Aug-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

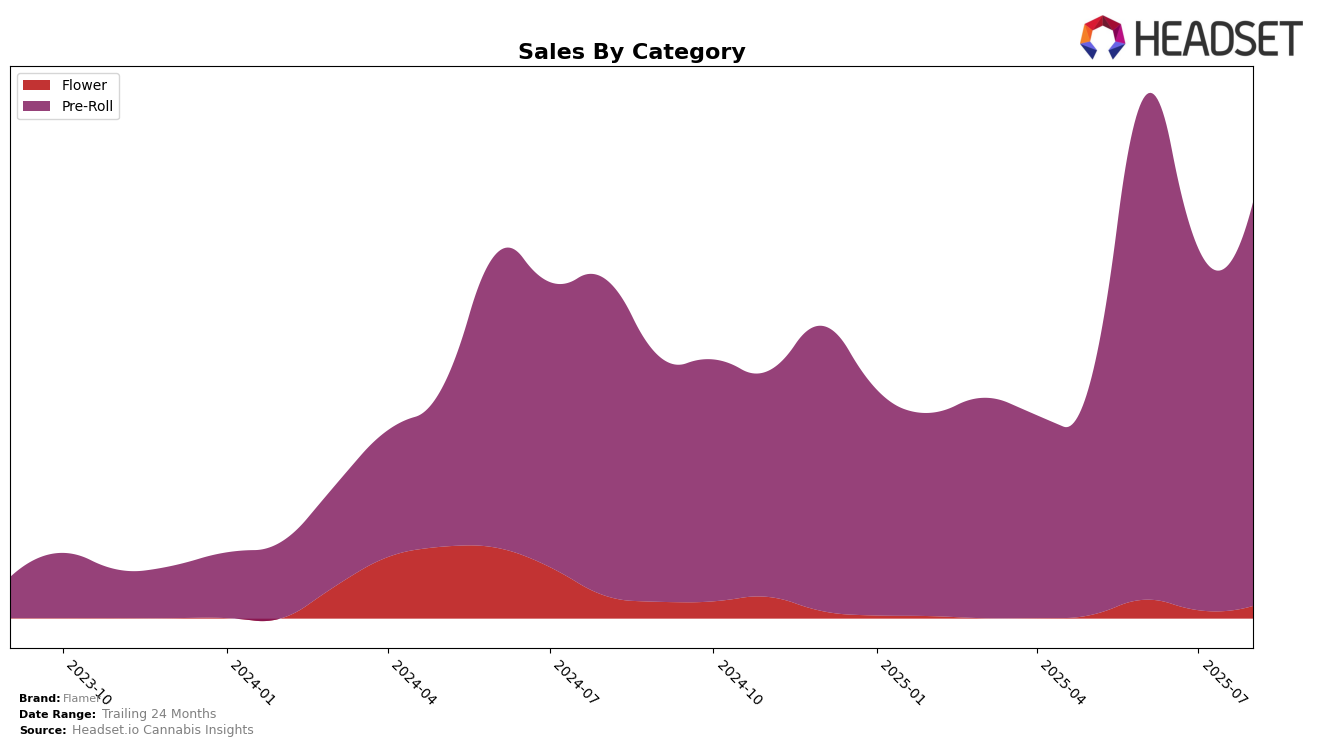

Flamer has shown an interesting trajectory in the Pre-Roll category within New York. Notably, the brand broke into the top 30 in June 2025, climbing from a rank of 34 in May to 19. This significant jump indicates a positive reception and growing consumer interest in their products. However, the following months saw some fluctuation, with a dip to rank 25 in July before slightly recovering to rank 23 in August. This movement suggests a competitive market environment and highlights the challenge of maintaining a top position.

The sales figures for Flamer in New York also reflect these ranking changes. There was a substantial increase in sales from May to June, which aligns with their improved ranking. However, the subsequent months saw a decline in sales, mirroring the slight drop in rankings. This pattern underscores the importance of consistently engaging marketing strategies to maintain consumer interest and loyalty in a competitive market. The absence of a top 30 ranking in May suggests that while Flamer has made significant strides, there is still room for growth and stabilization in their performance across the Pre-Roll category.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in New York, Flamer has experienced notable fluctuations in its market position from May to August 2025. Initially ranked 34th in May, Flamer surged to 19th in June, indicating a significant boost in sales momentum. However, the brand faced a slight decline in July, dropping to 25th, before recovering to 23rd in August. This dynamic shift suggests a competitive market where brands like Higgs and Anthem have shown upward trends, with Higgs climbing from 47th to 22nd and Anthem making a remarkable leap from 56th to 24th over the same period. Meanwhile, Electraleaf and Revert Cannabis New York have maintained relatively stable positions, albeit with slight declines, suggesting a competitive pressure that Flamer must navigate to sustain its growth trajectory. This analysis underscores the importance of strategic positioning and market responsiveness for Flamer to capitalize on its potential and enhance its competitive edge in the New York Pre-Roll market.

Notable Products

In August 2025, the top-performing product from Flamer was the Silly Goofy Pre-Roll 5-Pack (2.5g), maintaining its number one rank from July, with notable sales of 2765 units. The Silly Goofy Pre-Roll (0.75g) improved its standing, moving up to second place from fourth in July. Sasha Colby Kush Infused Pre-Roll 5-Pack (2.5g) dropped slightly to third place from second in the previous month. Lobotomy Pre-Roll 5-Pack (2.5g) consistently held its position at fourth place for two consecutive months. The P.N.C Pre-Roll 5-Pack (2.5g) re-entered the list in fifth place, having been absent in June and July.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.