Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

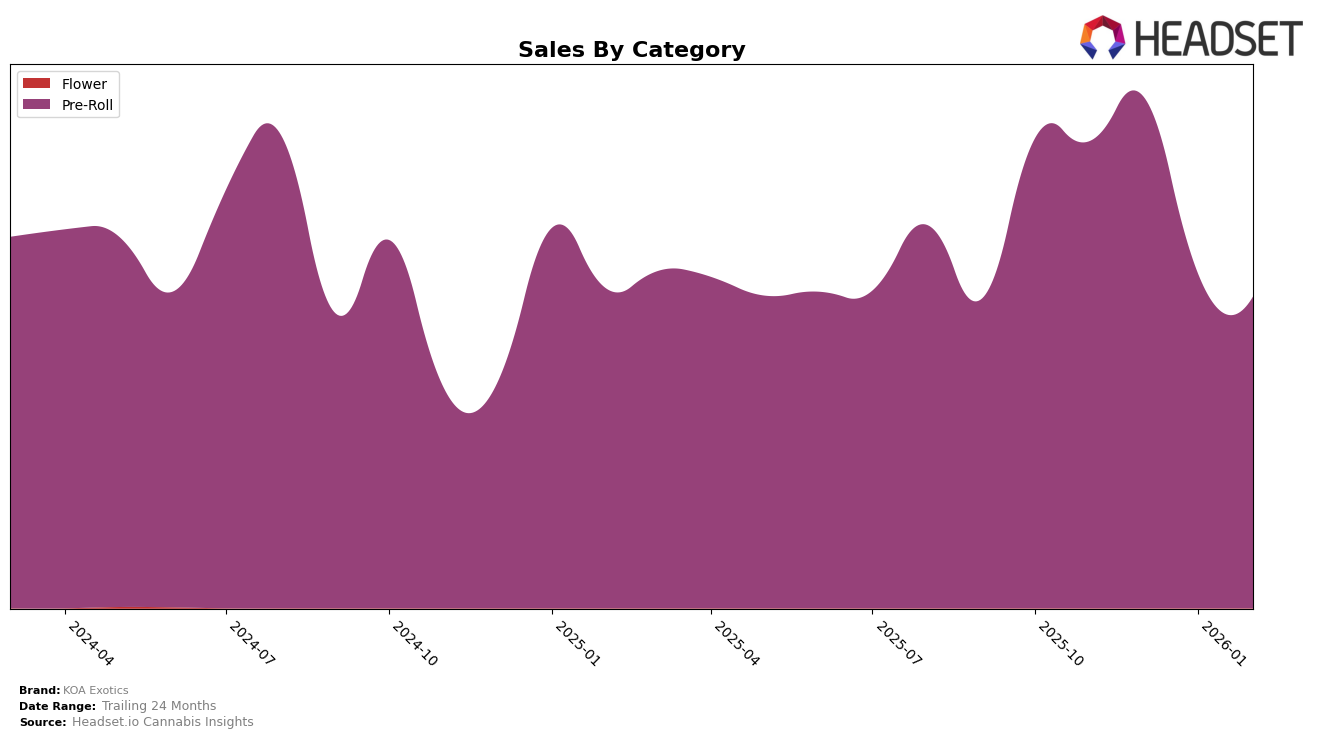

KOA Exotics has shown varied performance across different states and categories over recent months. In California, their presence in the Pre-Roll category has been consistent, although they have not cracked the top 30 rankings, with positions hovering around 49 to 62. This indicates a stable but not leading position in the market. Meanwhile, in Maryland, KOA Exotics has maintained a stronger foothold, consistently ranking within the top 30, even reaching as high as 17th in November 2025. This suggests a stronger brand recognition or preference in Maryland compared to California.

The performance in New York presents a more volatile picture. KOA Exotics was able to enter the top 30 in December 2025, but rankings have since dropped significantly to 78th by February 2026. This sharp decline could be indicative of increased competition or changing consumer preferences within the state. Notably, the sales figures in New York have seen a corresponding decrease, highlighting the challenge of maintaining market share in a competitive environment. Such fluctuations warrant a closer look at market dynamics and consumer trends in New York to understand the underlying causes.

