Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

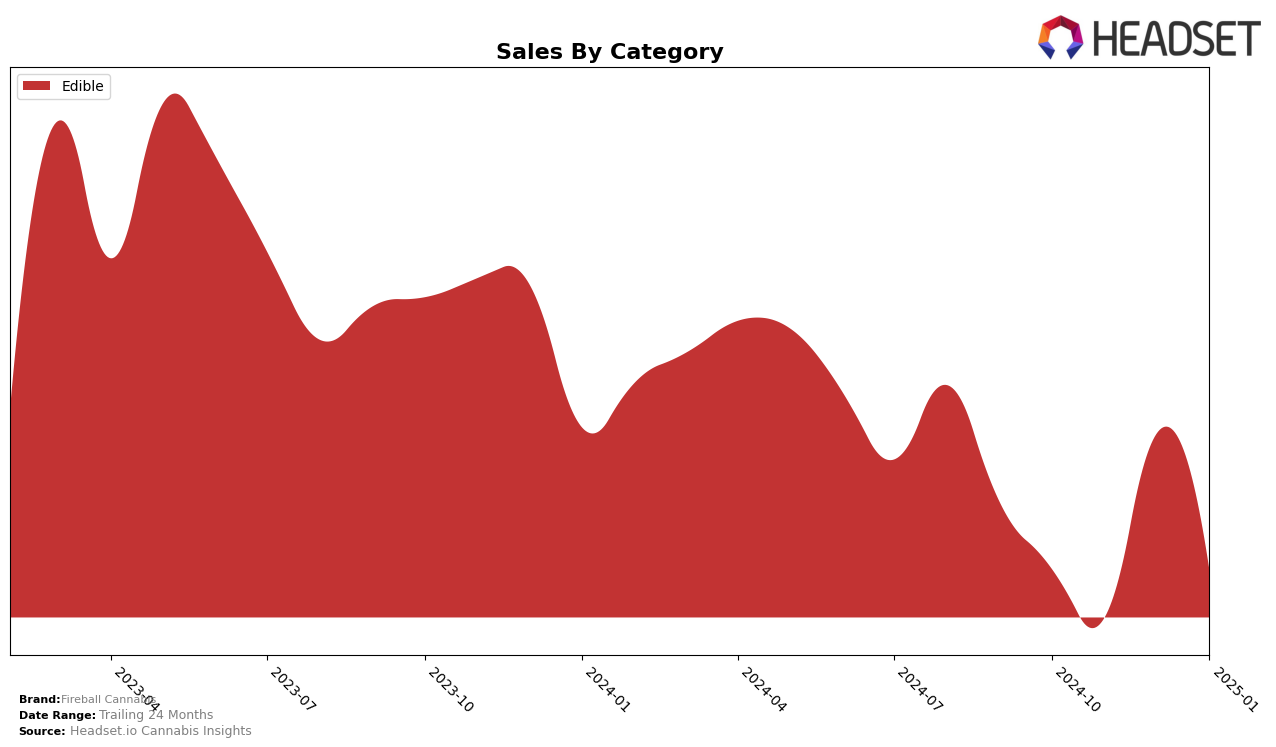

Fireball Cannabis has demonstrated varied performance across different states and categories in recent months. In Maryland, the brand has maintained a presence in the Edible category, although its ranking has fluctuated. Starting at 27th place in October 2024, Fireball Cannabis dropped to 29th in November, climbed to 23rd in December, and fell back to 29th by January 2025. Despite these shifts, a significant sales peak occurred in December, suggesting a temporary surge in popularity or promotional activity. The brand's ability to stay within the top 30 indicates a consistent, albeit modest, presence in the Maryland market.

In contrast, the performance of Fireball Cannabis in Missouri presents a more challenging picture. The brand was ranked 37th in October 2024 in the Edible category, but it did not make it into the top 30 in November, indicating a struggle to maintain momentum. However, it re-entered the rankings at 35th in December, only to fall out again in January, ranking 39th. This inconsistency suggests that while there is some interest in Fireball Cannabis products, the brand faces stiff competition and challenges in sustaining a strong foothold in the Missouri market. The absence from the top 30 in certain months could be a point of concern for the brand's strategy moving forward.

Competitive Landscape

In the Missouri edibles market, Fireball Cannabis has shown a fluctuating performance in terms of rank and sales over the past few months. Despite missing from the top 20 in November 2024, Fireball Cannabis rebounded in December 2024, climbing to the 35th position, which coincided with a significant increase in sales. This suggests a strong recovery and potential for growth. However, in January 2025, Fireball Cannabis dropped to the 39th position, indicating a need for strategic adjustments to maintain momentum. In contrast, Atta has consistently improved its ranking from 28th in October 2024 to 35th in January 2025, albeit with declining sales, which may suggest a focus on market penetration over revenue. Meanwhile, Hermit's Delight showed a promising upward trend, moving from 38th in December 2024 to 33rd in January 2025, with a corresponding increase in sales, highlighting its growing consumer appeal. Fireball Cannabis must address these competitive dynamics to enhance its market position and capitalize on growth opportunities in the Missouri edibles category.

Notable Products

In January 2025, the top-performing product from Fireball Cannabis was the Sativa Cinnamon Live Resin Gummies 10-Pack (500mg), which climbed to the number one spot with sales of 533 units. Following closely, the Fireball Gummies 10-Pack (100mg) secured the second position, improving from its consistent fourth place in the previous months. The Sativa Cinnamon Fruit Chews 20-Pack (100mg) also showed strong performance, maintaining a steady presence in the top three. The Cinnamon Red Hot Gummies 10-Pack (400mg) experienced a slight drop, moving from second place in December 2024 to fourth in January 2025. Notably, the Sativa Cinnamon Live Resin Gummies 10-Pack (100mg), which held the top rank for three consecutive months, fell to fifth place, indicating a significant shift in consumer preference.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.