Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

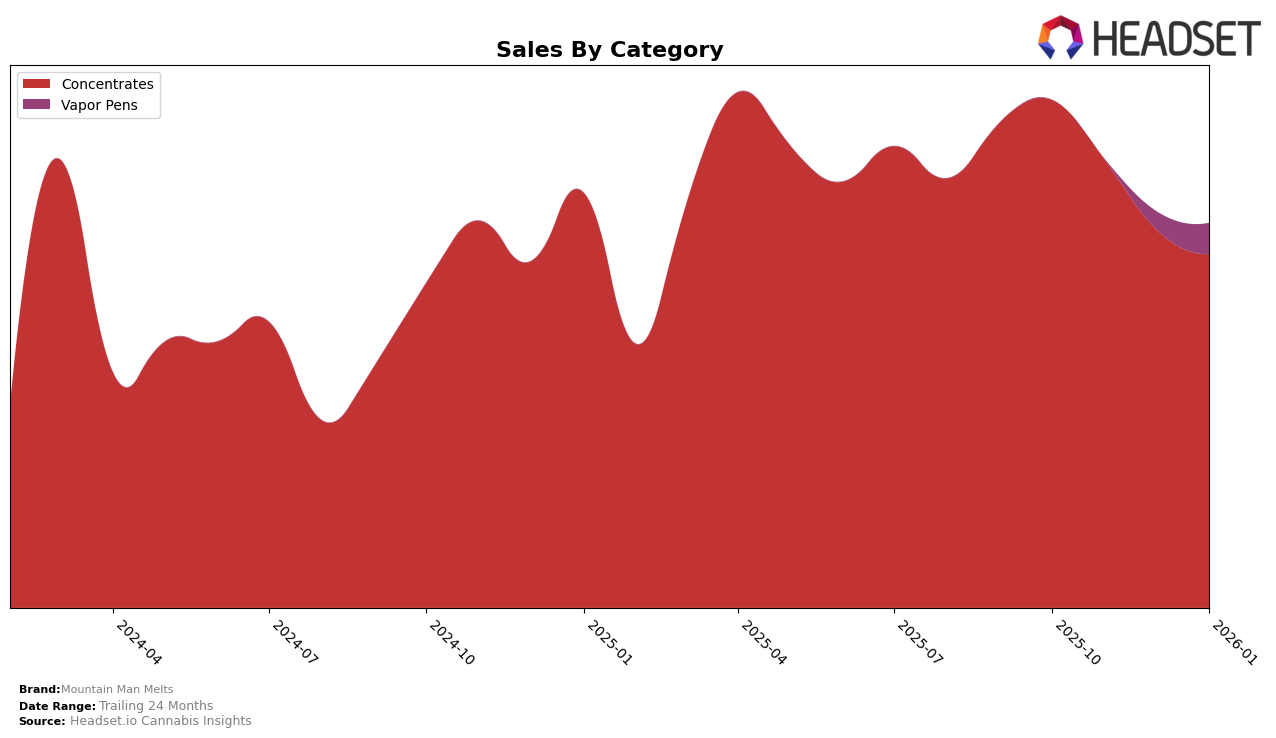

Mountain Man Melts has shown a notable trajectory in the California market within the concentrates category. Observing the rankings from October 2025 to January 2026, the brand has experienced a decline, moving from the 16th position in October to the 26th by January. This drop in rankings is accompanied by a decrease in sales figures over the same period, indicating potential challenges in maintaining market share. The decline in their standings suggests increasing competition or possibly shifting consumer preferences in the concentrates category within California.

Interestingly, the absence of Mountain Man Melts from the top 30 brands in other states or provinces during this period highlights a significant area for potential growth or concern. Their exclusive presence in California's top 30 suggests a strong regional focus but also points to limited brand penetration beyond this market. Understanding the reasons behind their performance in California could provide insights into opportunities for expansion or necessary strategic adjustments. This information serves as a valuable indicator of where Mountain Man Melts might focus its future efforts to broaden its market reach and improve its standings in the concentrates category.

Competitive Landscape

In the competitive landscape of California's concentrates market, Mountain Man Melts has experienced a notable shift in its ranking and sales trajectory. Initially ranked 16th in October 2025, the brand saw a decline to 26th by January 2026. This downward trend in rank is mirrored by a decrease in sales over the same period, suggesting a potential challenge in maintaining market share. In contrast, Clsics has shown resilience, maintaining a top 25 position throughout and even reaching the 20th spot in December 2025, indicating a stronger market presence. Meanwhile, Hashtag improved its rank from 35th to 25th, showcasing a positive sales trajectory that could pose a competitive threat. The fluctuating ranks of Everyday Cannabis Co. and Buddies highlight the dynamic nature of this market, with both brands experiencing significant rank changes. These insights underscore the competitive pressures Mountain Man Melts faces, necessitating strategic adjustments to regain its footing in the California concentrates sector.

Notable Products

In January 2026, Mountain Man Melts' top-performing product was Rainbow Guava Live Rosin (1g) in the Concentrates category, achieving the number one rank with sales of 496 units. Rainbow Push Pop Live Rosin (1g) followed closely as the second highest-selling product. A La Mode Live Rosin (1g) maintained its third position from December 2025, showing consistent performance. GMO Cold Cured Live Rosin (1g) experienced a slight decline, moving from the top spot in October 2025 to fourth place in January 2026. Z Boof Live Rosin (1g) entered the top five rankings for the first time in January 2026, showcasing its growing popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.