Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

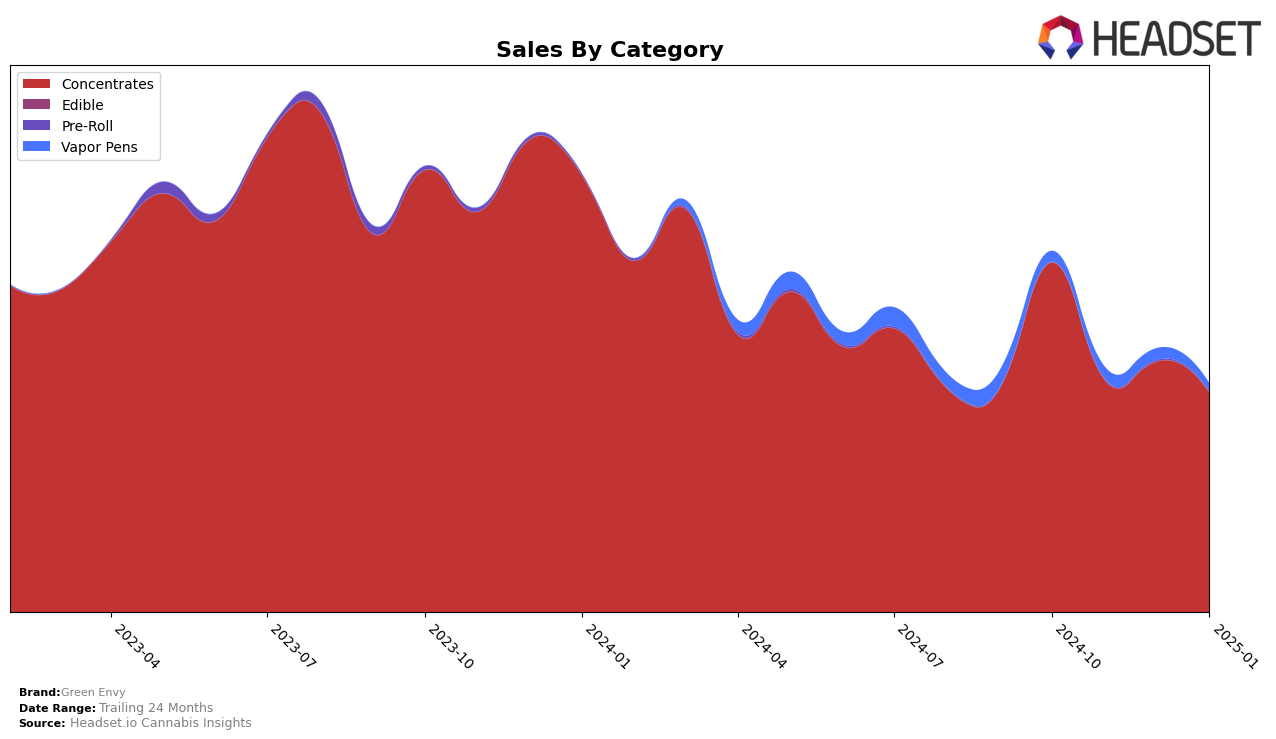

Green Envy's performance in the concentrates category in Washington has shown some fluctuations over the observed months. Starting in October 2024, they held the 23rd rank, but by November, they had dropped to the 30th position. This decline could be attributed to a decrease in sales, as evidenced by the reduction from $82,315 in October to $54,597 in November. Although they managed to slightly improve their ranking to 28th in December, the brand slipped back to the 30th spot by January 2025. This indicates that while there were some recovery efforts, maintaining a consistent top-tier presence remains a challenge for Green Envy in this state and category.

It's noteworthy that Green Envy did not fall out of the top 30 in the concentrates category in Washington during these months, which suggests a stable, albeit modest, market presence. The brand's ability to stay within the top 30 indicates a certain level of customer loyalty or product appeal that keeps them competitive. However, the lower rankings and fluctuating sales figures suggest that Green Envy might need to explore strategies to enhance their market position and ensure more robust growth. This could involve product innovation, marketing efforts, or competitive pricing strategies to capture a larger market share and improve their standings in the future.

Competitive Landscape

In the Washington concentrates market, Green Envy has experienced a fluctuating rank, moving from 23rd in October 2024 to 30th by January 2025. This decline in rank is mirrored by a decrease in sales over the same period. Notably, Lifted Cannabis Co and Dank Czar have shown similar volatility, with Lifted Cannabis Co ranking 27th in October 2024 and dropping to 29th by January 2025, while Dank Czar started at 29th and fell out of the top 20 by January 2025. Meanwhile, Incredibulk demonstrated a contrasting trend, climbing from 72nd to 28th, suggesting a significant increase in market presence and sales. This competitive landscape indicates that while Green Envy faces challenges in maintaining its rank, emerging brands like Incredibulk are rapidly gaining traction, potentially impacting Green Envy's market share and necessitating strategic adjustments to regain a competitive edge.

Notable Products

In January 2025, the top-performing product for Green Envy was 9lb Hammer Wax (1g) in the Concentrates category, maintaining its leading position from December with sales reaching 1455 units. Blackberry Cobbler Wax (1g) held steady at the second rank, showing consistent performance over the months. Green Crack Wax (1g) saw an impressive climb to the third position from fifth in December. Fruity Pebbles Wax (1g) dropped to fourth place, despite being the top seller back in October. Juicy Fruit Wax (1g) entered the rankings at fifth place, suggesting a new interest in this product.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.