Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

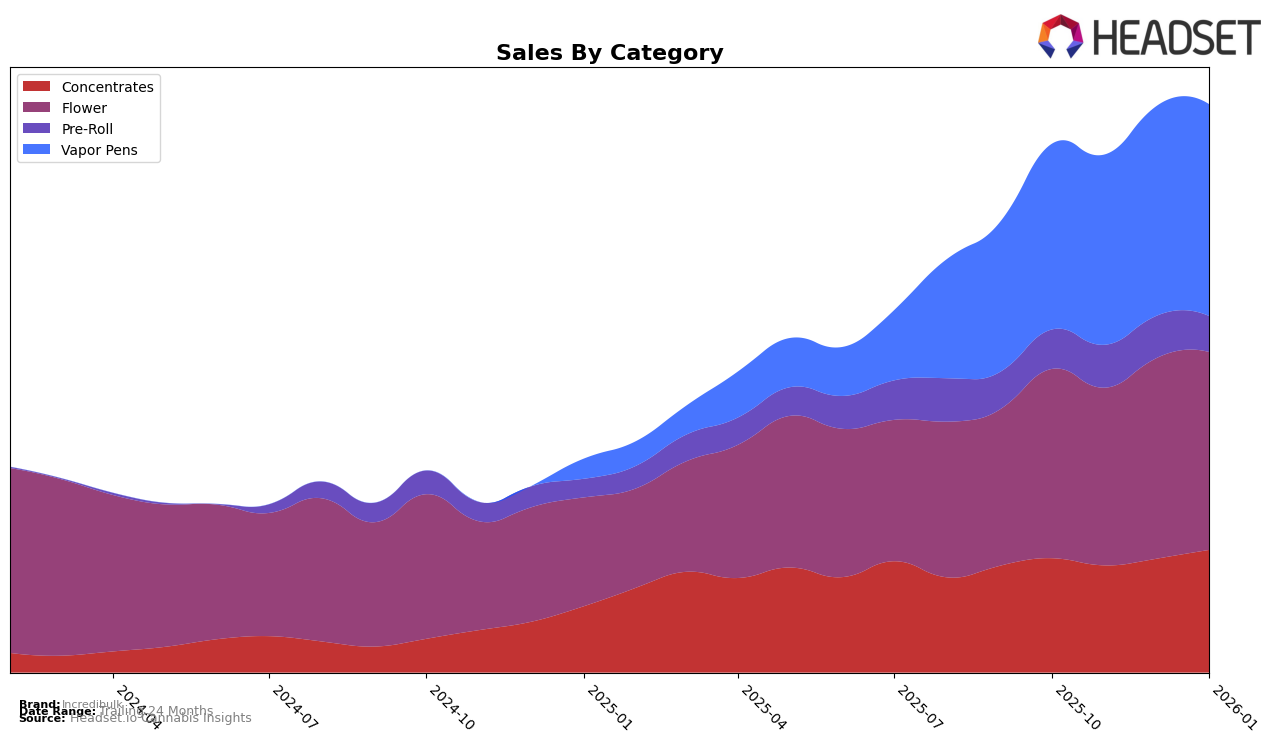

In the state of Washington, Incredibulk has shown varied performance across different cannabis categories. In the Concentrates category, Incredibulk maintained a consistent presence in the top 30, with rankings fluctuating slightly from 20th in October 2025 to 21st by January 2026. This steady ranking, coupled with a noticeable increase in sales from November to January, indicates a positive trajectory for the brand within this category. Conversely, in the Flower category, Incredibulk did not manage to break into the top 30, with rankings hovering in the mid-40s. This suggests a challenging market environment or potential areas for improvement in their Flower offerings.

Incredibulk's performance in the Vapor Pens category in Washington shows a gradual yet promising improvement. Starting at 38th place in October 2025, the brand climbed to 35th by January 2026, reflecting a consistent upward trend. This movement is complemented by a steady increase in sales over the same period, indicating growing consumer interest and potential market share gains. However, the brand still remains outside the top 30, highlighting an opportunity for further growth and strategic adjustments to capture a more significant share of the Vapor Pens market.

Competitive Landscape

In the Washington vapor pens market, Incredibulk has shown a steady improvement in its rankings, moving from 38th place in October 2025 to 35th by January 2026. This upward trend is indicative of growing consumer interest and effective market strategies, despite facing stiff competition. For instance, Passion Flower Cannabis started at 30th place in October 2025 but dropped to 36th by January 2026, suggesting a potential opportunity for Incredibulk to capture more market share. Meanwhile, Canna Organix and Falcanna maintained relatively stable positions, with Canna Organix improving slightly from 33rd to 31st, and Falcanna fluctuating around the mid-30s. Cookies, however, saw a decline from 36th to 40th, which could further open up opportunities for Incredibulk to enhance its market presence. Overall, Incredibulk's consistent sales growth and improved ranking highlight its potential to climb higher in the competitive landscape.

Notable Products

In January 2026, Amnesia Haze Distillate Cartridge (1g) maintained its position as the top-performing product for Incredibulk, with sales reaching 3631 units. Sour Blueberry Distillate Cartridge (1g) climbed back to the second position after briefly dropping to third in the previous two months. Dirty Girl Distillate Cartridge (1g) showed a consistent upward trend, moving from fifth in October 2025 to third in January 2026. Elmers Glue Distillate Cartridge (1g) held steady in fourth place, showing little change in rank over the months. Newcomer Kush Dream Distillate Cartridge (1g) debuted directly at fifth place, rounding out the top products for the month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.