Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

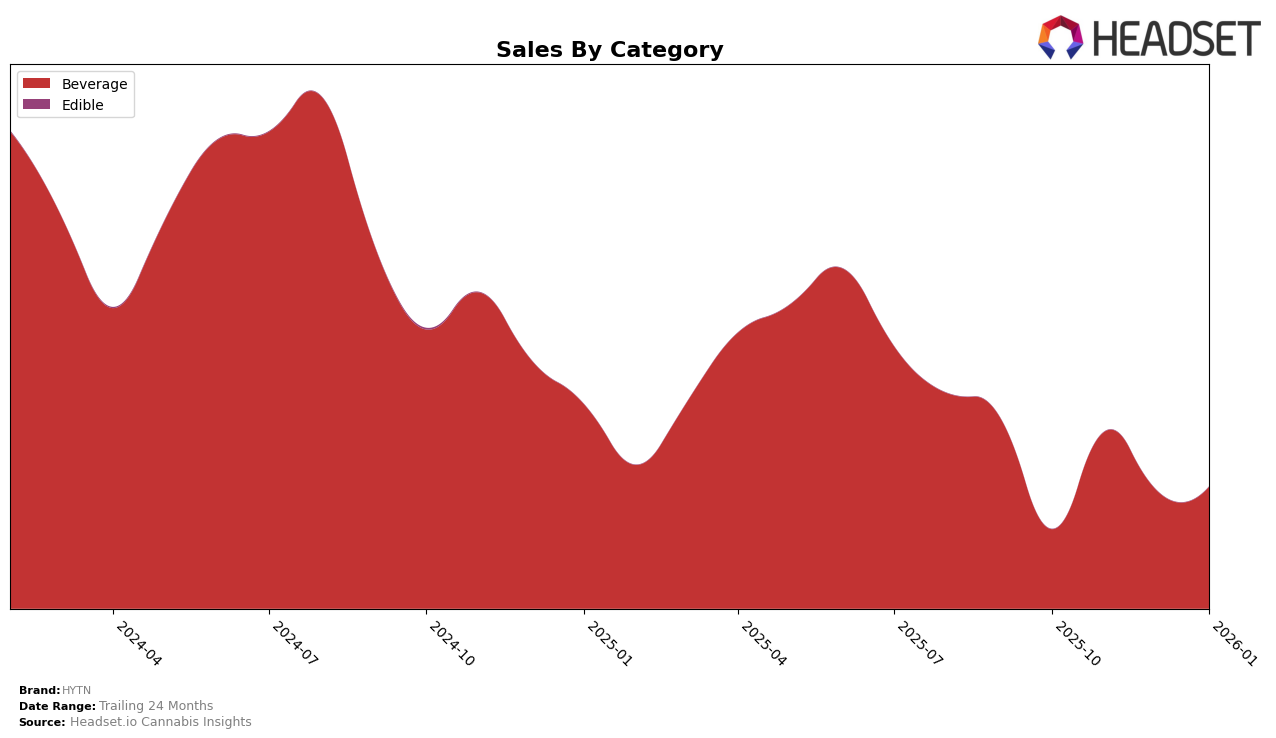

In the Canadian province of British Columbia, HYTN has demonstrated notable fluctuations in its performance within the Beverage category. Over the span of four months, the brand's ranking has oscillated, starting at 15th place in October 2025, moving up to 10th in November, then dropping to 17th in December, before climbing back to 12th by January 2026. This indicates a dynamic market presence with potential volatility in consumer demand or competitive pressures. The sales figures reflect this variability, with a significant surge in November, followed by a decrease in December, and a moderate recovery in January. Such movements suggest that while HYTN is capable of achieving strong market positions, sustaining a top-tier ranking consistently remains a challenge.

Interestingly, the data reveals that HYTN managed to stay within the top 30 brands throughout the observed period, which is a positive indicator of its resilience and market penetration in British Columbia. However, the absence of rankings in other states or provinces suggests that HYTN's influence might be geographically limited or that it faces stronger competition elsewhere. This might imply a strategic focus on maintaining and expanding its foothold in British Columbia while exploring opportunities for growth in other regions. Observing the brand's future movements in rankings and sales across different states and categories will be crucial to understanding its broader market strategy and potential for expansion.

Competitive Landscape

In the competitive landscape of the beverage category in British Columbia, HYTN has experienced notable fluctuations in its rank and sales over the past few months. Starting at 15th place in October 2025, HYTN climbed to 10th in November, only to drop to 17th in December before recovering to 12th in January 2026. This volatility suggests a dynamic market presence, with HYTN's sales peaking in November. In comparison, TeaPot consistently maintained a top 10 position, indicating a stable and strong market performance. Meanwhile, Summit (Canada) and Dabble Cannabis Co. also showed varied rankings, with Summit maintaining a steady presence around 12th to 13th place and Dabble experiencing a significant drop from 7th to 14th. Solei showed a positive trend, improving its rank from 16th to 11th by January. These shifts highlight the competitive pressure HYTN faces, emphasizing the need for strategic marketing efforts to stabilize and improve its market position.

Notable Products

In January 2026, the top-performing product from HYTN was the Rosewater Lemonade Drink (10mg THC, 355ml), maintaining its number one rank from the previous two months with sales reaching 2,832 units. The Blood Orange Sparkling Water (10mg THC, 355ml) held steady at the second position, although its sales saw a decline to 1,011 units. The Pomelo Papaya Sparkling Drink (10mg THC, 355ml) remained consistently in third place over the past four months. The Fruit Punch Sparkling Drink (10mg THC, 12oz, 355ml) followed in fourth, showing a slight decrease in sales compared to December 2025. Notably, the Citrus Nano Shot (100mg THC, 50ml) dropped out of the rankings in January, having previously been ranked fifth.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.