Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

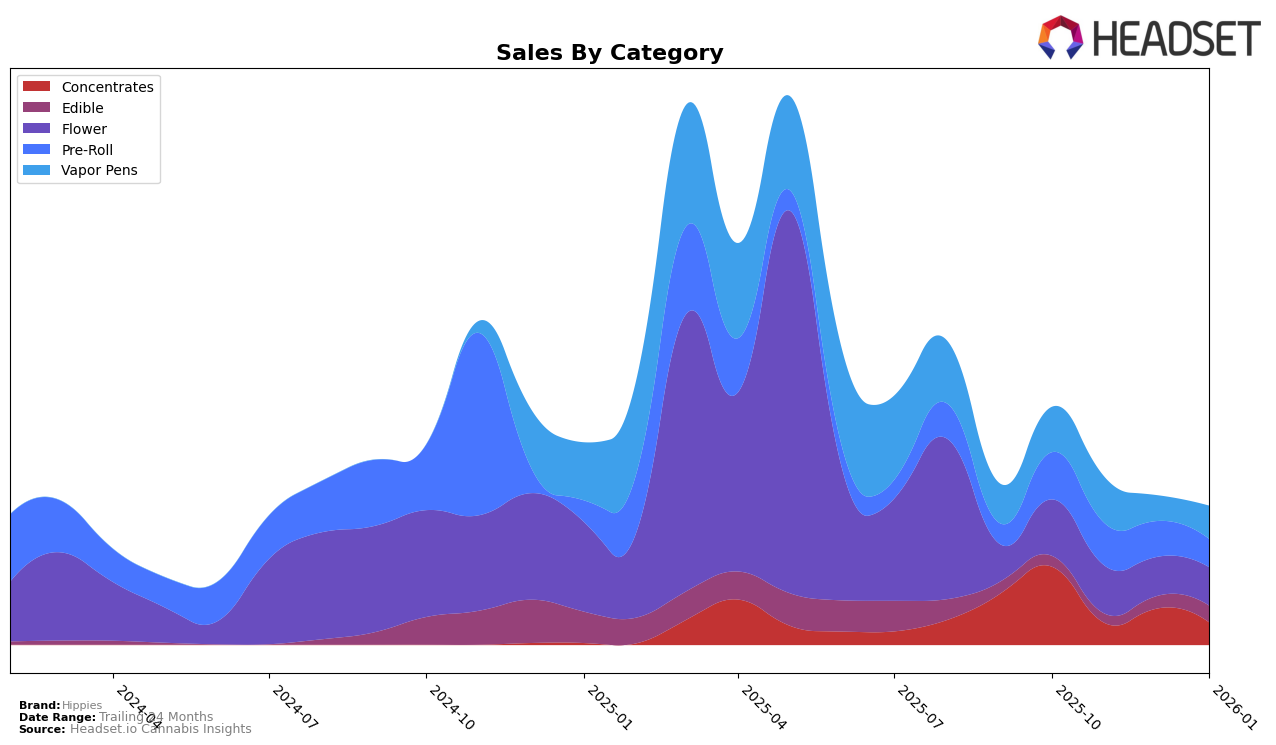

Hippies has displayed notable fluctuations in its performance across various product categories in Nevada. In the Concentrates category, the brand experienced a significant drop in rank from 7th in October 2025 to 21st in November 2025, with a brief recovery to 14th in December before returning to 21st in January 2026. This volatility suggests a competitive landscape where Hippies is struggling to maintain a consistent position. On the other hand, the Flower category has shown a steady rank, consistently placing 61st from November 2025 through January 2026, indicating a stable but less competitive presence. In the Pre-Roll category, Hippies started at 29th in October and maintained this position in November, but slipped to 31st in December and further to 39th in January, showing a downward trend that might be concerning for the brand.

In the Edible category, Hippies did not appear in the top 30 rankings until January 2026, where it ranked 33rd, an indication of a late but emerging presence in this segment. Meanwhile, the Vapor Pens category saw Hippies ranked 35th in October 2025, with a slight decline to 36th in November, dropping further to 46th in December, but showing a minor recovery to 41st in January 2026. This pattern suggests some challenges in maintaining a competitive edge in the Vapor Pens market in Nevada. Overall, while Hippies shows potential in certain categories, such as Concentrates, the brand faces challenges in others, indicating areas for strategic improvement and focus.

Competitive Landscape

In the competitive landscape of Nevada's flower category, Hippies has maintained a consistent rank of 61 from November 2025 to January 2026, indicating a stable market presence despite a gradual decline in sales over these months. In contrast, Tyson 2.0 has shown a notable improvement, climbing from a rank of 60 in December 2025 to 51 in January 2026, with a corresponding increase in sales. Meanwhile, Spiked Flamingo has made significant strides, moving from a rank of 80 in December 2025 to 64 in January 2026, reflecting a strong upward trend in sales. LP Exotics experienced fluctuating ranks, with a notable dip in December 2025 but a recovery in January 2026, indicating volatility. Hijinks also displayed variability, peaking at rank 45 in November 2025 before dropping to 66 in January 2026. This competitive analysis suggests that while Hippies remains stable, competitors are experiencing dynamic changes, potentially impacting Hippies' market share and necessitating strategic adjustments to maintain its position.

Notable Products

In January 2026, Garlic Cream Pre-Roll (1g) maintained its position as the top-performing product for Hippies, despite a significant drop in sales to 1112 units. Ape S#!t Pre-Roll (1g) climbed to the second position, showing a slight increase in sales from the previous month. Lato Purp Infused Pre-Roll (1g) entered the rankings for the first time, securing the third spot. Jenny Kush Cured Resin Sugar (1g) remained stable at fourth, although its sales decreased. Alien Rock Candy Pre-Roll (1g) dropped to fifth place, reflecting a downward trend in its sales performance since November 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.