Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

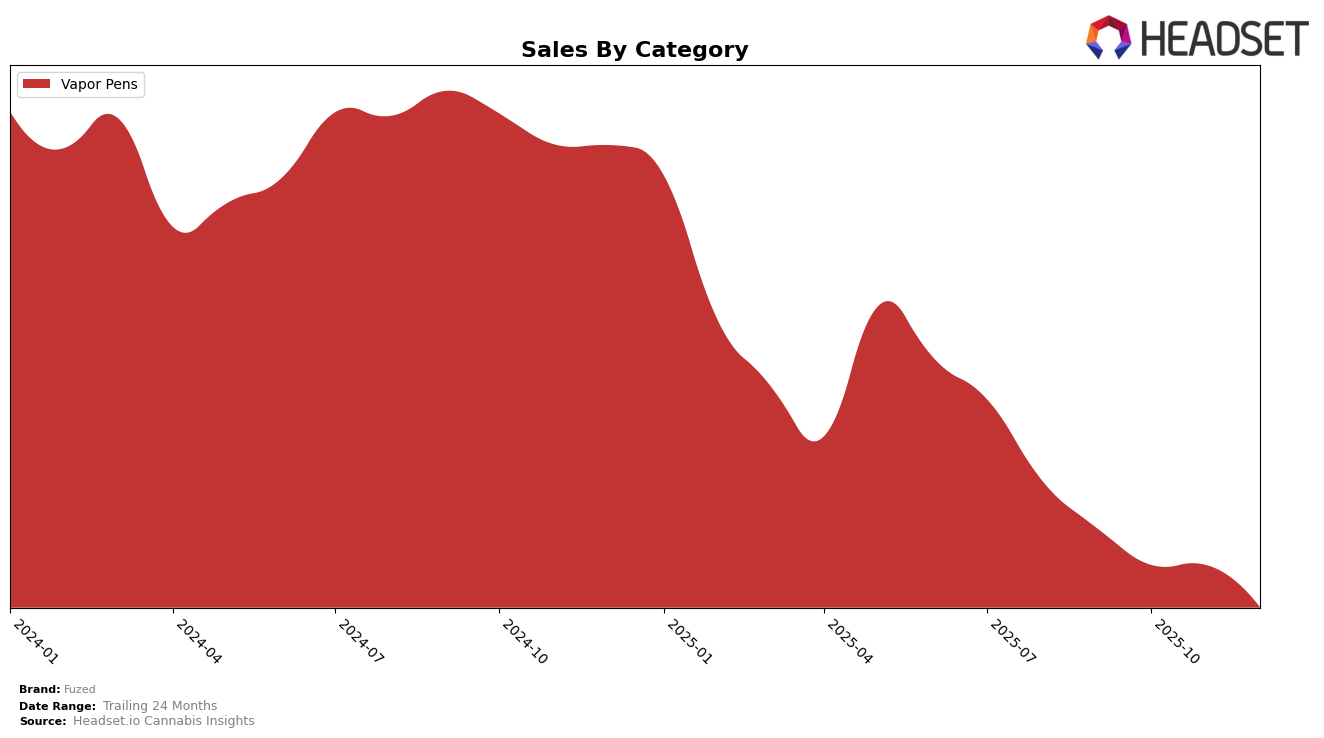

Fuzed, a brand known for its vapor pens, has experienced varying performance across different states in recent months. In Illinois, Fuzed's ranking in the vapor pen category showed some volatility, starting at 62 in September 2025, improving to 54 in October and November, but then dropping to 68 by December. This fluctuation reflects a competitive market environment in Illinois, where maintaining a consistent top position seems challenging. In contrast, in Maryland, Fuzed maintained a relatively stable position within the top 20, although there was a slight decline from 17 in September to 20 by December. This suggests a steady demand for Fuzed's products in Maryland, albeit with a need to address the slight downward trend.

In Missouri, Fuzed has shown some promising upward movement, improving its rank from 46 in September to 42 in November, before slipping back to 51 in December. This indicates potential growth opportunities in Missouri, provided the brand can sustain its upward trajectory. Meanwhile, in Ohio, Fuzed's ranking saw a slight decline from 25 in September to 31 in November, though it rebounded slightly to 30 in December. This suggests that while Fuzed is facing challenges in maintaining its position, there is potential for recovery and growth in Ohio. Such mixed performances across states highlight the need for Fuzed to adapt its strategies to the unique market dynamics of each region.

Competitive Landscape

In the Maryland Vapor Pens category, Fuzed has experienced a challenging period from September to December 2025, maintaining a consistent rank of 20th place. Despite this stability in rank, Fuzed's sales have shown a downward trend, decreasing from September's figures to December's. In contrast, Roll One / R.O. has demonstrated a more dynamic performance, climbing from 20th to 15th place in November before settling back to 18th in December, with sales generally higher than Fuzed's. Meanwhile, Savvy, despite missing from the rankings in November, reappeared in December at 19th place, closely trailing Fuzed with comparable sales figures. Grass and Cheetah have shown upward mobility, with Grass surpassing Fuzed in November before dropping slightly in December, and Cheetah consistently ranking just below Fuzed. These competitive dynamics suggest that while Fuzed has managed to maintain its position, the brand faces pressure from both established and emerging competitors, indicating a need for strategic initiatives to bolster sales and improve rank.

Notable Products

In December 2025, the top-performing product from Fuzed was the Strawberry Blonde Distillate Disposable (1g) in the Vapor Pens category, which achieved the number one rank with sales reaching 3,397 units. This product showed a consistent upward trend, climbing from fourth in September to first by December. The Peaches & Cream Distillate Disposable (1g), which had been leading in October and November, fell to the second position despite strong sales figures. Blueberry Distillate Disposable (1g) maintained a steady presence in the top three, ranking third in December. Mango Mama Distillate Disposable (1g) consistently held the fourth position, while Passion Fruit Distillate Disposable (1g) remained fifth, showing less fluctuation compared to other products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.