Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

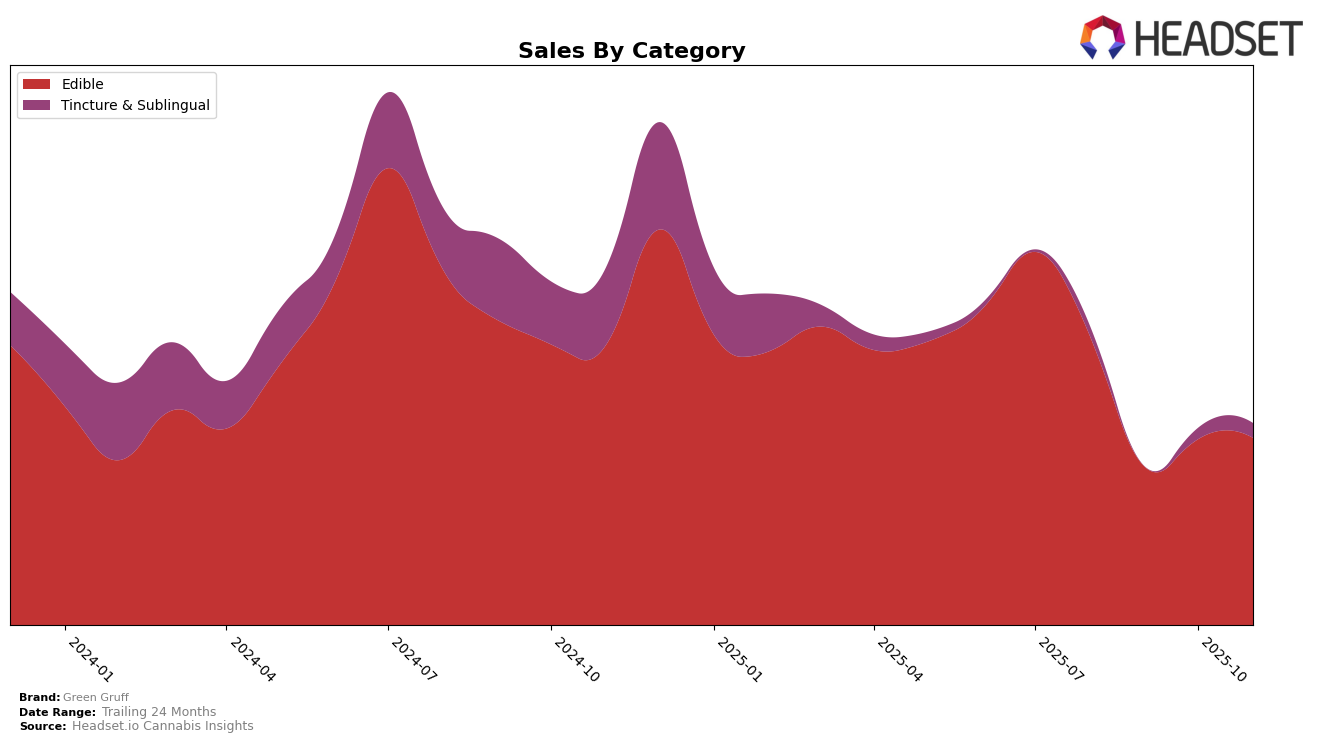

Green Gruff's performance in the edible category within the state of Michigan reveals some intriguing dynamics. In August 2025, the brand was ranked 100th, with sales amounting to $12,609. However, in the subsequent months of September, October, and November, Green Gruff did not make it into the top 30 brands in the edible category. This indicates a significant drop in their market presence within Michigan, suggesting potential challenges in maintaining competitive momentum or possibly facing increased competition from other brands.

The absence of Green Gruff in the top 30 rankings across the last three months of the analyzed period highlights a potential area of concern for the brand's market strategy in Michigan. This lack of presence might suggest the need for a reassessment of their product offerings or marketing strategies to regain traction. While the specific factors contributing to this decline are not detailed here, the data points to a critical need for the brand to evaluate their positioning and adapt to market demands to enhance their visibility and sales performance in the state.

Competitive Landscape

In the Michigan edible market, Green Gruff has faced significant challenges in maintaining a competitive edge, as evidenced by its absence from the top 20 rankings from August to November 2025. This contrasts sharply with competitors like Sauce Essentials, which, despite a downward trend from 51st to 66th place, consistently remained within the top 100, indicating a relatively stronger market presence. Meanwhile, Zoobies also showed volatility, dropping from 64th to out of the top 100 by October, yet still managed a higher sales volume than Green Gruff. The data suggests that while Green Gruff has potential, it needs strategic adjustments to enhance its market position and sales performance, especially when compared to brands like Motor City Cannabites and Zilla's, which also did not rank but had varying sales figures. This analysis underscores the importance of leveraging advanced market insights to identify growth opportunities and competitive strategies.

Notable Products

In November 2025, Green Gruff's top-performing product was the CBD Relax & Calming Dog Plus Chews 24-Pack (120mg CBD), maintaining its first-place ranking from October, with impressive sales of 203 units. The CBD Soothe Skin & Coat Salmon Flavor Chews 90-Pack (225mg CBD) climbed to second place, showing a remarkable recovery from its absence in October. The CBD Plus Ease Joint & Hip Dog Treats Chews 90-Pack (450mg CBD) held steady in third place, consistent with its performance in October. Meanwhile, the CBD Relax & Calming Dog Chews 90-Pack (180mg CBD, 6.35Oz) improved its standing, rising from fifth in October to share the third position in November. Lastly, the Soothe CBD Skin & Coat Soft Dog Chews 24-Pack (120mg CBD) slipped to fourth place, down from the second position in October.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.