Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

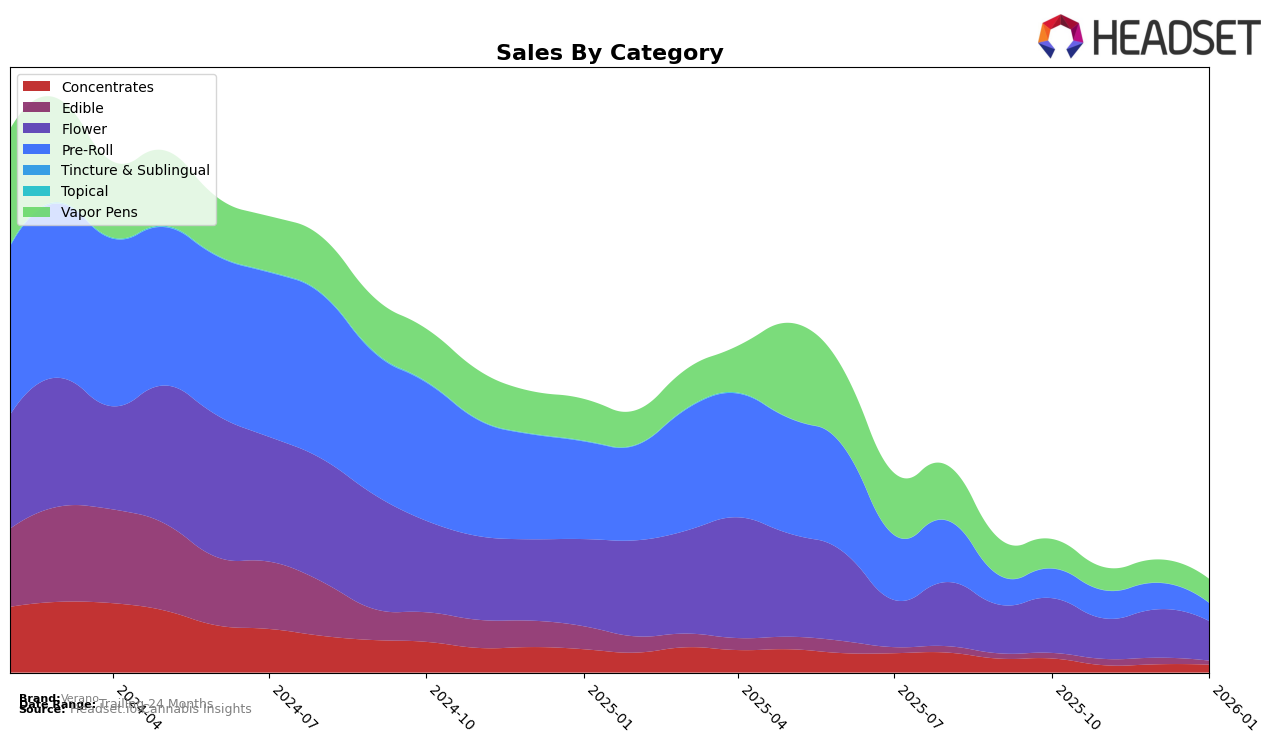

Verano's performance across various cannabis categories demonstrates a mixed trajectory, with notable movements in different states. In Illinois, the brand's presence in the Flower category is outside the top 30, indicating a challenging market position. However, their Pre-Roll category maintained a consistent presence within the top 30, albeit with a slight decline, moving from rank 27 to 30 over the observed months. In contrast, the Vapor Pens category saw a downward trend, dropping from rank 42 to 50, reflecting a potential area for improvement. Meanwhile, in Maryland, Verano's Flower category saw a drop in rankings from 30 to 39, indicating increased competition or shifting consumer preferences. Their Concentrates category, however, maintained a stronger position, consistently ranking within the top 20, although it did not appear in the rankings for January 2026, suggesting a possible decline in market presence.

In New Jersey, Verano's performance in the Pre-Roll category was strong, with a peak at rank 13 in December 2025 before dropping to 25 in January 2026. This fluctuation could suggest seasonal demand changes or competitive pressures. The Flower category also showed resilience, consistently ranking within the top 30. However, their Vapor Pens category did not appear in the rankings for December 2025 and January 2026, indicating a potential decline in popularity or sales. In Ohio, Verano's Vapor Pens category showed promising growth, moving up from rank 31 to 23, signaling an increasing consumer interest. On the other hand, the Flower category experienced a setback, dropping from rank 49 to 54, which may highlight challenges in maintaining market share. These dynamics across states and categories provide a snapshot of Verano's market performance, with areas of strength and opportunities for growth.

Competitive Landscape

In the competitive landscape of the Flower category in New Jersey, Verano has experienced fluctuations in its rankings, indicating a dynamic market presence. From October 2025 to January 2026, Verano's rank varied between 27th and 30th, reflecting a stable yet competitive position. Notably, Anthologie showed an impressive climb from 35th in December 2025 to 27th in January 2026, surpassing Verano in the latest month. Meanwhile, Illicit / Illicit Gardens also demonstrated a strong performance, peaking at 24th in November 2025, although it slightly declined to 28th by January 2026. GreenJoy maintained a relatively higher rank than Verano in most months, despite a drop to 31st in January 2026. The entry of Craft Kings into the top 30 in January 2026 further intensifies the competition. These shifts highlight the need for Verano to strategize effectively to enhance its market position amidst evolving consumer preferences and competitive pressures.

Notable Products

In January 2026, Verano's top-performing product was Reserve - White Tangie (2.83g) in the Flower category, maintaining its first-place rank from November 2025 and boasting a sales figure of 2539 units. Reserve - Guava Cooler (3.5g), also in the Flower category, held steady in second place, consistent with its debut in December 2025. Reserve - B52 Bomber Live Resin Cartridge (1g) emerged as the third-ranking product in the Vapor Pens category, marking its first appearance on the list. Reserve - Moon Boots (3.5g) and Reserve - Orange Push Pop Live Resin Disposable (1g) were ranked fourth and fifth, respectively, both making their first entry in January 2026. The consistent top performance of Flower products indicates a strong consumer preference for this category within Verano's offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.