Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

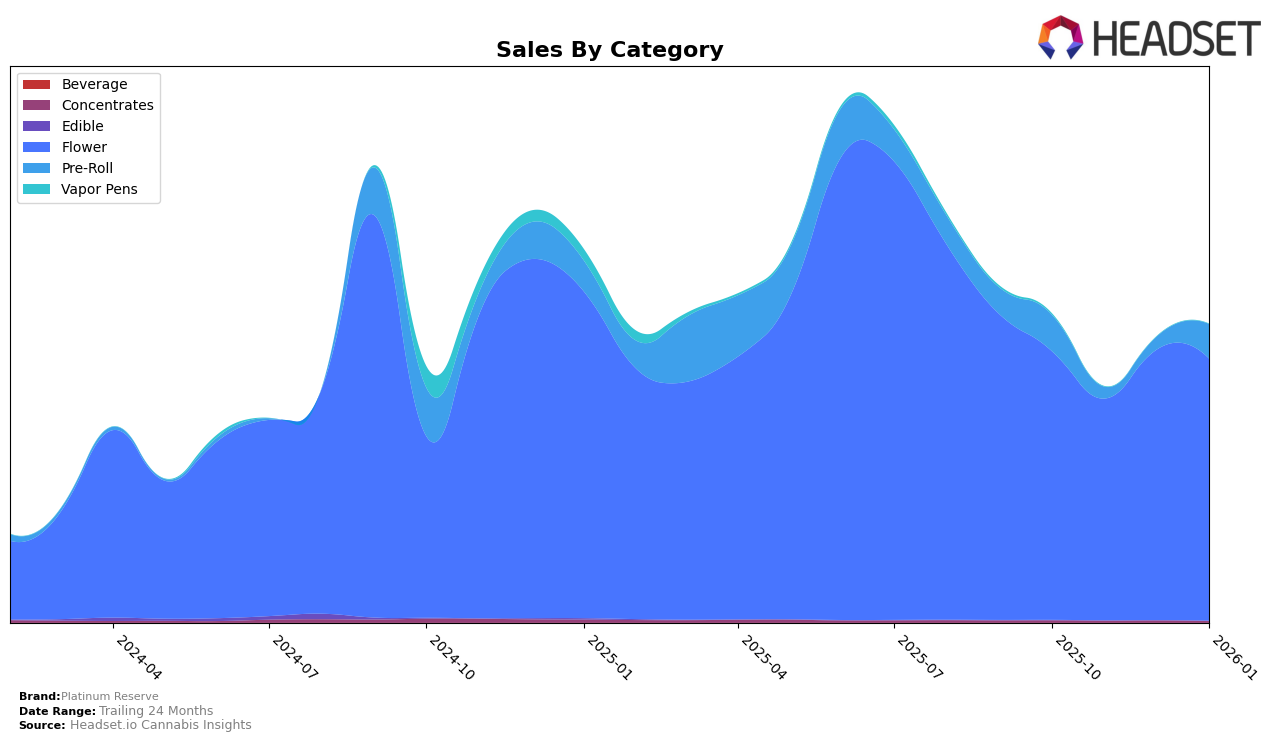

In the state of New York, Platinum Reserve has maintained a consistent presence in the Flower category, with rankings fluctuating slightly between 17th and 20th place from October 2025 to January 2026. This consistency suggests a stable demand for their Flower products despite minor shifts in rank. Notably, while there was a dip in sales in November 2025, the brand quickly rebounded in December, indicating resilience and possibly effective marketing or product strategies during the holiday season. The performance in this category highlights their ability to stay competitive in a crowded market.

Conversely, in the Pre-Roll category, Platinum Reserve's presence in New York is less prominent, with the brand not appearing in the top 30 for November and December 2025. This absence could be a point of concern, suggesting that they might be struggling to gain traction in this segment. However, they re-entered the rankings at 70th place in January 2026, indicating a potential area for growth if they can capitalize on this momentum. The fluctuations in their category performance across these months provide insights into where the brand might focus its efforts to improve market share.

Competitive Landscape

In the competitive landscape of the Flower category in New York, Platinum Reserve has experienced fluctuating rankings, moving from 17th in October 2025 to 20th by January 2026. This shift reflects a dynamic market environment where brands like LivWell and RIPPED have shown notable movements. LivWell maintained a relatively stable presence, although it slipped from 13th to 18th over the same period, indicating a potential decline in market traction. Meanwhile, RIPPED made a significant leap from 48th in October to 19th by January, suggesting a strong upward trajectory in sales performance. This competitive pressure, particularly from rising brands, underscores the need for Platinum Reserve to strategize effectively to maintain or improve its market position amidst evolving consumer preferences and competitive dynamics.

Notable Products

In January 2026, Sour Tangie (3.5g) led the sales for Platinum Reserve, securing the top spot with 1,238 units sold. Skywalker OG (3.5g) followed closely as the second-best performer, while White Widow Pre-Roll (1g) took the third rank. Bruce Banner Pre-Roll (1g) and Haze Pre-Roll (1g) rounded out the top five, ranking fourth and fifth, respectively. These products showed notable shifts from previous months, with Sour Tangie and Skywalker OG making significant gains to reach the first and second positions. The pre-roll category also saw a strong presence in the top rankings, indicating a consistent demand.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.