Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

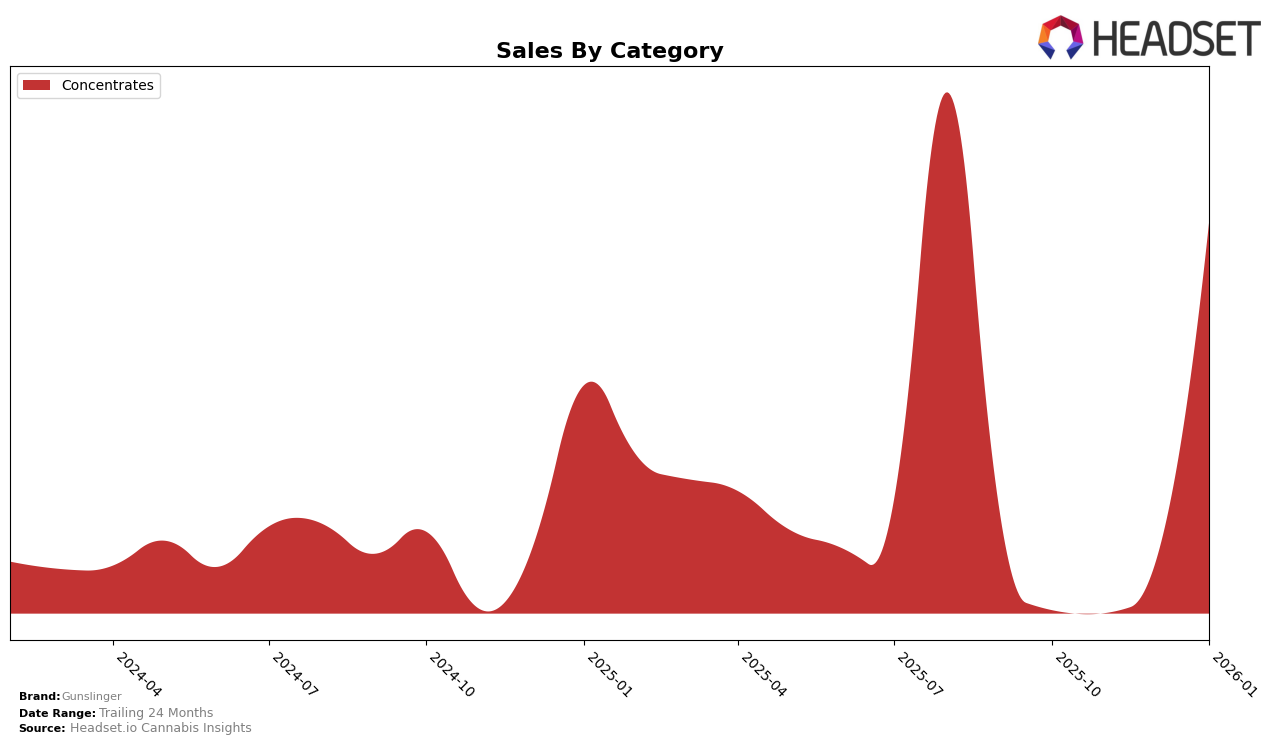

Gunslinger has shown a notable performance in the Nevada market, specifically within the Concentrates category. After not appearing in the top 30 rankings from October to December 2025, Gunslinger made a significant leap to secure the 12th position by January 2026. This upward movement indicates a strong market entry or resurgence, suggesting that Gunslinger has successfully captured consumer interest or responded effectively to market demands within this period. The sales figures for January 2026, amounting to $58,102, further underscore its impactful presence in the Concentrates category, signaling a noteworthy turnaround from the previous months.

The absence of Gunslinger in the top 30 rankings from October to December 2025 across other states and categories might initially suggest limited reach or competition. However, the brand's ability to break into the rankings in Nevada demonstrates potential for growth and expansion. It's crucial to consider how Gunslinger's strategy in Nevada could be replicated in other markets to enhance its footprint. The brand's performance in January 2026 serves as a valuable case study for understanding market dynamics and consumer preferences in the cannabis industry, particularly in the Concentrates category.

Competitive Landscape

In the Nevada concentrates market, Gunslinger made a notable entry in January 2026, securing the 12th position, indicating a strong debut in the competitive landscape. This is particularly impressive considering the fluctuating ranks of established competitors. For instance, Matrix NV showed a significant improvement, climbing from 21st in October 2025 to 10th by January 2026, suggesting a strategic push in sales. Meanwhile, Nature's Chemistry experienced a decline, dropping from 11th to 15th over the same period, which could indicate challenges in maintaining market share. Tsunami Labs (NV) also saw fluctuations, peaking at 7th in December 2025 before falling to 11th in January 2026, reflecting potential volatility in their sales strategy. Khalifa Kush had inconsistent rankings, missing from the top 20 in December 2025 but reappearing at 13th in January 2026. Gunslinger's entry into the top 20 with a strong 12th rank highlights its potential to disrupt the market and suggests a promising trajectory if it can maintain or improve its position against these fluctuating competitors.

Notable Products

In January 2026, Diesel Tree Live Resin Badder (1g) emerged as the top-performing product for Gunslinger, maintaining its first-place rank from December 2025 with impressive sales of 825 units. Strawberry OG Live Resin Badder (1g) climbed from third to second place, showing a significant increase in popularity and sales. Belly Laugh Live Resin Sugar (1g) made its debut in the rankings at third place, indicating a strong market entry. Hoover Runtz Live Resin Sugar (1g) improved from fifth to fourth place, while Yellow Snow Live Resin Badder (1g) entered the top five for the first time. These shifts highlight a dynamic change in consumer preferences towards a variety of concentrate products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.