Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

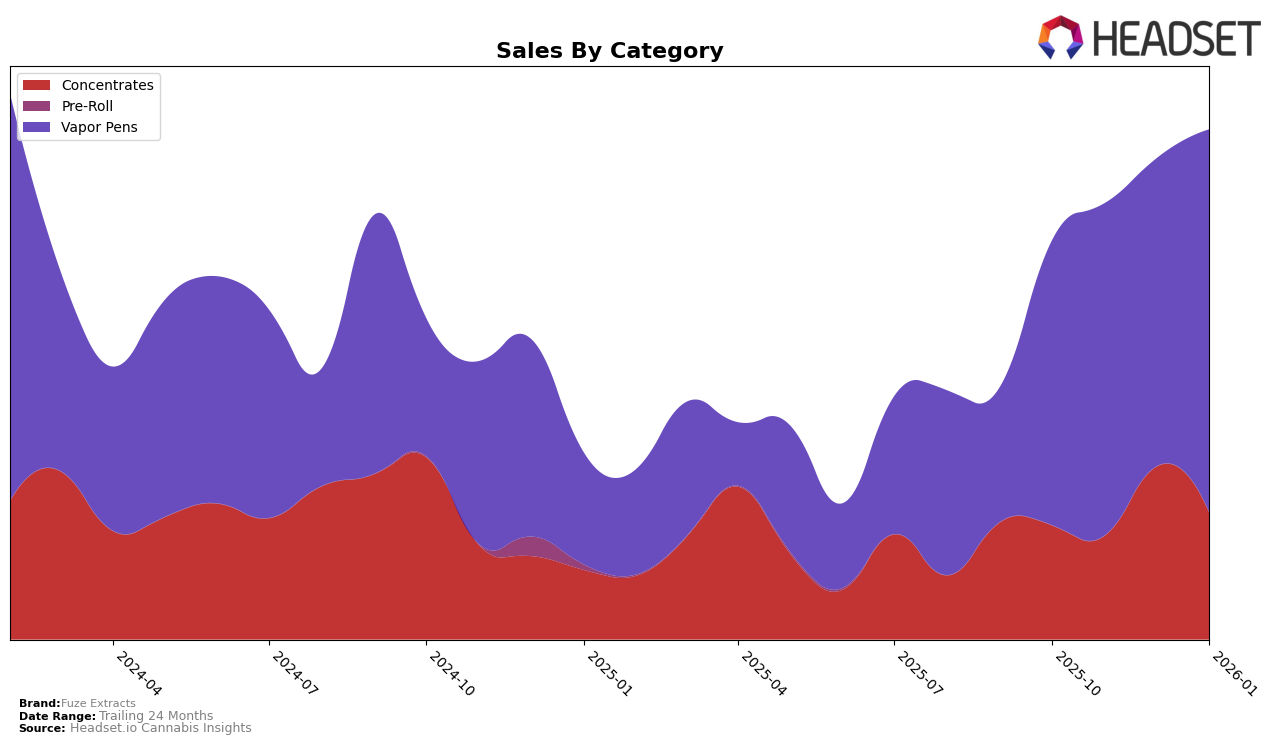

Fuze Extracts has demonstrated a notable performance trajectory within the Nevada market, particularly in the Concentrates category. While the brand maintained a steady ranking of 22 in both October and November of 2025, it experienced a significant improvement to rank 16 by December, before slightly declining to 18 in January 2026. This fluctuation in rankings corresponds with a pronounced increase in sales from November to December, suggesting a strong holiday season performance. The ability to maintain a position within the top 20 in this competitive category highlights Fuze Extracts' growing influence and consumer preference in Nevada.

In contrast, Fuze Extracts' presence in the Vapor Pens category within Nevada reveals a different dynamic. Despite not being in the top 30 brands in October 2025, the brand made impressive strides, climbing from a rank of 52 in October to 35 by January 2026. This upward movement, alongside a substantial increase in sales, indicates a successful strategy in capturing market share and expanding its footprint within this category. The brand's ability to move up the ranks so significantly over a few months suggests effective marketing and product alignment with consumer trends, although the initial absence from the top 30 could imply challenges faced earlier in the year.

Competitive Landscape

In the competitive landscape of vapor pens in Nevada, Fuze Extracts has demonstrated a notable upward trajectory in its market rank, moving from 52nd in October 2025 to 35th by January 2026. This improvement is indicative of a significant increase in sales, particularly evident in the jump from November to December 2025. In comparison, Nature's Chemistry and Khalifa Kush have shown fluctuating ranks, with Nature's Chemistry improving to 34th in January 2026, while Khalifa Kush dropped to 36th. Meanwhile, Mojo (Edibles) maintained a relatively stable position, consistently ranking around the low 30s, and Kushberry Farms re-entered the top 40 in January 2026 after a brief absence. The overall trend suggests that Fuze Extracts is gaining momentum in the Nevada vapor pen market, potentially positioning itself as a stronger competitor against established brands.

Notable Products

In January 2026, the top-performing product from Fuze Extracts was Watermelon Mania Live Resin Disposable (1g) in the Vapor Pens category, reclaiming its top position from October 2025 after a dip in November. Trop Cherry Live Rosin Disposable (0.5g) rose to second place, showing consistent improvement from its fourth-place ranking in November and third in December, with sales reaching 231 units. Strawberry Blonde Live Resin Disposable (1g) secured the third spot, having re-entered the rankings after a previous absence, and moved up from an earlier second-place position in October. Garlic Juice Live Rosin Disposable (0.5g) made its debut in the rankings at fourth place, indicating a strong entry into the market. Grape Hill Live Resin Disposable (0.5g) saw a decline, dropping to fifth place from its peak first-place ranking in November, with sales of 137 units in January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.