Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

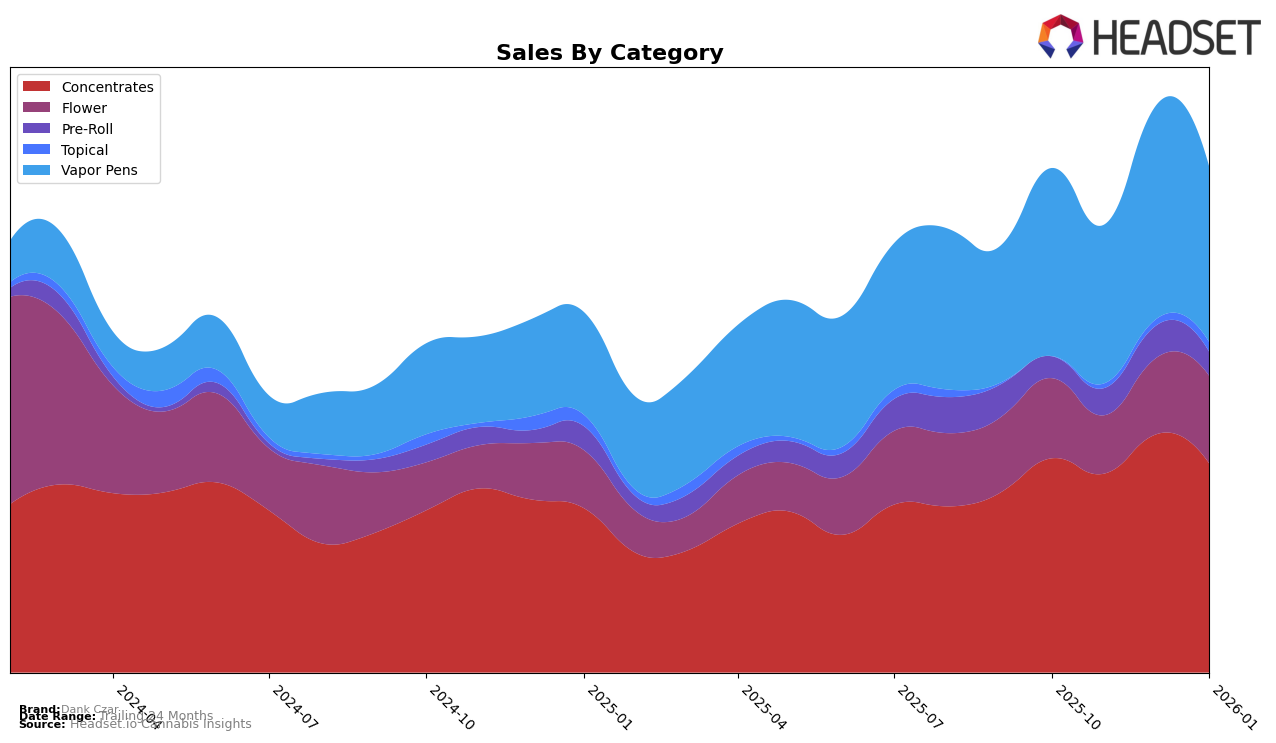

Dank Czar has shown a dynamic performance in the Washington market, particularly in the Concentrates category. The brand maintained a steady presence, ranking 16th in both October and November 2025, before climbing to 14th in December 2025. However, a dip was observed in January 2026, when it fell to the 20th position. This fluctuation might be indicative of increased competition or seasonal demand variations. Despite this, Dank Czar's sales in December 2025 reached their peak, suggesting a strong consumer preference during the holiday season.

In contrast, Dank Czar's performance in the Vapor Pens category has been less consistent. Starting at the 53rd position in October 2025, the brand saw a slight decline to 55th in November, before improving to 46th in December. However, this upward trend did not sustain, as it dropped to 49th in January 2026. The brand's sales figures in this category also reflect a similar pattern, with notable sales in December. The absence of a top 30 ranking in any month for Vapor Pens highlights the competitive nature of this category in Washington, indicating potential areas for strategic improvement.

Competitive Landscape

In the competitive landscape of Washington's concentrates market, Dank Czar has experienced a fluctuating performance in rankings over recent months. Despite a strong position in October 2025, ranked 16th, Dank Czar saw a slight improvement to 14th place by December 2025, before dropping to 20th in January 2026. This volatility contrasts with the steady ascent of Buddy Boy Farms, which climbed from 53rd to 18th place over the same period, indicating a significant increase in market presence and sales. Meanwhile, Hitz Cannabis and Dabs 4 Less maintained relatively stable rankings, hovering around the late teens, suggesting consistent sales performance. The competitive pressure from these brands, particularly the rapid rise of Buddy Boy Farms, highlights the dynamic nature of the market and suggests that Dank Czar may need to innovate or adjust strategies to regain higher rankings and bolster sales.

Notable Products

In January 2026, Dank Czar's top-performing product was the Indica RSO Tanker (1g) from the Concentrates category, which climbed to the number 1 rank with sales reaching 603 units. Reserve - Blue Dream Live Resin (1g) debuted at the second position, while Silver - Funnel Cake Live Resin (1g) followed closely in third. The Silver - Straw Guava Live Resin (1g) secured the fourth spot, marking its first appearance in the rankings. Gusherz Distillate Cartridge (1g) experienced a slight drop to fifth place from its previous third position in November 2025. Overall, January saw a significant reshuffling in rankings, with several new entries and shifts in product performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.