Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

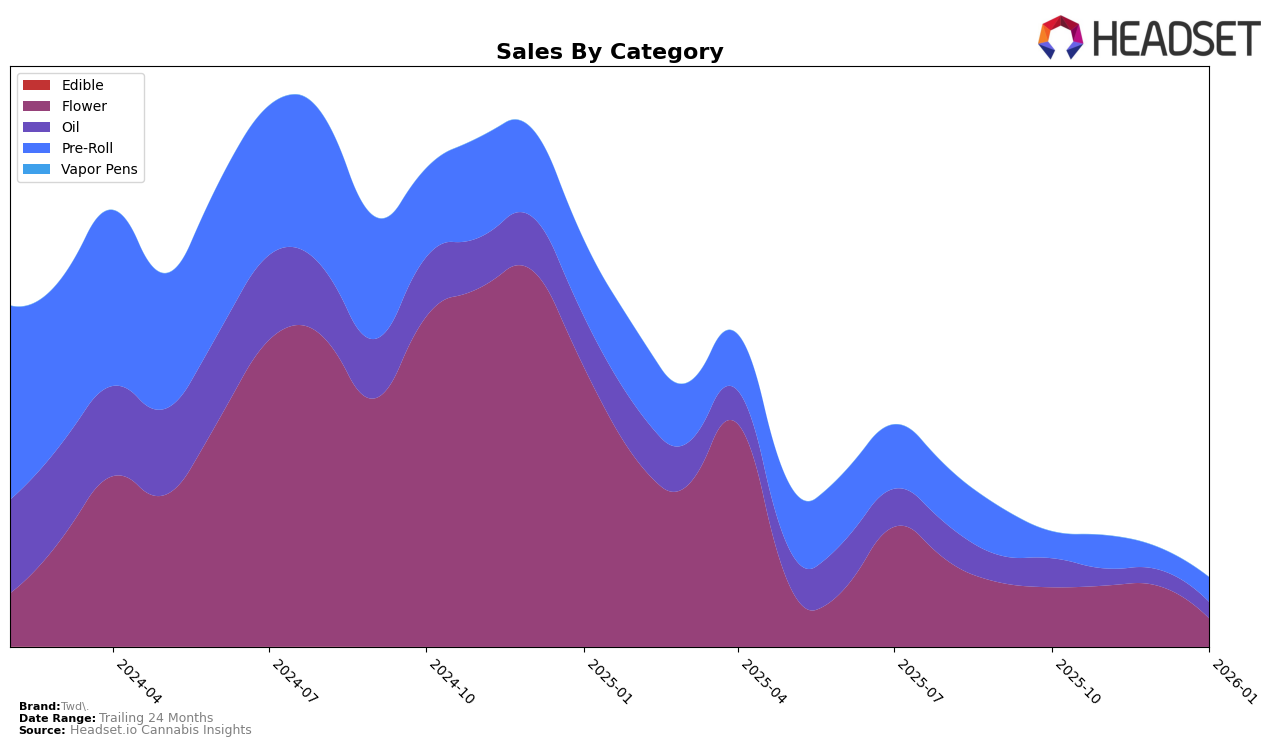

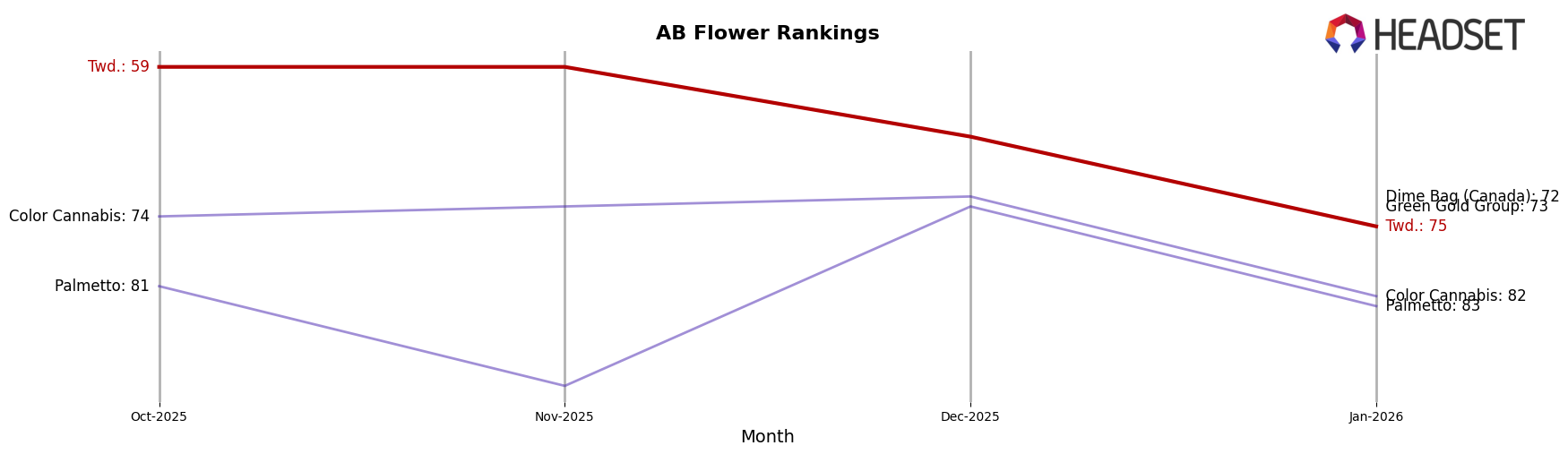

In the province of Alberta, Twd. has shown a consistent presence in the Oil category, maintaining a stable ranking of 11th place from October 2025 through January 2026. This stability is noteworthy, especially when compared to their performance in the Flower category, where Twd. has not been able to break into the top 30, with rankings slipping from 59th in October and November 2025 to 75th by January 2026. This indicates a potential area of concern for Twd. in Alberta's Flower market, as it highlights a declining trend in sales and visibility. The brand's ability to maintain its position in the Oil category, however, suggests a strong consumer base and product acceptance in that segment.

In British Columbia, Twd. has had a more sporadic presence. Notably, they were not ranked in the top 30 for the Flower category until December 2025, where they appeared at 100th place. Similarly, their Pre-Roll category performance saw a brief appearance in October 2025 at 100th place, with a slight improvement to 98th by January 2026. This indicates a marginal increase in visibility in the Pre-Roll category, although their overall market presence remains limited. Meanwhile, in Ontario, Twd.'s Oil category ranking slipped slightly from 15th to 16th between October and November 2025, before dropping out of the top 30 altogether. This drop suggests a need for strategic adjustments to regain their competitive edge in Ontario's Oil market.

Competitive Landscape

