Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

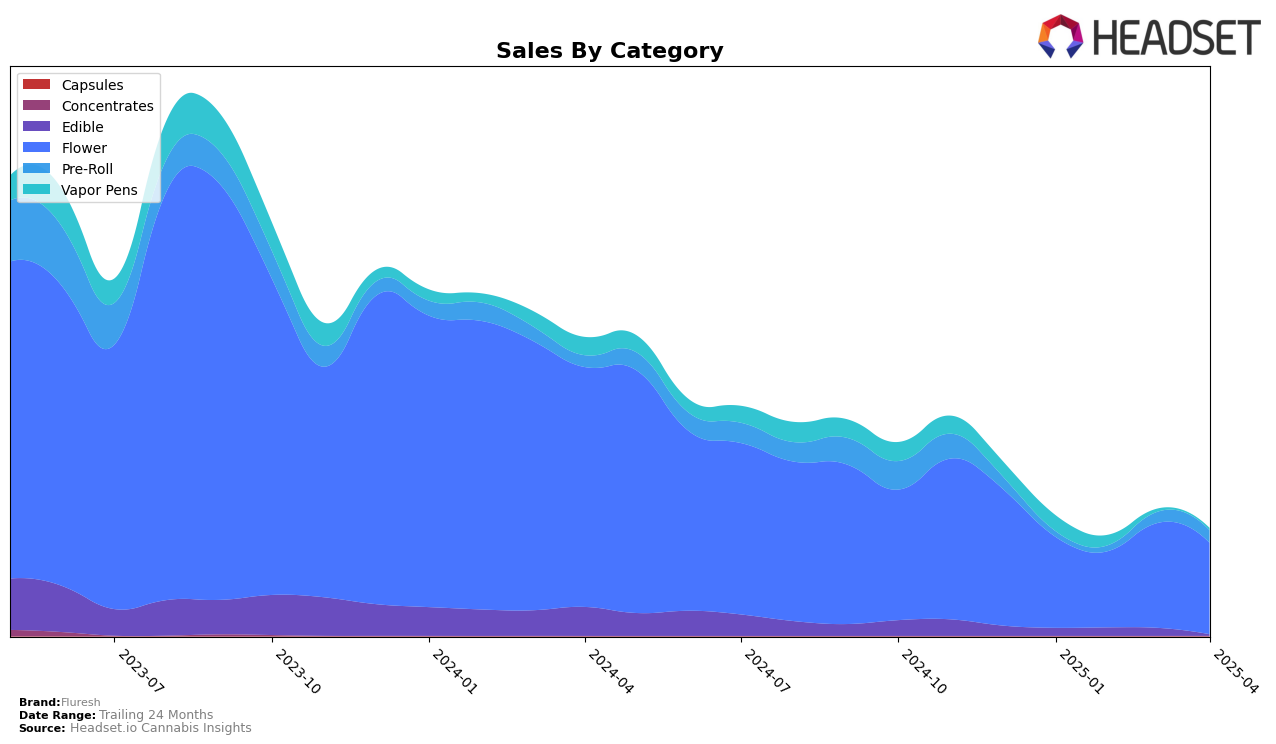

Fluresh has shown a varied performance across different product categories in Michigan. In the Flower category, Fluresh maintained a strong presence, consistently ranking within the top 30 over the first four months of 2025, with a slight dip in February but a recovery by April. This stability in ranking reflects a steady demand for their flower products, which is further supported by the significant sales figures reported in March. Conversely, their performance in the Edible category has not been as robust, as they did not make it into the top 30 rankings during this period, indicating a potential area for growth or strategic adjustment.

In the Pre-Roll category, Fluresh demonstrated an impressive upward trajectory, moving from a rank of 92 in January to 58 by April. This positive trend suggests a growing consumer interest and successful market strategies in this segment. Meanwhile, the Vapor Pens category saw Fluresh drop out of the top rankings after February, which could point to increased competition or shifting consumer preferences that the brand may need to address. Overall, Fluresh's performance highlights both areas of strength and opportunities for improvement, particularly in expanding their presence in categories where they have not yet secured a top 30 position.

Competitive Landscape

In the competitive landscape of the Michigan flower category, Fluresh has demonstrated a consistent performance, maintaining a rank within the top 30 throughout the first four months of 2025. Despite a slight dip in February, Fluresh rebounded in March, securing the 26th position before settling at 27th in April. This stability in ranking is noteworthy, especially when compared to competitors like Hytek, which fluctuated significantly, peaking at 20th in January and March but dropping to 30th in February. Meanwhile, High Life Farms made a remarkable climb from 64th in January to 26th by April, signaling a potential threat if this upward trend continues. Fluresh's sales figures reflect its stable market presence, with a notable peak in March, although it was surpassed by Hytek in terms of sales volume. The data suggests that while Fluresh maintains a strong position, it faces increasing competition from brands like High Life Farms and Hytek, necessitating strategic initiatives to bolster its market share in the coming months.

Notable Products

In April 2025, Nana Mama Pre-Roll (1g) was the top-performing product for Fluresh, maintaining its number one rank from March with a notable sales figure of 36,792 units. Mango Mintz (3.5g) climbed two spots from March, securing the second position with significant growth in sales. White Super Skunk Pre-Roll (1g) entered the rankings for the first time in April, achieving third place, while Trop Peels Pre-Roll (1g) followed closely behind in fourth. Mango Mintality Pre-Roll (1g) rounded out the top five, showing strong entry performance in its debut month. The overall rankings indicate a strong preference for pre-rolls, with notable shifts in consumer choices from the previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.