Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

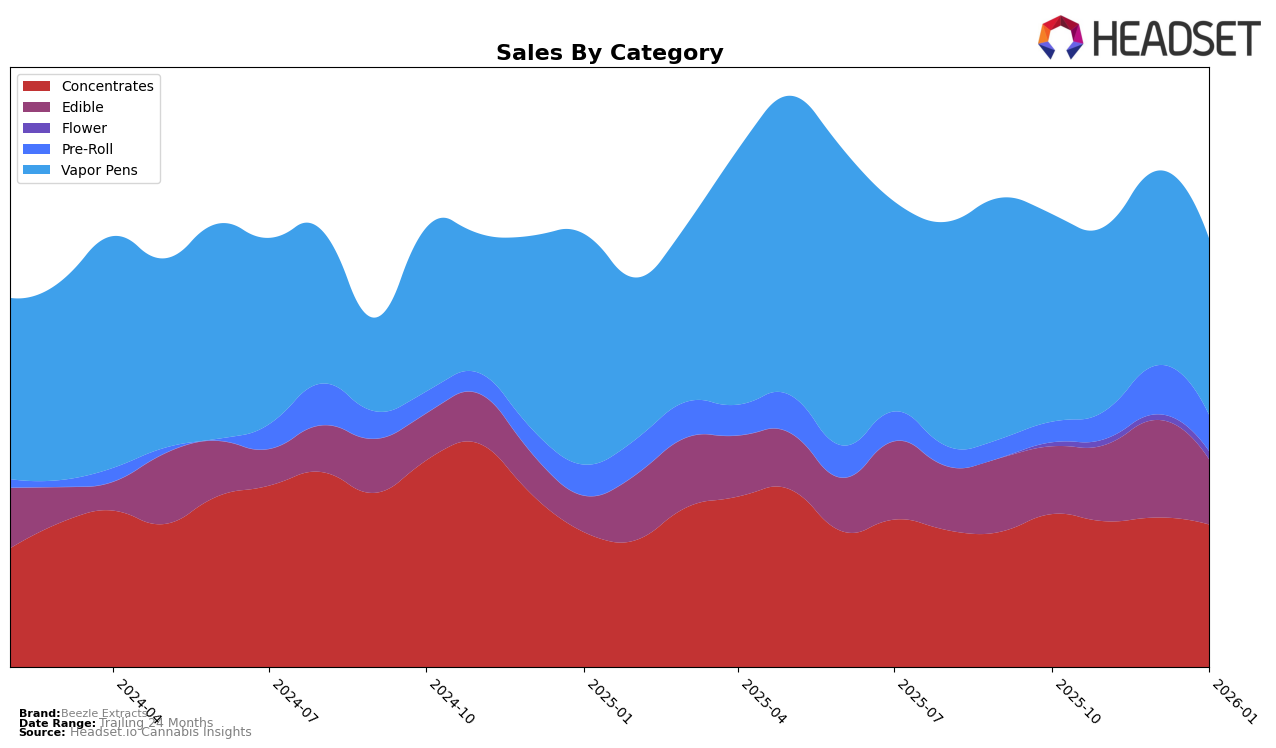

Beezle Extracts has shown varied performance across different states and product categories. In Illinois, the brand made a notable entry into the top rankings for Concentrates, debuting at 29th place in December 2025. However, its position slipped slightly to 32nd by January 2026, indicating a challenging market environment or increased competition. This movement signifies that while Beezle Extracts managed to break into the top 30, maintaining that position in Illinois proves to be a competitive endeavor. The absence of rankings in earlier months suggests that the brand was not among the top 30, highlighting a recent upward trend in visibility or sales efforts in this state.

In contrast, Maryland presents a more stable and promising landscape for Beezle Extracts. The brand consistently held a strong position in the Concentrates category, ranking 4th in both October and November 2025, before slightly dropping to 5th and 6th in the following months. This indicates a robust presence and consumer loyalty in Maryland. Additionally, Beezle Extracts saw improvements in the Pre-Roll category, climbing from 38th to 25th place from October 2025 to January 2026. While the Vapor Pens category maintained a consistent ranking around 12th to 14th, the Edible category showed fluctuations, peaking at 18th before returning to 20th place. These movements reflect the brand’s varying strengths across product lines and underscore the importance of strategic focus in key categories to sustain growth.

Competitive Landscape

In the competitive landscape of vapor pens in Maryland, Beezle Extracts has demonstrated a steady climb in rankings from October 2025 to January 2026, improving from 14th to 12th position. This upward trajectory is noteworthy, especially when contrasted with competitors like Just Vapes (MA), which experienced fluctuations, dropping from 13th to 17th before recovering to 14th. Despite a decline in sales from October to January, Beezle Extracts has managed to maintain its rank, suggesting resilience in market presence. Meanwhile, Fade Co. consistently held the 11th position, indicating a stable yet slightly higher market share compared to Beezle Extracts. Additionally, District Cannabis maintained a top 10 position, showcasing stronger sales figures, which could be a benchmark for Beezle Extracts to aim for. The data suggests that while Beezle Extracts is on a positive trajectory in terms of rank, there is room for growth in sales to close the gap with higher-ranked competitors.

Notable Products

In January 2026, the top-performing product from Beezle Extracts was the Night Time Bites - THC/CBN 1:1 Blue Razz Chews 10-Pack, maintaining its consistent first-place ranking from previous months with sales reaching 1514 units. The Fruit Gushers Live Rosin emerged as the second top product, making its debut on the list with notable sales of 1299 units. Kiwi Tree Nectarz BDT Distillate Disposable climbed to third place, despite a decrease in sales from previous months. Jet Fuel Cured Resin Shatter entered the rankings in fourth place, while CBD/THC 4:1 Black Cherry Chews slipped to fifth, showing a significant drop in sales compared to December. The rankings highlight a strong preference for edibles and concentrates among consumers, with some shifts in product popularity over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.