Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

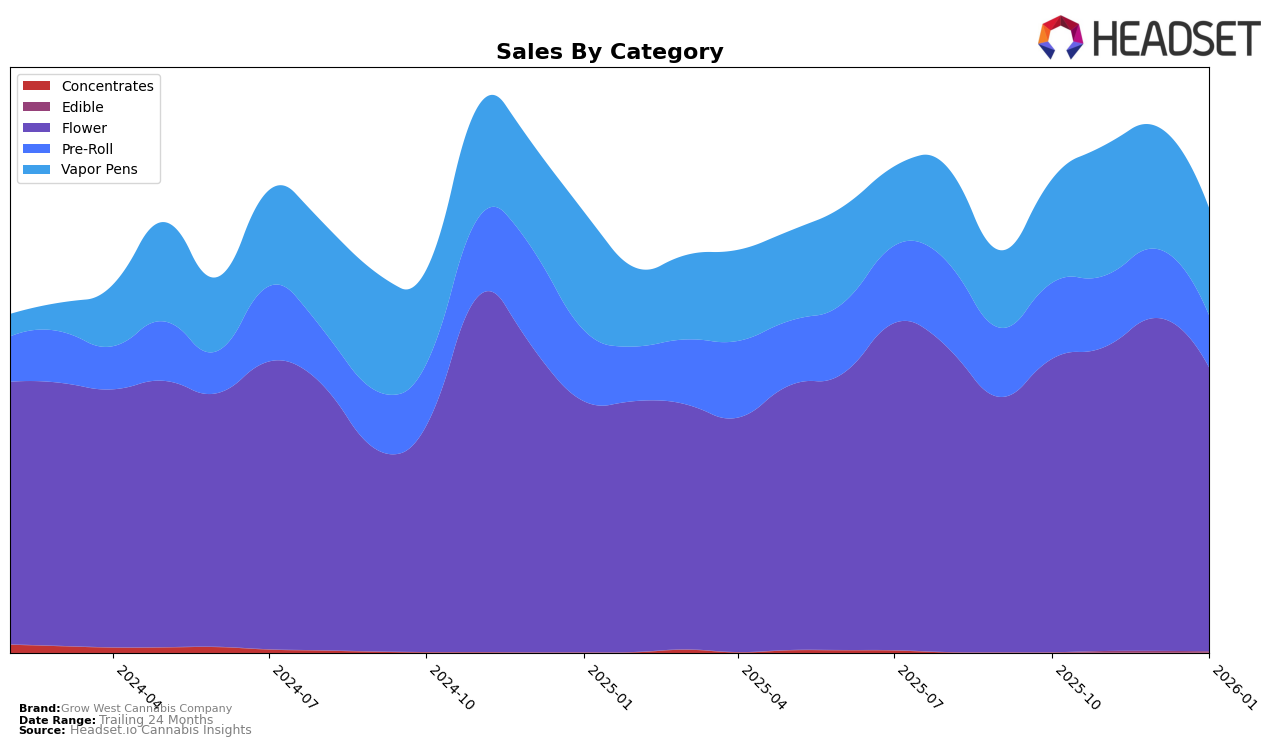

Grow West Cannabis Company has demonstrated a stable yet dynamic presence in the Maryland cannabis market, particularly in the Flower category. The brand maintained a consistent ranking at 9th place in both October and November 2025, with a notable rise to 6th place in December before returning to 9th place in January 2026. This fluctuation indicates a competitive edge, especially with a sales peak in December. The Vapor Pens category also showed resilience with a slight improvement in rankings, moving from 10th in October to 8th in November, maintaining that position through January. This suggests a growing consumer preference for their vapor products, despite a minor dip in sales in January compared to November. However, the Pre-Roll category saw a gradual decline in ranking from 10th in October to 12th in December, before slightly recovering to 11th in January, which could point to challenges in maintaining consumer interest or increased competition in that segment.

Interestingly, Grow West Cannabis Company did not appear in the top 30 brands in any other states or provinces across these categories, which could be interpreted as a strategic focus on the Maryland market or a limitation in their geographical expansion. The absence of rankings in other regions highlights the brand's concentrated efforts in Maryland, where they seem to be leveraging their strengths in specific product categories. The Flower category, in particular, stands out as a significant contributor to their overall performance, with sales figures consistently higher than those in Pre-Roll and Vapor Pens. This data suggests that while Grow West Cannabis Company is making notable strides within Maryland, there may be untapped opportunities or challenges in scaling their brand presence beyond this state.

Competitive Landscape

In the competitive landscape of the Maryland flower category, Grow West Cannabis Company has demonstrated a stable yet fluctuating performance in recent months. Despite a promising rise to 6th place in December 2025, Grow West's rank slipped back to 9th by January 2026, indicating a need to maintain momentum against strong competitors. Notably, Grassroots surged from 13th in October 2025 to consistently hold the 7th position by January 2026, showcasing a significant upward trend in sales. Meanwhile, Evermore Cannabis Company maintained a strong presence, peaking at 5th place in November and December 2025, before dropping to 10th in January 2026, which could signal an opportunity for Grow West to capitalize on any potential weaknesses. Additionally, Curio Wellness and Kind Tree Cannabis have shown variable rankings, with Curio Wellness dropping to 11th in January 2026, potentially opening a competitive gap for Grow West to exploit. Overall, while Grow West Cannabis Company has shown resilience, the dynamic shifts among competitors highlight the importance of strategic positioning and innovation to enhance market share in Maryland's flower category.

Notable Products

In January 2026, the top-performing product for Grow West Cannabis Company was Reserve - Goat Piss (3.5g) in the Flower category, which moved up to the number one rank with sales of 6,229 units. Cherry Chocolate Widow (3.5g) emerged as a strong contender, securing the second spot, while Electric Berry Bliss (3.5g) followed closely in third place. Premium MK Ultra Black Ops (3.5g) experienced a slight decline, landing in the fourth position after previously ranking second in November 2025. Member Berry (3.5g), which held the top rank in October and November 2025, dropped to fifth place in January 2026. These shifts indicate a dynamic change in consumer preferences, with newer products gaining popularity over older favorites.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.