Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

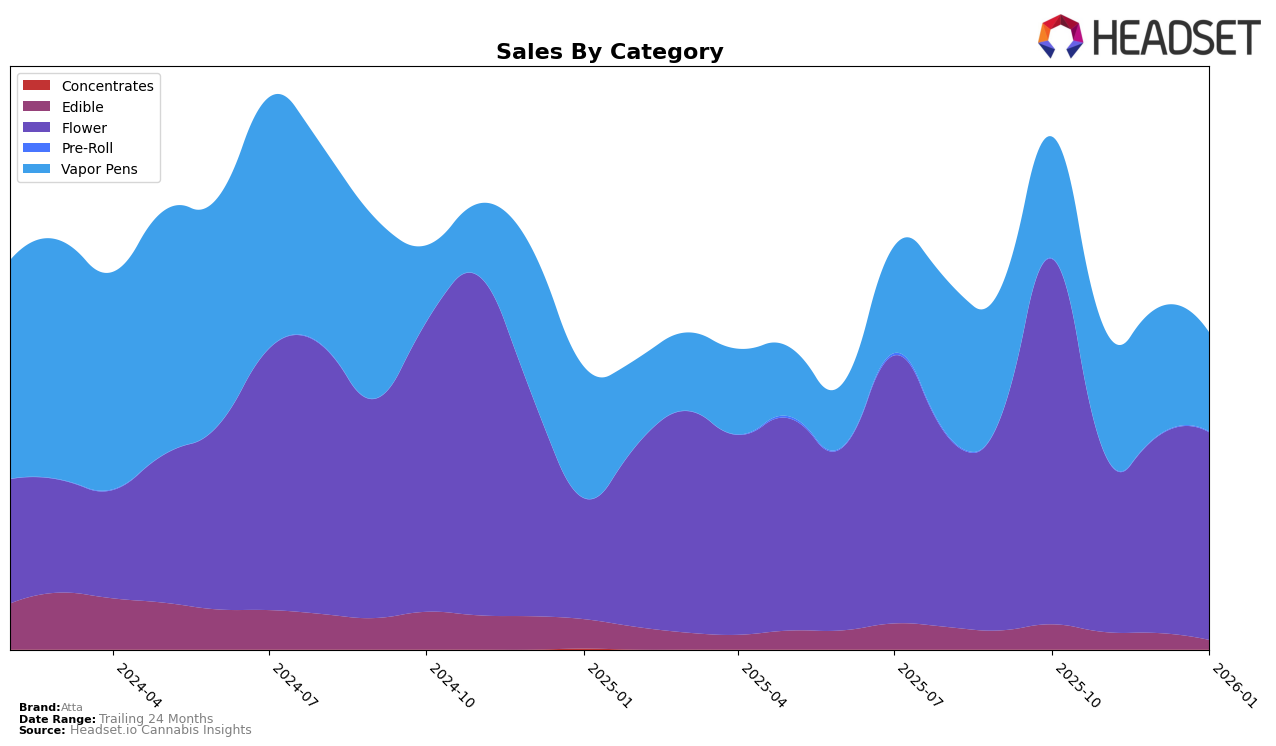

In the state of Missouri, Atta's performance across various cannabis product categories shows a nuanced picture of their market presence. In the Edible category, Atta has not managed to break into the top 30 brands, with rankings slipping from 38th in October 2025 to 46th by January 2026. This downward trend, coupled with a consistent decline in sales, suggests challenges in maintaining consumer interest or competitive pricing. On the other hand, their presence in the Flower category, while experiencing a dip in November and December 2025, saw a rebound to the 25th position by January 2026, indicating some resilience or strategic adjustments that helped regain some ground.

Atta's performance in the Vapor Pens category in Missouri presents a mixed outlook. Starting at 29th in October 2025, the brand slightly improved to 28th in November and December but fell to 32nd by January 2026. This fluctuation points to a volatile market position where maintaining a stable ranking seems challenging. Despite these ups and downs, the sales figures showed a peak in December before declining in January, hinting at possible seasonal factors or shifts in consumer preferences affecting demand. Understanding these trends could be crucial for Atta as they strategize to enhance their market share and stabilize their rankings across categories.

