Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

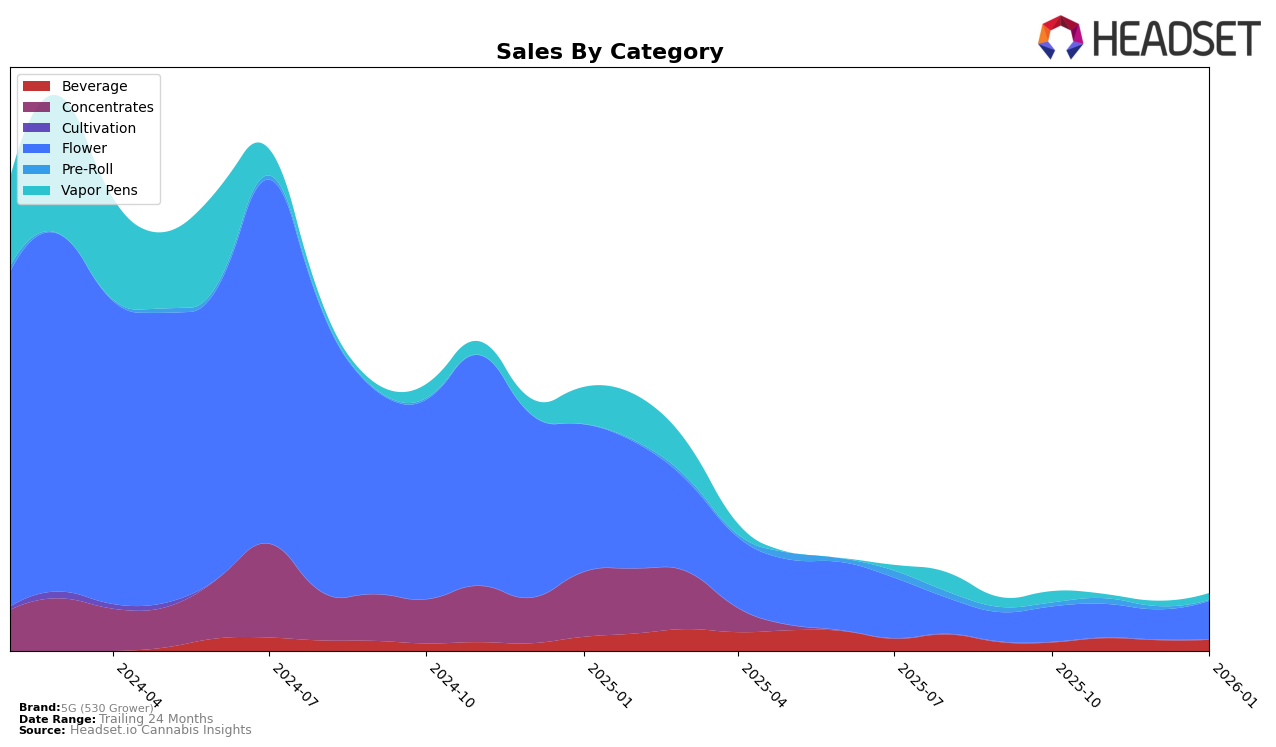

Market Insights Snapshot

In the state of California, 5G (530 Grower) has shown consistent improvement in the Beverage category over the last few months. Starting from a rank of 21 in October 2025, the brand climbed to 17th by January 2026. This upward trajectory indicates a strengthening presence and growing consumer acceptance within the competitive California market. The brand's sales figures also reflect this positive trend, with a notable increase from October to November 2025, before stabilizing in the following months. This suggests that 5G (530 Grower) is successfully capturing market share and resonating with consumers in the beverage segment.

It is important to note that 5G (530 Grower) has not appeared in the top 30 rankings in any other states or provinces across the categories analyzed. This absence could imply a focused strategy within California, or it might highlight potential areas for growth and expansion. The brand's ability to improve its ranking within California's competitive landscape is commendable, but the lack of presence in other markets suggests there are opportunities to explore broader distribution or marketing strategies. As 5G (530 Grower) continues to build its brand, monitoring its performance across different states and categories will provide valuable insights into its overall market positioning and potential for future expansion.

Competitive Landscape

In the competitive landscape of the California beverage category, 5G (530 Grower) has shown a notable upward trajectory in rank from October 2025 to January 2026. Starting at 21st place in October, 5G (530 Grower) climbed to 17th by January, indicating a positive trend in market presence. This rise is particularly significant when compared to competitors like Kan+Ade, which maintained a steady rank of 16th, and Sip Elixirs, which saw a decline from 10th to 15th over the same period. Despite Voila! entering the top 20 in November and maintaining a presence thereafter, 5G (530 Grower) managed to surpass High Power, which dropped out of the top 20 in December. This competitive shift suggests that 5G (530 Grower) is effectively capturing market share, potentially due to strategic marketing efforts or product innovations, positioning itself as a brand to watch in the California beverage market.

Notable Products

In January 2026, the top-performing product from 5G (530 Grower) was Zero Sugar Root Beer Pop (100mg), maintaining its leading position as the number one ranked product for two consecutive months with sales of 597 units. Orange Soda Pop (100mg THC, 355ml) held steady in the second rank, continuing its consistent performance since November 2025. Peach Tea Pop Soda (100mg THC, 12oz) remained in the third spot, reflecting stability in its sales figures. New entries in the top ranks include LZG (7g) and Jawbreakerz (7g), which debuted at fourth and fifth positions, respectively. These shifts indicate a growing interest in the Flower category, as these products were not ranked in the previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.