Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

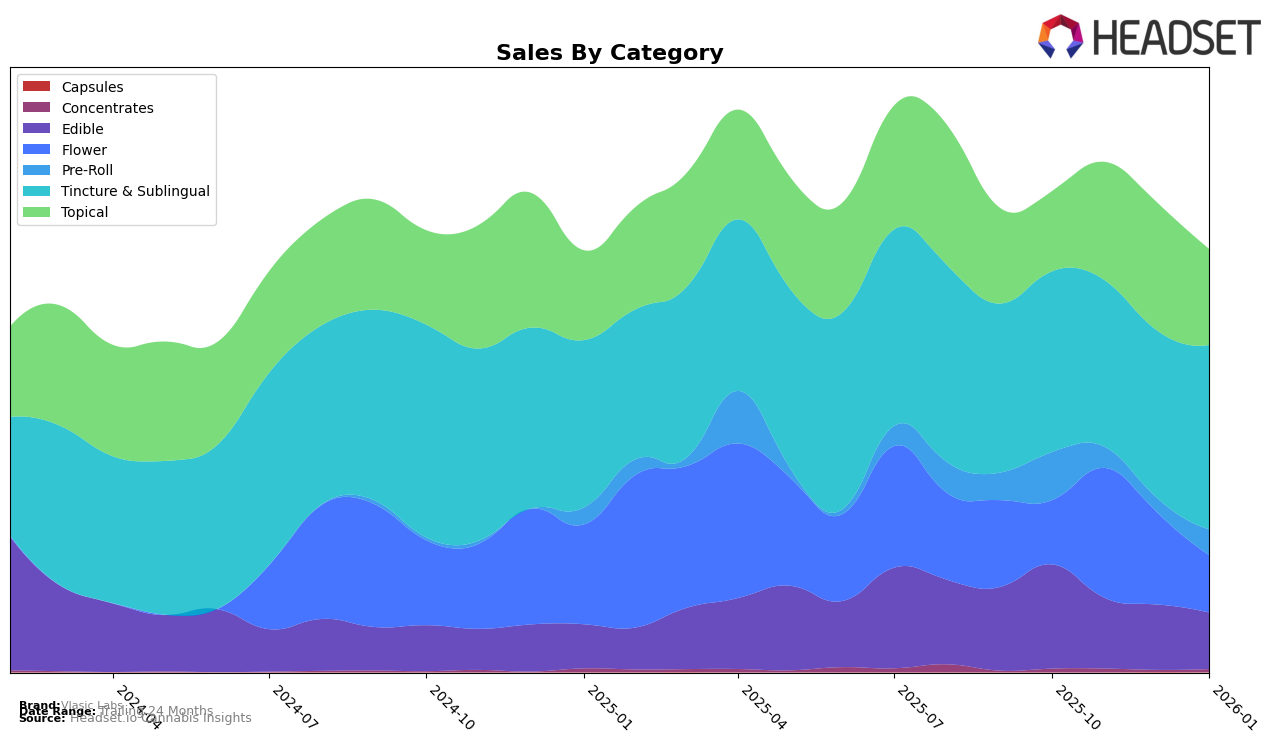

In Michigan, Vlasic Labs has shown a consistent performance in the Tincture & Sublingual category, maintaining a top 4 ranking across several months, with a slight dip from the second position in October 2025 to the third position by January 2026. This stability in ranking is complemented by a gradual decrease in sales figures, which might indicate a competitive market environment or seasonal fluctuations. On the other hand, their performance in the Edible category has not been as strong, as they have not managed to break into the top 30, reflecting a challenging market presence in this segment.

In Missouri, Vlasic Labs has maintained a strong foothold in the Tincture & Sublingual category, consistently ranking third and even reaching the second position in January 2026. This indicates a positive reception and growing consumer base for their products in this category. Conversely, the Edible category in Missouri shows a downward trend with Vlasic Labs failing to secure a top 30 position by January 2026, which could suggest increased competition or a shift in consumer preferences. Meanwhile, in Nevada, their presence in the Pre-Roll category was noted in October 2025 and January 2026, but absence in the intervening months highlights potential volatility or strategic market adjustments.

Competitive Landscape

In the competitive landscape of the Tincture & Sublingual category in Michigan, Vlasic Labs has experienced notable fluctuations in its market position from October 2025 to January 2026. Initially holding the 2nd rank in October 2025, Vlasic Labs saw a decline to 4th place in November before recovering slightly to 3rd place in December and maintaining this position in January 2026. This shift in rank is influenced by the performance of competitors such as Rise (MI), which ascended to the top rank by December 2025, and Treetown, which consistently held strong positions, only dropping to 2nd place in December and January. Meanwhile, Mary's Medicinals maintained a stable presence in the top 5, while Cannalicious Labs remained in 5th place throughout the period, except for January when it fell out of the top 20. These dynamics suggest that while Vlasic Labs remains a key player, it faces strong competition from brands that are either maintaining or improving their market positions, impacting Vlasic Labs' sales trajectory and necessitating strategic adjustments to regain a higher rank.

Notable Products

In January 2026, Vlasic Labs' top-performing product was the CBD Broad Spectrum Tincture (3000mg CBD, 30ml, 1oz), reclaiming the number one spot after slipping to second place in December 2025, with a notable sales figure of 1084 units. The Grape Crush Pre-Roll (1g) made a significant leap, rising to second place from fifth in December, with a substantial increase in sales. The CBD Full Spectrum Relief Cream (3000mg CBD, 3oz) dropped to third place, despite being the top product in December. The CBG Isolate Focus Tincture (1800mg CBG, 30ml, 1oz) maintained its fourth position consistently over the past months. Meanwhile, the CBN Isolate Tincture (1200mg CBN, 30ml, 1oz) saw a decline, moving down to fifth place from its third position in December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.