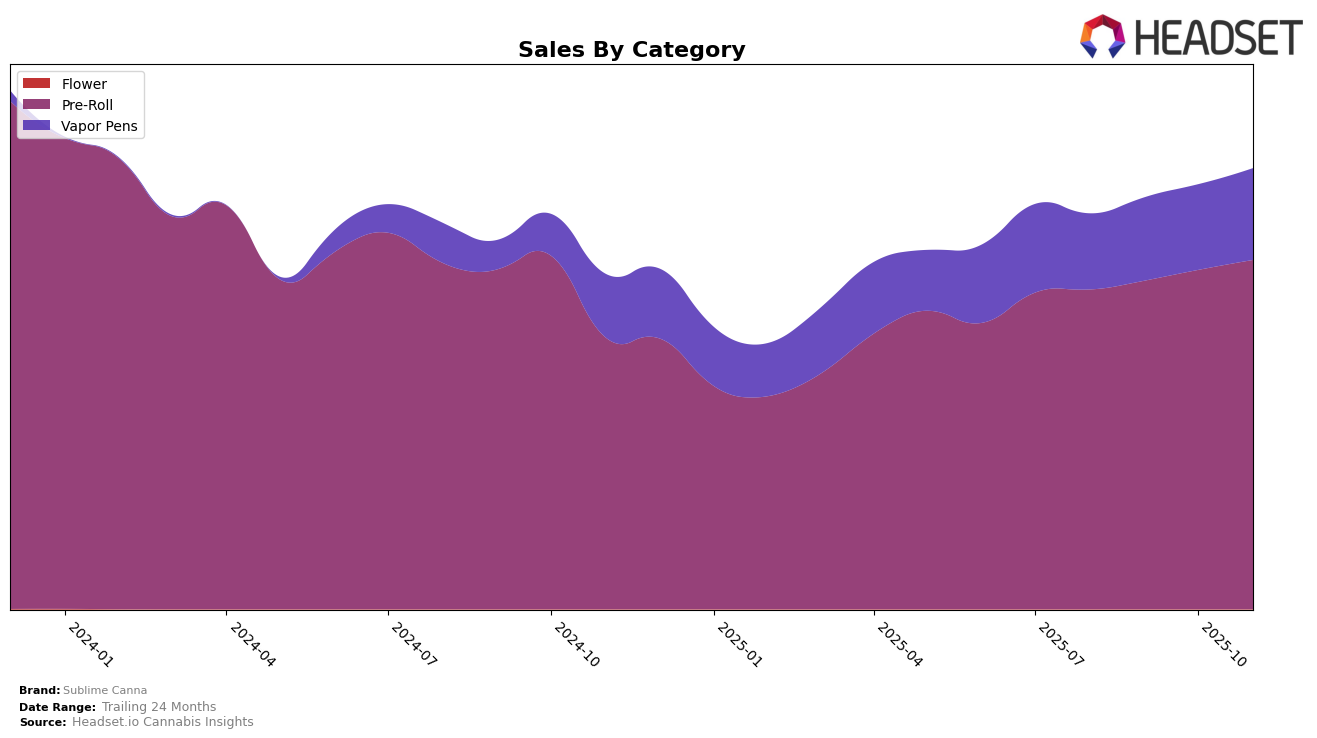

Sublime Canna has shown consistent performance in the California market, particularly in the Pre-Roll category. Their ranking improved from 32nd in August 2025 to 28th in September, and they maintained a steady position at 29th in both October and November. This indicates a stable demand for their products in this category, with sales figures reflecting a gradual increase over this period. However, it's important to note that while they are within the top 30 brands in Pre-Rolls, their presence in other categories, such as Vapor Pens, does not rank as highly, suggesting room for growth in diversifying their market reach.

In the Vapor Pens category, Sublime Canna's performance in California shows a positive trajectory, moving from 91st in August to 80th by November. This upward movement highlights a growing acceptance and popularity of their vapor pen products, although they remain outside the top 30 brands. The increase in sales from approximately 91,284 USD in August to 110,331 USD in November underscores this trend. Despite not being in the top 30, the consistent improvement suggests that with strategic efforts, Sublime Canna could potentially enhance their standing in this segment, further solidifying their presence in the California market.

Competitive Landscape

In the competitive landscape of California's Pre-Roll category, Sublime Canna has maintained a relatively stable position, ranking 29th in both October and November 2025. This stability comes amidst a dynamic market where competitors like Raw Garden and Connected Cannabis Co. have shown notable upward mobility, with Raw Garden climbing from 31st to 28th and Connected Cannabis Co. from 34th to 31st over the same period. Despite these shifts, Sublime Canna's sales have consistently increased, indicating a robust consumer base and effective market strategies. Meanwhile, Sunset Connect experienced a decline from 23rd to 27th, which might suggest opportunities for Sublime Canna to capture additional market share if they can leverage their steady sales growth. While Fig Farms saw fluctuations, ending November at 30th, Sublime Canna's consistent ranking suggests resilience against competitive pressures in the California market.

Notable Products

In November 2025, Sublime Canna's top-performing product was the King Fuzzies Fruities - Blueberry Dream Infused Pre-Roll (1.5g), maintaining its first-place rank consistently from previous months. The Blueberry Dream Infused Pre-Roll 5-Pack (2.5g) rose to second place, showcasing a notable increase in sales to 1607 units. The Fuzzies Shorties Fruities - Lemon Diesel Infused Pre-Roll 5-Pack (2.5g) remained steady in third place, indicating stable demand. The King Fuzzies - OG Kush Infused Pre-Roll (1.5g) entered the rankings at fourth place, highlighting its growing popularity. Lastly, the Fuzzies Delights - Honeydew Infused Pre-Roll 5-Pack (2.5g) dropped to fifth, following a consistent decline from its peak in August 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.