In the competitive landscape of the Flower category in Alberta, Twd. has experienced notable fluctuations in its market position over the past few months. As of October 2025, Twd. held the 59th rank, maintaining this position into November before slipping to 66th in December and further down to 75th by January 2026. This downward trend in rank is mirrored by a decline in sales, particularly evident in the sharp drop from November to January. In contrast, Color Cannabis showed a relatively stable performance, maintaining a higher rank than Twd. throughout this period, despite a sales dip in January. Meanwhile, Palmetto and Green Gold Group both re-entered the top 20 in January, with Dime Bag (Canada) also making a notable entry at 72nd in January. These shifts suggest a competitive pressure on Twd., highlighting the need for strategic adjustments to regain its market standing in Alberta's Flower category.

Notable Products

In January 2026, Twd.'s top-performing product was the Sativa Pre-Roll (1g) in the Pre-Roll category, maintaining its consistent first-place rank from previous months with sales of 2065 units. The Indica Pre-Roll (1g) also held its position steadily at second place, although its sales figures continued to decline, reaching 1338 units. The Sativa (28g) in the Flower category sustained its third-place rank, despite a drop in sales compared to December 2025. Notably, Tropical Hazy Daze (3.5g) improved its rank to fourth place, up from fifth in December 2025, indicating a positive sales trend. The Max THC Sativa Oil Spray (30ml) remained in fifth place, showing a slight decrease in sales, but maintaining its position from December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.