Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

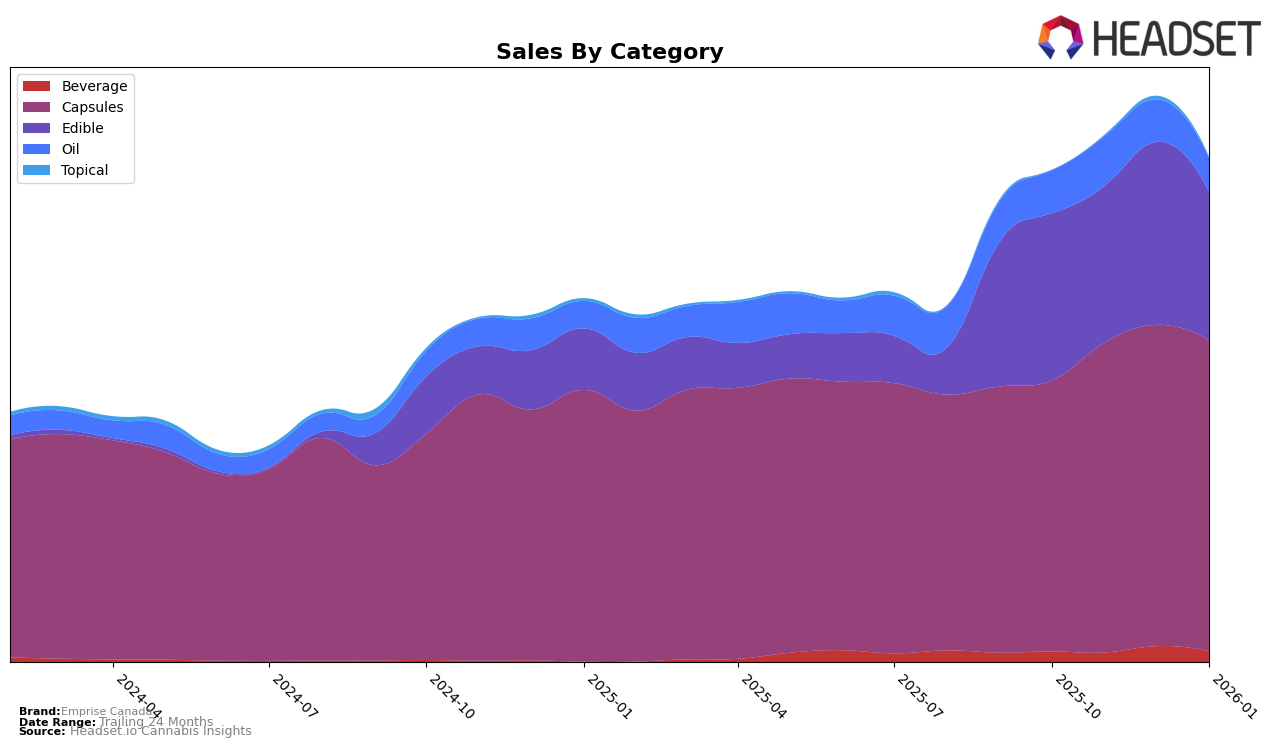

Emprise Canada has demonstrated a consistent performance in the Alberta market, particularly in the Capsules category where it maintained a steady third place ranking from October 2025 through January 2026. This consistency is noteworthy, especially when considering the fluctuations in sales figures, which showed a gradual increase over the period. However, in the Edible category, Emprise Canada slipped from the tenth position in October, November, and December 2025 to eleventh in January 2026, indicating a potential area for improvement. Meanwhile, in British Columbia, the brand showed a stable presence in the Capsules category, holding the third position consistently from November 2025 to January 2026. Despite this, they failed to make the top 30 in the Oil category in October 2025, though they later achieved eighth and ninth positions in the following months, signaling a positive trend.

In Ontario, Emprise Canada's performance in the Capsules category remained robust, consistently ranking fifth from October 2025 to January 2026, showcasing their strong foothold in this segment. The Edible category saw an upward trajectory, with the brand moving from sixteenth in October and November 2025 to fourteenth by January 2026, indicating growing consumer preference. The Oil category, however, presented a mixed picture, with rankings fluctuating but remaining within the top 15. In Saskatchewan, Emprise Canada dominated the Capsules category, holding the top position throughout the observed period. The brand's performance in the Edible category was less stable, with a slight drop from ninth to eleventh place by December 2025, which persisted into January 2026. Notably, the Oil category saw Emprise Canada drop out of the top 30 in January 2026 after previously ranking first and third, suggesting a need to reassess strategies in this segment.

Competitive Landscape

In the competitive landscape of the Ontario cannabis capsules market, Emprise Canada maintained a consistent rank of 5th from October 2025 through January 2026. Despite this stability, Emprise Canada faces strong competition from brands like Glacial Gold and Tweed, which have consistently ranked higher, occupying the 3rd and 4th positions respectively. Notably, Glacial Gold improved its rank to 3rd in January 2026, indicating a potential upward trend in sales performance. Meanwhile, Indiva and Decimal have remained stable in their ranks at 6th and 7th, respectively, suggesting that Emprise Canada is well-positioned in the middle of the pack. However, to climb the ranks, Emprise Canada may need to strategize on how to close the sales gap with the top-tier competitors.

Notable Products

In January 2026, the top-performing product for Emprise Canada was the Rapid- Blue Raz Indica Gummy (10mg) from the Edible category, maintaining its number 1 rank for four consecutive months, despite a slight decrease in sales to 2673 units. The CBD/THC 1:1 Balanced Softgels 100-Pack saw a significant rise to the second position from fourth in December 2025, with sales reaching 2513 units. Rapid - Sativa Grape Gummy (10mg) secured the third spot, climbing up from its previous absence in December. Meanwhile, THC Light Year Softgels 30-Pack experienced a drop to fourth place from third, with sales decreasing to 1972 units. ThirstC - Cherry Instant Drink Mix (10mg) rounded out the top five, slipping from second to fifth position, indicating a notable decline in its performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.