Competitive Landscape

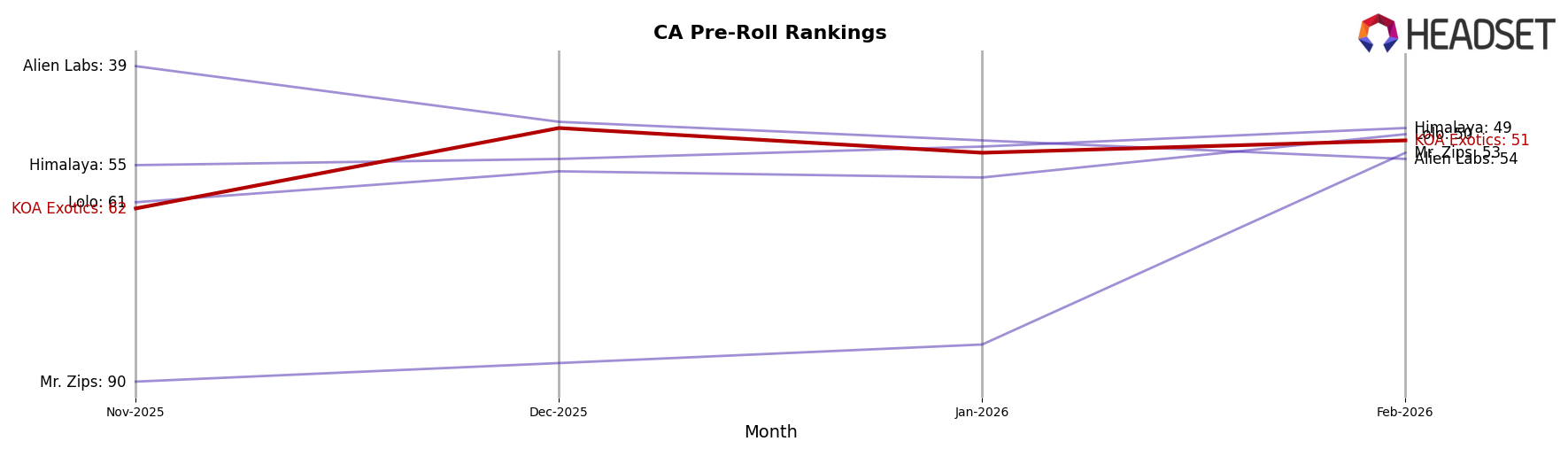

In the competitive landscape of the California pre-roll category, KOA Exotics has shown a dynamic performance over recent months. Starting from a rank of 62 in November 2025, KOA Exotics improved significantly to 49 in December 2025, although it slightly declined to 53 in January 2026 before stabilizing at 51 in February 2026. This fluctuation suggests a competitive struggle in maintaining a top position, especially against brands like Alien Labs, which experienced a downward trend from 39 to 54 over the same period, indicating a potential opportunity for KOA Exotics to capture market share. Meanwhile, Himalaya and Lolo have been gradually climbing the ranks, with Himalaya moving from 55 to 49 and Lolo from 61 to 50, suggesting increasing competition. Notably, Mr. Zips re-entered the top 20 in February 2026 at rank 53 after being absent in December, highlighting the volatility and competitive nature of this market. KOA Exotics' ability to maintain a relatively stable position amidst these shifts underscores its resilience and potential for growth in this competitive environment.

Notable Products

In February 2026, KOA Exotics' top-performing product was the Pineapple Express Live Resin Infused Pre-Roll 10-Pack (3.5g) in the Pre-Roll category, maintaining its number one rank from January 2026 with sales of 2027 units. The King Louis XIII x Watermelon Live Resin Infused Pre-Roll 10-Pack (3.5g) secured the second position, marking its debut in the rankings. The Indica Live Resin Infused Pre-Roll 10-Pack (3.5g) remained consistent at third place, despite a slight decrease in sales. Strawberry Cough Live Resin Infused Pre-Roll 10-Pack (3.5g) entered the rankings at fourth place, while Blue Dream Live Resin Infused Pre-Roll 10-Pack (3.5g) dropped to fifth place from second in January. Overall, there were notable shifts in the rankings, with new entries and changes in positions reflecting dynamic sales performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.