Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

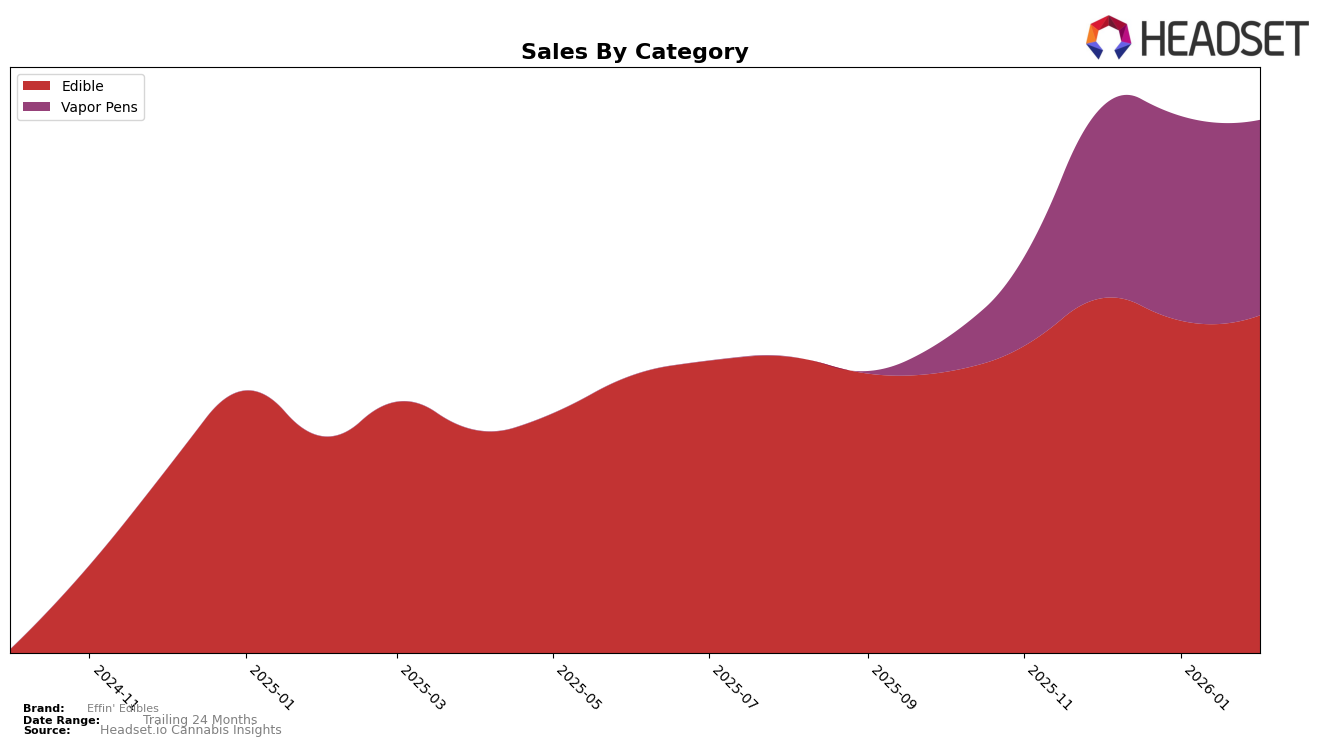

Effin' Edibles has shown varied performance across different states and product categories. In Illinois, the brand has struggled to break into the top 30 for both edibles and vapor pens. Their rankings in the edible category have hovered around the mid-30s, with a slight improvement from 37th in November 2025 to 36th by February 2026. This indicates a relatively stable but unremarkable presence in the Illinois market. Meanwhile, their vapor pen sales have seen a more notable fluctuation, with rankings slipping from 77th to 79th over the same period. The absence of a top 30 ranking suggests that Effin' Edibles faces significant competition in Illinois, particularly in the vapor pen category.

Conversely, in New Jersey, Effin' Edibles has maintained a strong foothold in the edible category, consistently holding the 11th position from November 2025 through February 2026. This stability highlights their strong brand presence and consumer preference in the state. Additionally, their performance in the vapor pen category has shown impressive upward movement. Starting from 51st place in November 2025, they ascended to 22nd by February 2026, indicating a growing acceptance and demand for their products. This positive trend in New Jersey contrasts with their performance in Massachusetts, where despite a strong start in the vapor pen category, their ranking dropped from 57th in January 2026 to 64th in February 2026, reflecting potential challenges in maintaining momentum.

Competitive Landscape

In the competitive landscape of the edible cannabis market in New Jersey, Effin' Edibles has maintained a consistent rank of 11th from November 2025 to February 2026. This stability in ranking indicates a steady performance amidst fluctuating sales figures of its competitors. For instance, Smokiez Edibles experienced a notable drop from 9th to 13th place by February 2026, despite their sales peaking in December 2025. Meanwhile, Valhalla showed a positive trend, climbing from 15th to 10th place, suggesting a strategic gain in market share. Encore Edibles maintained a strong presence, consistently ranking within the top 10, which could pose a challenge for Effin' Edibles to break into higher ranks. Lastly, BITS showed slight fluctuations but remained close to Effin' Edibles in rank, indicating a competitive peer in the market. These dynamics highlight the importance for Effin' Edibles to innovate and adapt to maintain and potentially improve its position in the New Jersey edible market.

Notable Products

In February 2026, the top-performing product for Effin' Edibles remained the Sleep - THC/CBN 2:1 Goodnight Grape Gummies 20-Pack, maintaining its consistent number one ranking since November 2025, with sales reaching 6192 units. The Deep Sleep - THC/CBN/CBD 2:2:1 Dreamy Dark Cherry Gummies 10-Pack also held its position at rank two, showing a steady increase in sales over the months. The Chillin - CBD/THC 1:1 Relaxing Razz Gummies 10-Pack maintained its third position, despite a slight dip in sales compared to January 2026. Notably, the Do It - THC/THCV 1:1 Amplified Apple Gummies 10-Pack improved from rank five in January to rank four in February. The Peaceful Peach Distillate Cartridge, a vapor pen product, entered the rankings in January at position four but dropped to fifth place in February, indicating a decrease in its popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.