Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

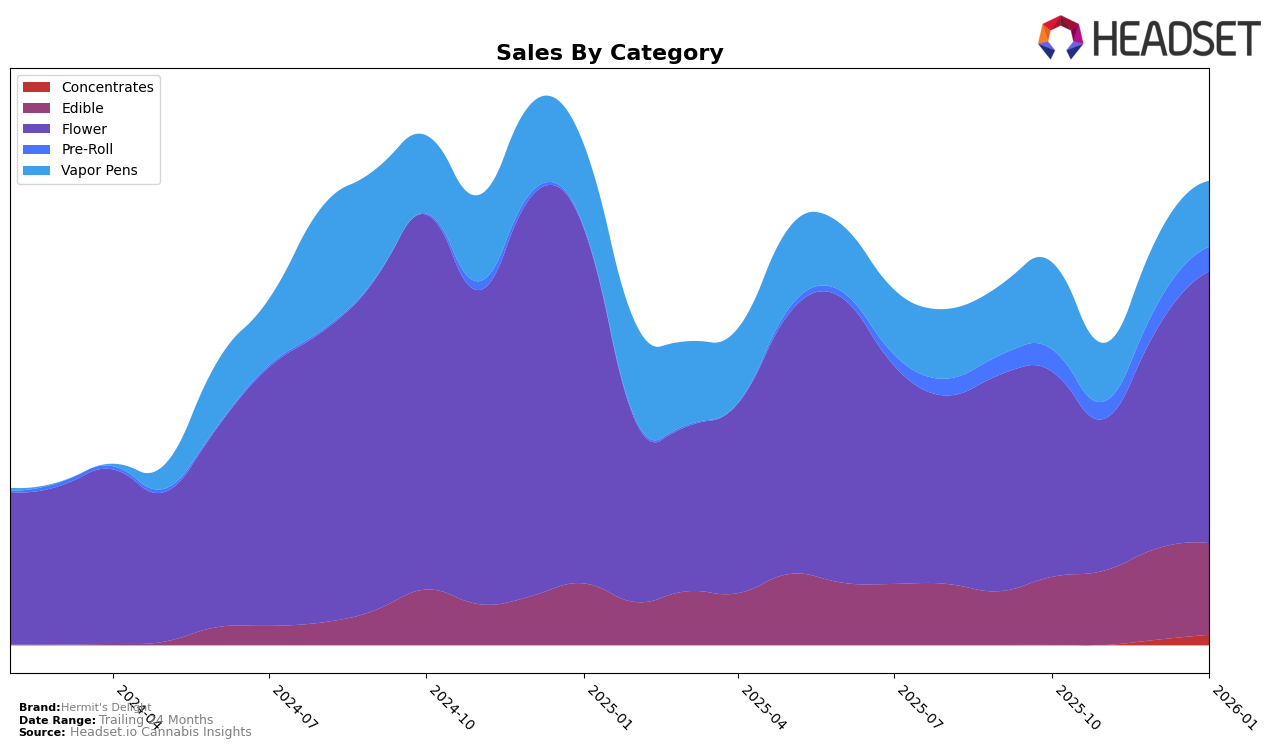

Hermit's Delight has shown a varied performance across different cannabis categories in Missouri. In the Edible category, the brand has made a consistent upward movement, improving its rank from 29th in October 2025 to 22nd by January 2026. This steady climb suggests a growing consumer preference for their edible products. In contrast, the Concentrates category did not see Hermit's Delight break into the top 30 rankings, indicating potential challenges in gaining traction in that segment. However, the Flower category has seen a notable improvement, with the brand rising from 31st to 26th place over the same period, hinting at a strengthening presence in this competitive market.

On the other hand, Hermit's Delight's performance in the Pre-Roll and Vapor Pens categories in Missouri reflects a more modest trajectory. While the Pre-Roll category saw a slight improvement from 58th to 48th place, it still remains outside the top 30, suggesting room for growth. Similarly, the Vapor Pens category experienced fluctuations, with rankings dropping from 37th to 47th before slightly recovering to 43rd. This inconsistency might indicate challenges in maintaining a competitive edge or market share in these segments. Overall, while Hermit's Delight has demonstrated strength in some areas, there are clear opportunities for expansion and increased market penetration in others.

Competitive Landscape

In the competitive landscape of the Flower category in Missouri, Hermit's Delight has shown a notable upward trend in rank from October 2025 to January 2026, moving from 31st to 26th position. This improvement is significant when compared to competitors like Daily Driver, which consistently remained outside the top 20, and Sundro Cannabis, which fluctuated and even dropped to 35th in December before recovering slightly. Meanwhile, Pinchy's and Atta experienced declines, with Pinchy's falling from 18th to 27th and Atta dropping from 16th to 25th, indicating potential market share opportunities for Hermit's Delight. Despite lower sales figures compared to some competitors, Hermit's Delight's consistent rank improvement suggests a strengthening brand presence and potential for increased sales momentum in the Missouri Flower market.

Notable Products

In January 2026, Cherry Burst (3.5g) emerged as the top-performing product for Hermit's Delight, securing the number one rank with sales reaching 2142 units. Garlicane Pre-Roll (1g) followed closely in second place, maintaining its position from previous months. Cherry Choka Pre-Roll (1g) experienced a slight drop in rank to third place compared to its second-place ranking in December 2025. Big Black Gorilla (3.5g) held steady at fourth place, showing a notable increase in sales from the previous month. Watermelon Gummies 10-Pack (100mg) rounded out the top five, marking its first appearance in the top rankings for this period.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.