Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

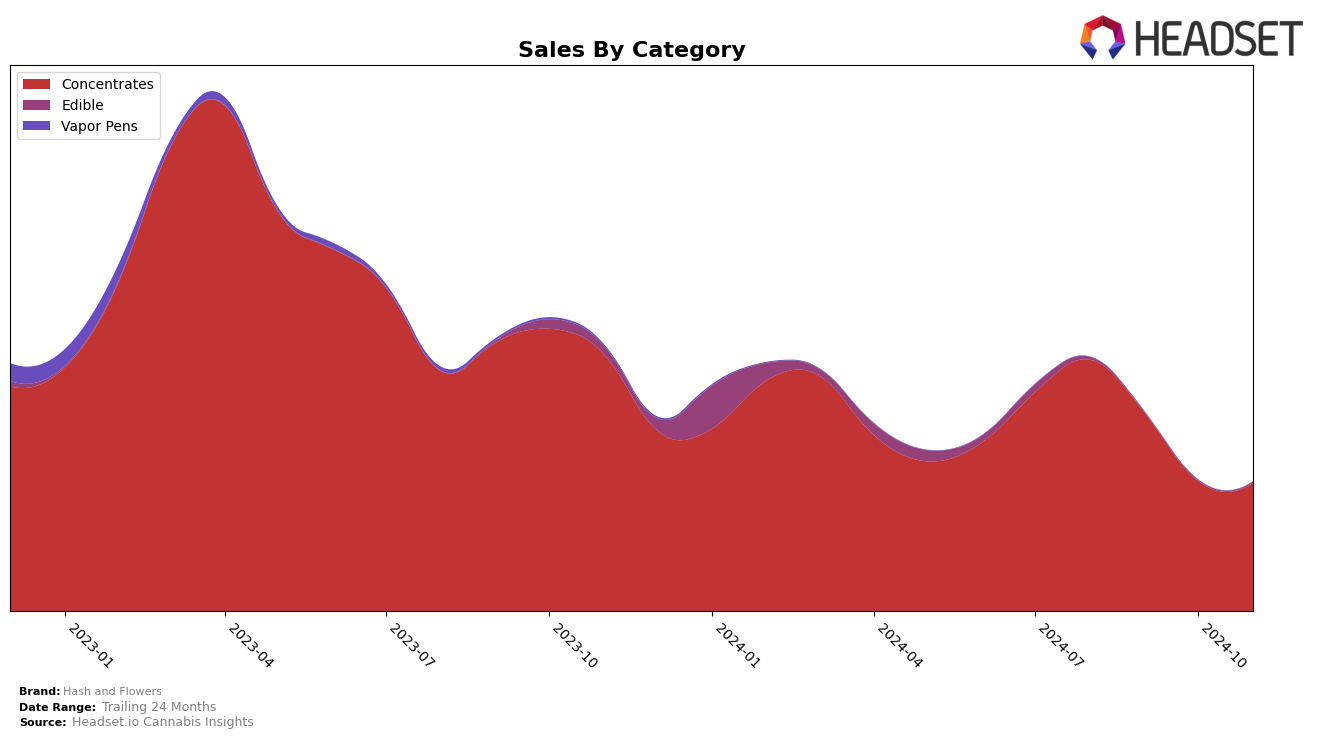

Hash and Flowers has experienced notable fluctuations in its performance across different categories and states, with particular attention to its trajectory in the concentrates category in California. The brand saw a steady decline in its ranking from August to November 2024, moving from 13th to 25th place. This downward trend suggests a potential challenge in maintaining its competitive position within the concentrates market in California. The sales figures corroborate this movement, showing a consistent decrease over the months. Such a decline in both ranking and sales may indicate increased competition or shifts in consumer preferences within the state.

Interestingly, the absence of Hash and Flowers from the top 30 rankings in other states or categories during these months could be interpreted in various ways. On one hand, it might suggest a concentrated focus on the California market, potentially at the expense of broader market penetration. On the other hand, it could reflect challenges in expanding their brand presence or appeal outside of California. This limited visibility in other markets could either be a strategic decision or a missed opportunity, depending on the brand's long-term goals. The data indicates an area worth exploring further for understanding the brand's overall market strategy and potential areas for growth.

Competitive Landscape

In the competitive landscape of the California concentrates market, Hash and Flowers has experienced a notable decline in rank over the past few months, dropping from 13th place in August 2024 to 25th by November 2024. This downward trend in ranking is mirrored by a decrease in sales, indicating potential challenges in maintaining market share. In contrast, Lime has shown resilience, climbing back to 24th place in November after briefly entering the top 20 in October. Meanwhile, 5G (530 Grower) has made a significant leap, moving from 44th in August to 23rd in November, suggesting a strong upward trajectory in both rank and sales. Additionally, Mountain Man Melts has steadily improved its position, reaching 26th place in November. These shifts highlight the dynamic nature of the market and suggest that Hash and Flowers may need to strategize to regain its competitive edge.

Notable Products

In November 2024, Rotten Bananas Live Rosin (1g) maintained its position as the top-performing product for Hash and Flowers, achieving a notable sales figure of 964. Baja Splash Live Rosin (1g) remained steady in second place, consistent with its rank from October. Ichigo Jamu Live Hash Rosin (1g) rose to third place, showing an upward trend from its debut in fourth place the previous month. Fruitisma Live Resin (1g) also improved, moving up from fifth to fourth place. Banana Punch Hash Rosin (1g) entered the rankings for the first time, securing the fifth position in November.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.