Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

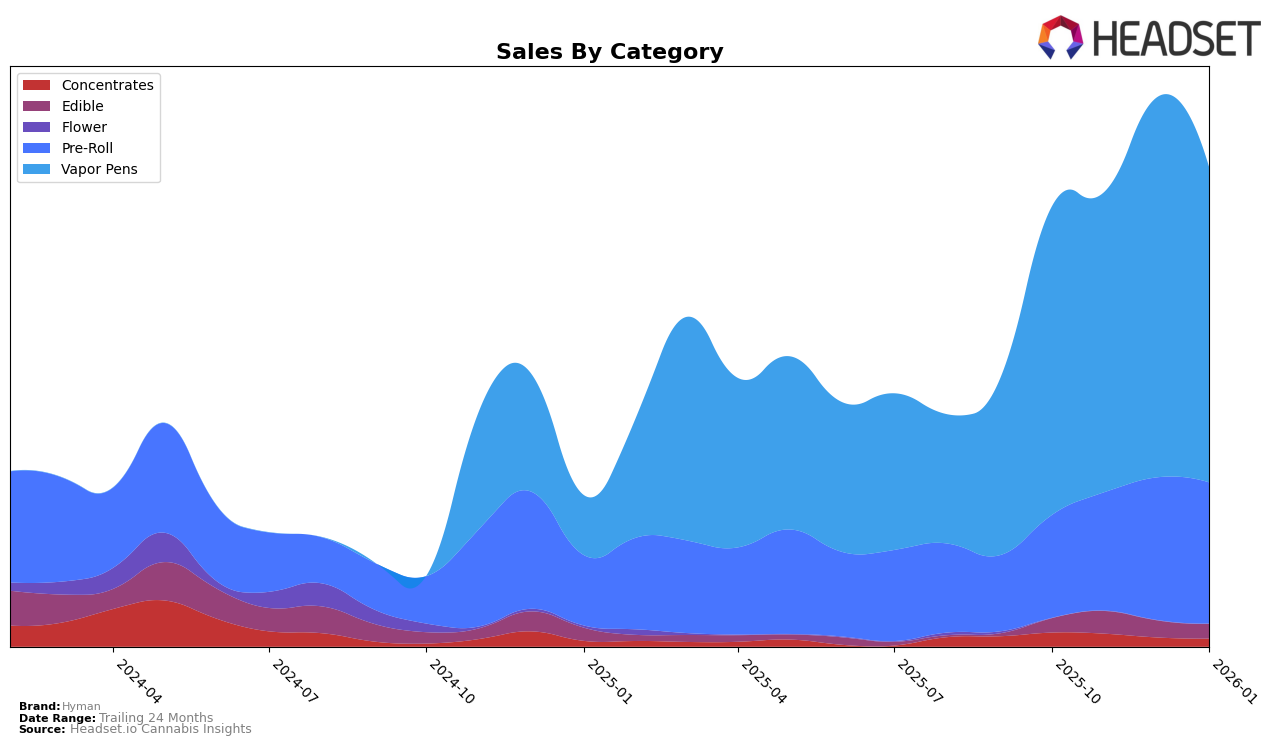

Hyman's performance in Michigan across different cannabis product categories shows varied progress. In the Edible category, Hyman has struggled to break into the top 30, with rankings hovering in the 80s and 90s over the last few months, indicating a need to strengthen their presence in this segment. Their sales peaked in November 2025 but showed a decline in the following months. Conversely, the Pre-Roll category has seen a significant upward trajectory, with Hyman climbing from a rank of 68 in October 2025 to 43 in January 2026. This improvement suggests a growing consumer preference or effective marketing strategies in this category.

The Vapor Pens category is where Hyman seems to have a stable foothold, maintaining a consistent rank around the low 20s. While the rankings have remained relatively steady, there was a notable spike in sales in December 2025, suggesting a seasonal or promotional influence. Despite not breaking into the top 20, Hyman's ability to sustain a strong position in this category indicates a solid product offering that resonates with consumers. However, the lack of top 30 presence in other states or provinces could point to opportunities for expansion or areas where the brand might need to bolster its efforts.

