Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

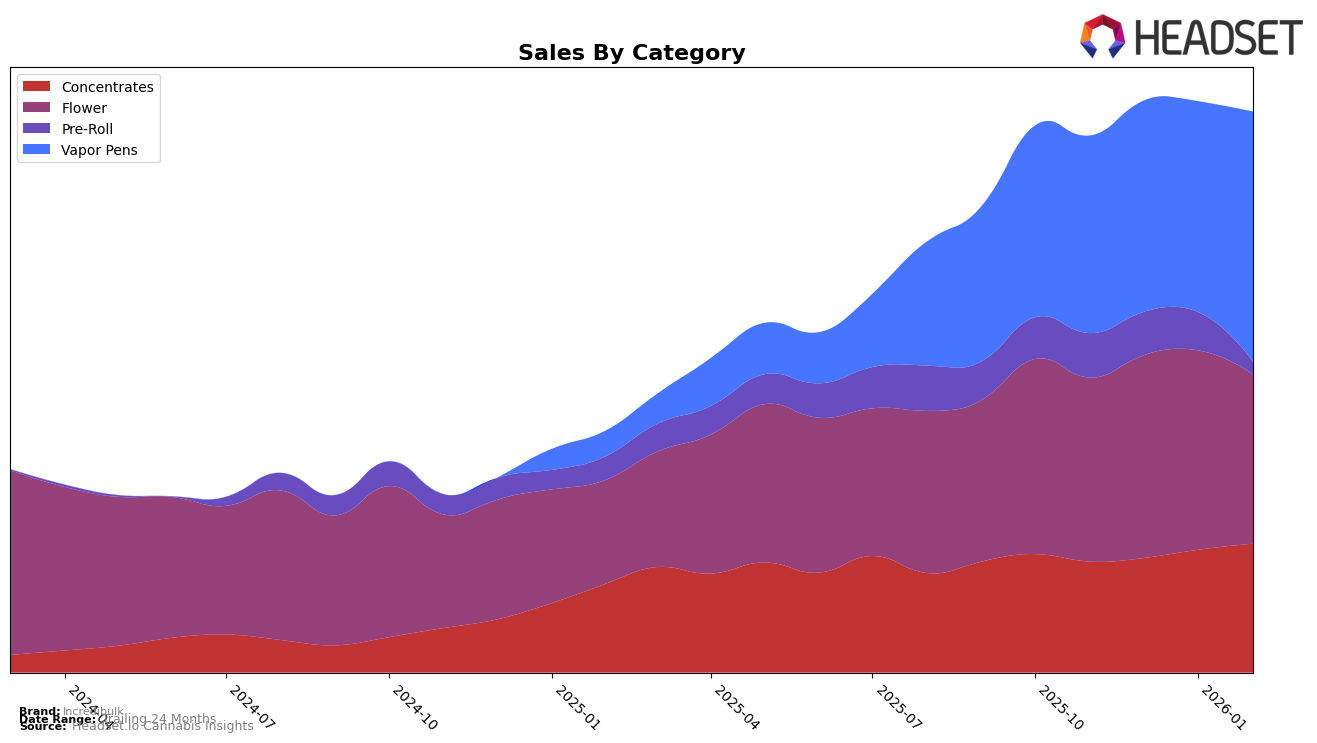

Incredibulk has shown a notable performance in the Washington market, particularly in the Concentrates category. Over the months from November 2025 to February 2026, the brand improved its ranking from 22nd to 20th, indicating a positive trajectory. This upward movement is supported by a steady increase in sales, reflecting a growing consumer interest in their products. However, in the Pre-Roll category, Incredibulk did not make it into the top 30 brands, suggesting potential areas for growth or a need to reassess their strategy in this segment.

In the Flower category, Incredibulk's performance has been more volatile, with rankings hovering around the 50th position. Despite a brief improvement in January 2026, where they moved up to 46th, they slipped back to 47th in February. This suggests that while there is some traction, competition remains stiff. On a more positive note, the Vapor Pens category has seen significant progress, with Incredibulk climbing from 38th in November 2025 to 28th by February 2026. This leap in rankings could be indicative of successful product offerings or effective marketing strategies in this category.

Competitive Landscape

In the competitive landscape of vapor pens in Washington, Incredibulk has demonstrated a notable upward trajectory in its market position from November 2025 to February 2026. Initially ranked at 38th in November, Incredibulk climbed to 28th by February, showcasing a significant improvement in rank, which is indicative of a positive shift in consumer preference or strategic marketing efforts. This upward movement contrasts with brands like AiroPro, which saw a decline from 26th to 30th, and Kelso Kandy (aka Kelso Kreeper), which fluctuated but ultimately ended at 29th. Meanwhile, Honey Tree Extracts and Trichome Extracts / Canna Pacific maintained relatively stable positions, with Honey Tree Extracts improving slightly to 26th by February. Incredibulk's sales figures also reflect this positive trend, with a notable increase in February, surpassing some competitors who experienced declines. This data suggests that Incredibulk's strategic initiatives are effectively enhancing its market presence and consumer engagement in Washington's vapor pen category.

Notable Products

In February 2026, Amnesia Haze Distillate Cartridge (1g) maintained its position as the top-performing product for Incredibulk in the Vapor Pens category, with sales reaching 3842 units. This product has consistently held the number one rank since November 2025. Dirty Girl Distillate Cartridge (1g) climbed to the second spot, up from third place in January 2026, showcasing a significant sales increase. Sour Blueberry Distillate Cartridge (1g) slipped to third place after being the second in January, while Zkittlez Distillate Cartridge (1g) re-entered the rankings at fourth position. Trophy Wife Distillate Cartridge (1g) made its first appearance in the rankings in February, securing the fifth spot.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.