Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

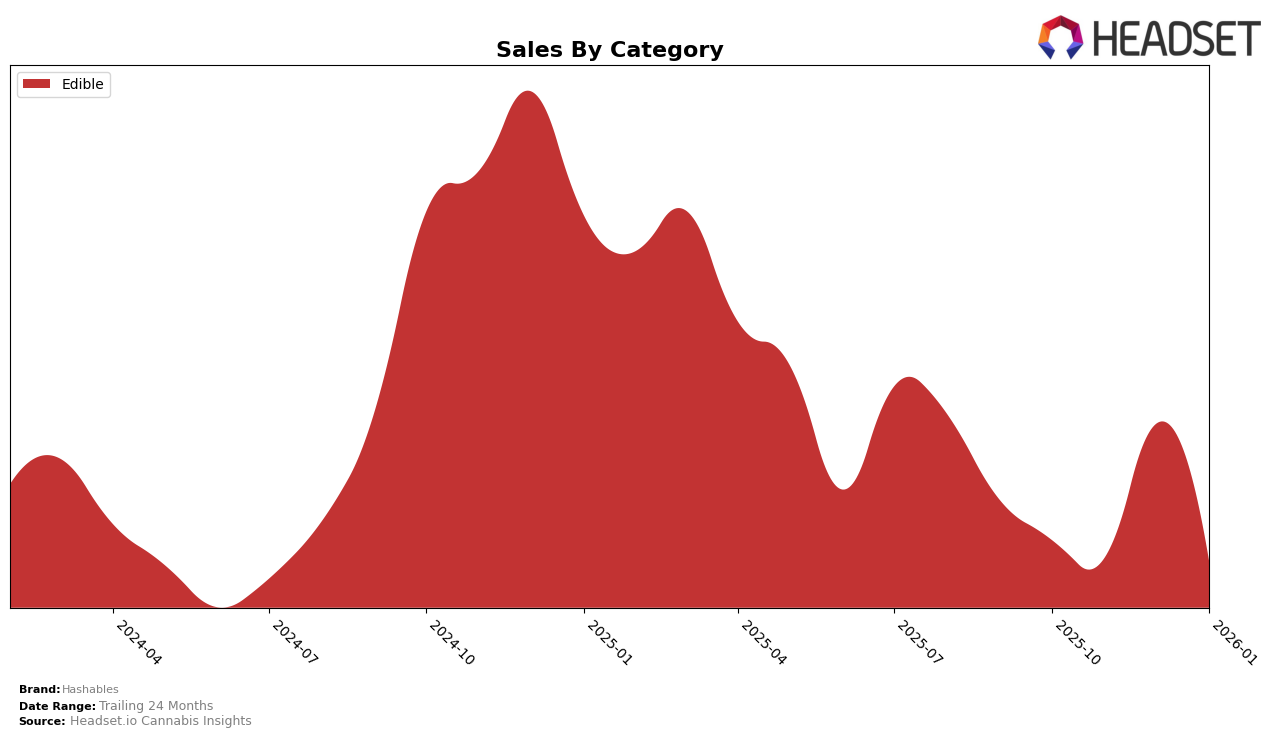

Hashables has shown consistent performance in the Massachusetts edible category, maintaining a steady 15th position from October 2025 through January 2026. Despite fluctuations in monthly sales figures, with a notable increase in December 2025, the brand's rank stability suggests a solid market presence. This consistency in Massachusetts contrasts with their performance in New Jersey, where Hashables experienced more variability in rankings. The brand improved its position from 21st in October 2025 to 17th in December 2025, before dropping back to 21st in January 2026. This indicates potential challenges in maintaining momentum in New Jersey's competitive market.

While Hashables managed to stay within the top 30 brands across both states, their fluctuating rankings in New Jersey highlight areas for potential growth and strategic focus. The December 2025 peak in New Jersey suggests that certain factors or promotions might have temporarily boosted their market position, an insight that could be valuable for future planning. In contrast, the stability in Massachusetts could point to a loyal customer base or effective market strategies that consistently resonate with consumers. Understanding these dynamics and the underlying reasons for their performance can provide strategic insights for Hashables as they navigate different state markets and aim to enhance their brand presence across categories.

Competitive Landscape

In the Massachusetts edible market, Hashables has maintained a consistent rank of 15th from October 2025 to January 2026. This stability in ranking reflects a steady performance amidst a competitive landscape. Notably, Mindy's Edibles and Treeworks have consistently ranked higher, with Mindy's Edibles holding the 12th position in October and November 2025 before dropping to 14th in December 2025 and January 2026, while Treeworks improved from 14th to 13th over the same period. Meanwhile, Dialed In Gummies showed significant upward momentum, climbing from outside the top 20 in October 2025 to 18th by January 2026, indicating a growing market presence. Hashables' sales saw a peak in December 2025, aligning with a general upward trend in the market, but its sales figures in January 2026 suggest a need for strategic adjustments to capitalize on market opportunities and improve its competitive standing.

Notable Products

In January 2026, the top-performing product from Hashables was the Bangin Berry Solventless Gummies 20-Pack (100mg), which reclaimed the number one rank after dropping to second in December 2025, with sales reaching 2739 units. The Watermelon Jolt Solventless Hash Infused Gummies 20-Pack (100mg) maintained a strong position, moving up to second place from third in the previous two months. Peachy Mango Solventless Hash Gummies 20-Pack (100mg) consistently held the third position, showing steady performance despite a slight decrease in sales. Tropical Typhoon Solventless Rosin Gummies 20-Pack (100mg) experienced a drop from first in December 2025 to fourth in January 2026. Electric Grape Solventless Live Hash Rosin Hash Infused Gummies 20-Pack (100mg) remained in fifth position throughout the analyzed months, indicating stable but lower sales compared to the top performers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.