Competitive Landscape

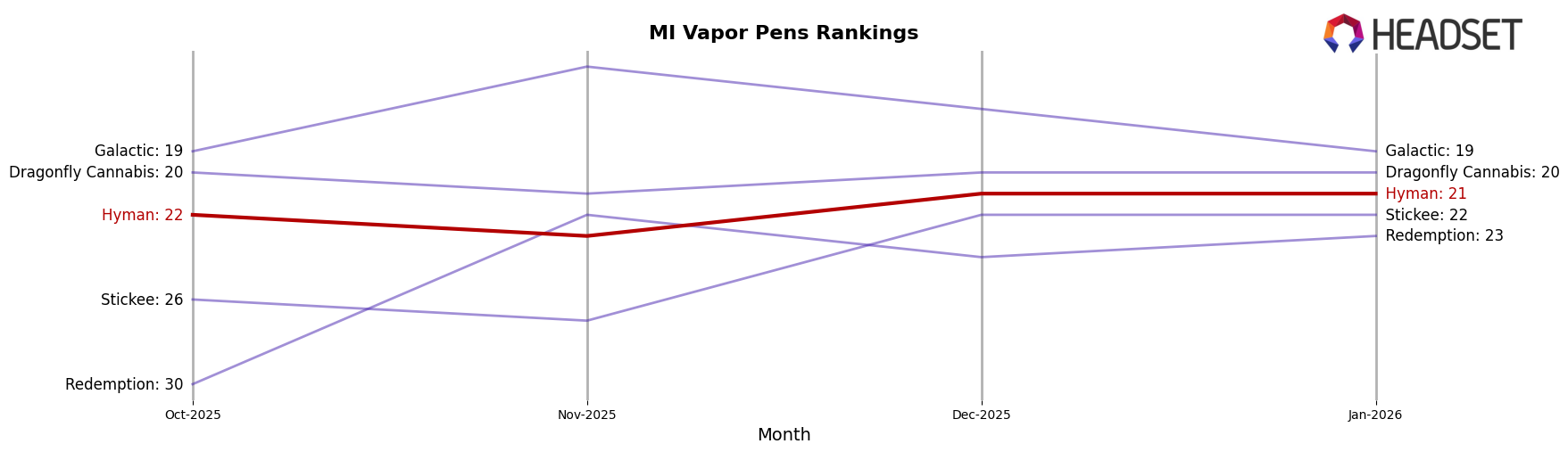

In the competitive landscape of vapor pens in Michigan, Hyman has shown a notable performance trajectory from October 2025 to January 2026. Despite a slight dip in rank from 22nd to 23rd in November, Hyman rebounded to 21st place by December and maintained this position into January. This upward movement in rank is indicative of a positive trend in sales, particularly in December when Hyman's sales surged, surpassing those of Redemption and Stickee. However, Hyman still trails behind more consistently higher-ranked competitors like Dragonfly Cannabis and Galactic, which have maintained stronger sales figures and higher rankings throughout the period. This data highlights Hyman's potential for growth and the competitive pressure from leading brands in the Michigan vapor pen market.

Notable Products

In January 2026, the top-performing product for Hyman was the Screw Ball Sherbert Live Resin Stylus Disposable (1g) in the Vapor Pens category, securing the number one rank with sales of 2913 units. Following closely, the Bubblegum Gelato Live Resin Stylus Disposable (1g) rose to the second position, showing a steady increase from its previous ranks of fourth in November and fifth in December. Jackknife Live Resin Stylus Disposable (1g) maintained a consistent presence, ranking third in both November and January. Kelly Kapowski Live Resin Stylus Disposable (1g) experienced a drop to fourth place after reaching third in December. Wolf Pac Live Resin Stylus Disposable (1g) fell to fifth place, having previously held the top spot in November.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.