Competitive Landscape

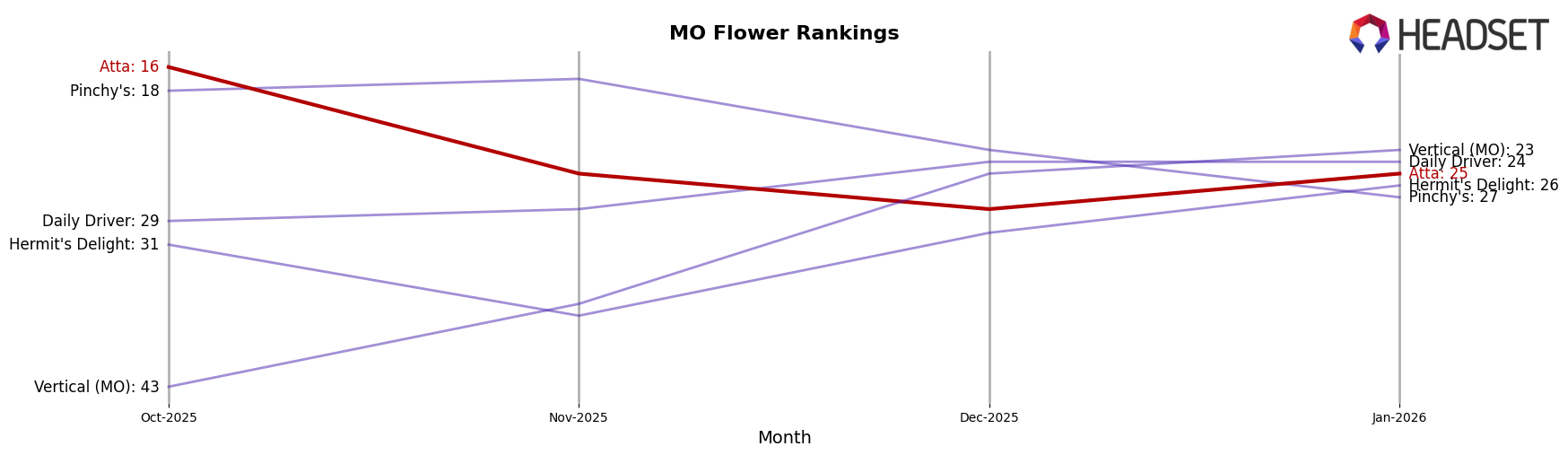

In the competitive landscape of the flower category in Missouri, Atta has experienced a dynamic shift in its market position over the past few months. Initially ranked 16th in October 2025, Atta saw a significant drop to 25th in November, further slipping to 28th in December before slightly recovering to 25th in January 2026. This fluctuation in rank coincides with a notable decrease in sales from October to November, followed by a gradual recovery towards January. In contrast, Pinchy's maintained a relatively stable presence, starting at 18th and ending at 27th, despite a decline in sales. Meanwhile, Daily Driver and Vertical (MO) showed upward trends, with Vertical (MO) notably climbing from 43rd in October to 23rd in January, suggesting a strong sales performance. These shifts indicate a competitive market where Atta faces challenges in maintaining its rank amidst competitors who are either stabilizing or improving their positions.

Notable Products

In January 2026, the top-performing product for Atta was Miracle Mintz (3.5g) in the Flower category, achieving the number one rank with sales of 2113 units. Grease Monkey (3.5g), also in the Flower category, ranked second, though it experienced a slight drop from its first-place position in December 2025. Bunny Runtz (3.5g) maintained a strong presence by securing the third spot, climbing up from its previous absence in ranking. Super Snocone Distillate Cartridge (1g) in the Vapor Pens category slipped to fourth place despite its top position in October 2025. Fantasy Melon Smalls (3.5g) rounded out the top five, showing a stable performance compared to its fluctuating ranks in prior months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.