Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

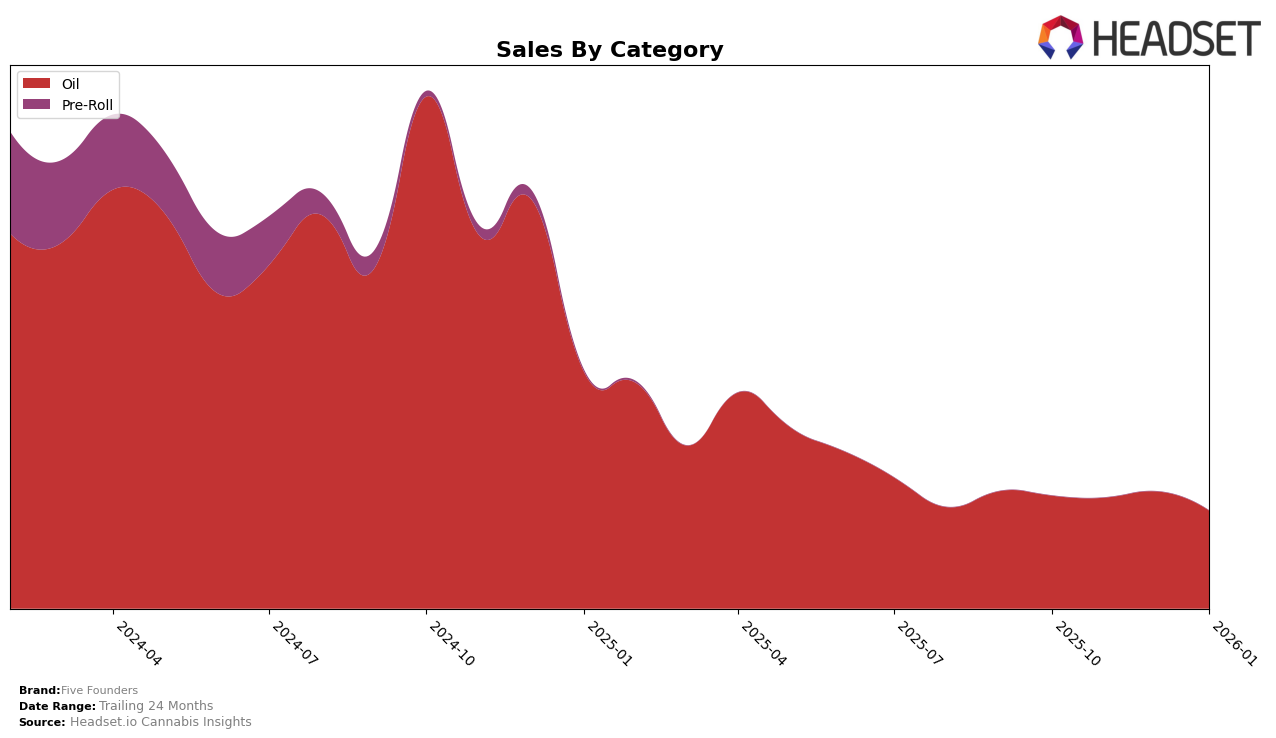

Five Founders has shown a consistent presence in the Ontario cannabis oil market, with a steady climb in rankings over the last quarter of 2025 and into early 2026. Starting at rank 16 in October 2025, the brand moved up to rank 15 in November and further improved to rank 14 by December, maintaining this position into January 2026. This upward movement indicates a strengthening foothold in the competitive oil category within the province. However, despite the ranking improvements, sales figures showed a slight dip from December to January, suggesting potential seasonal fluctuations or market challenges that may have impacted their revenue.

Interestingly, Five Founders' absence from the top 30 in other states or categories could be seen as both a challenge and an opportunity. The lack of presence in additional markets might highlight areas for growth and expansion, especially if the brand is aiming to replicate its success in Ontario elsewhere. This scenario presents a dual narrative: while they have established a solid position in one of Canada's key provinces, there remains untapped potential in other regions and categories that could drive future growth. Understanding the dynamics behind their performance in Ontario could provide insights into strategies that might be applied in other markets.

Competitive Landscape

In the competitive landscape of the Oil category in Ontario, Five Founders has shown a consistent upward trend in its ranking, moving from 16th place in October 2025 to 14th by December 2025, maintaining this position into January 2026. This improvement in rank suggests a positive reception of their products, even as their sales saw a slight dip in January 2026. Despite this, Five Founders faces stiff competition from brands like Emprise Canada, which consistently ranks higher, maintaining the 11th position in January 2026. LoFi Cannabis and DayDay also pose significant competition, with DayDay holding a steady 12th rank across the months, while LoFi Cannabis fluctuates but remains close in proximity to Five Founders. Meanwhile, High Plains re-entered the rankings in January 2026 at 16th, indicating a potential emerging competitor. These dynamics highlight the competitive pressures Five Founders faces, necessitating strategic marketing and product innovation to continue climbing the ranks and boosting sales in the Ontario Oil market.

Notable Products

In January 2026, Five Founders' top-performing product was THC Oil (30ml) in the Oil category, maintaining its number one rank consistently since October 2025, with sales reaching 373 units. CBD Oil (30ml) also held its position as the second-best-selling product, despite a notable decrease in sales to 132 units. The rankings for these two products have remained unchanged over the past few months, indicating stable consumer preference. THC Oil (30ml) continues to dominate its category with a clear lead over other products. Overall, the sales figures reflect a strong and consistent performance for Five Founders' top products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.