Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

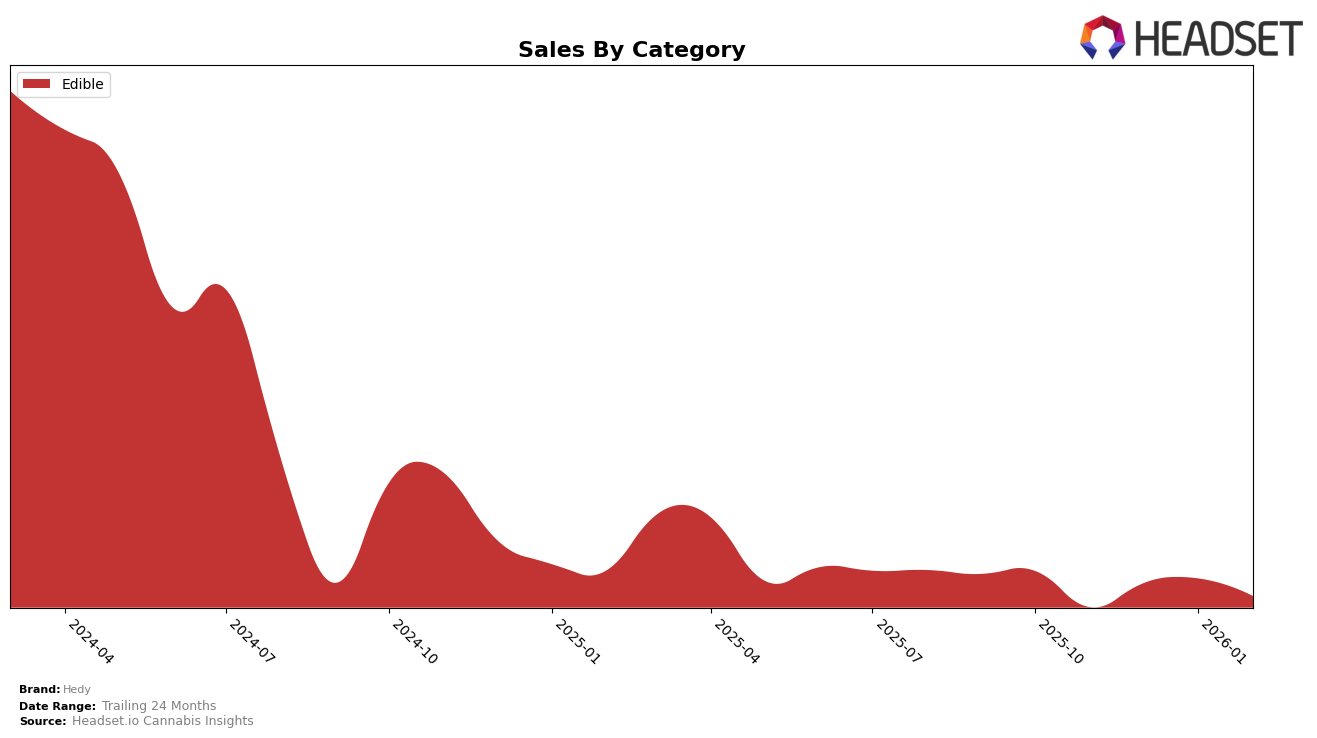

In the state of Colorado, Hedy has maintained a consistent position in the Edible category, holding steady at the 10th rank from November 2025 through February 2026. This stability in ranking, despite fluctuations in monthly sales, indicates a strong foothold in the market. On the other hand, in Illinois, Hedy's performance in the Edible category has been less robust, with the brand not breaking into the top 30 rankings by February 2026. This absence from the top tier suggests a challenging competitive environment or a need for strategic adjustments to capture more market share.

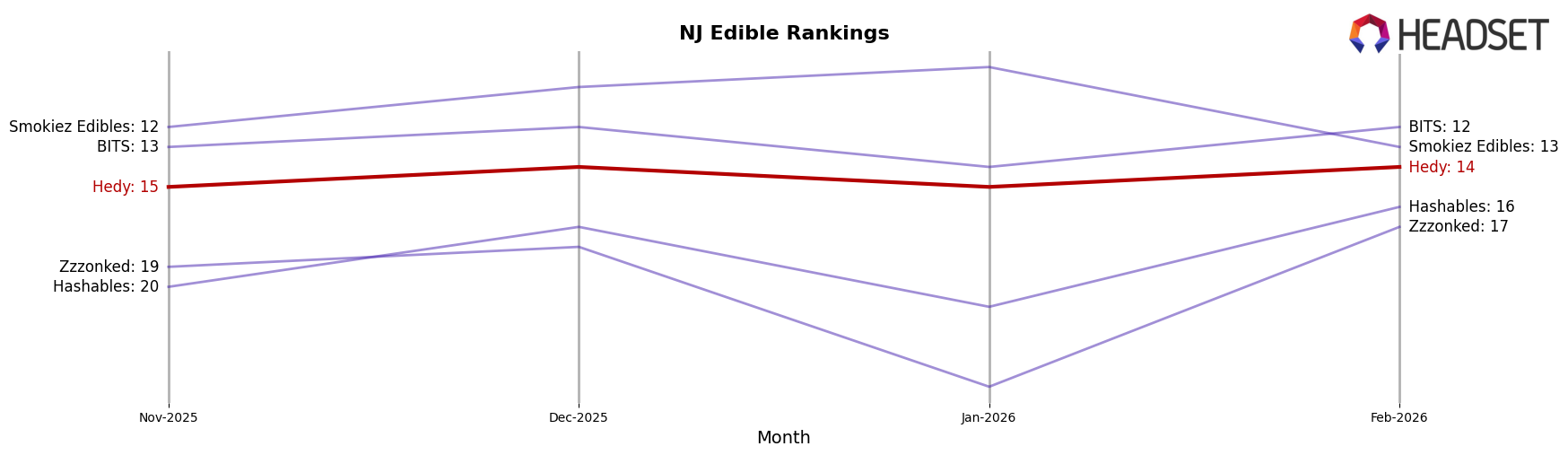

In Maryland, Hedy has shown some positive momentum by entering the top 30 in December 2025 and maintaining a presence through February 2026, although just barely holding onto the 30th position at the end of the period. This indicates a potential upward trend that could be capitalized on with the right marketing strategies. Meanwhile, in New Jersey, Hedy has shown a solid and slightly improving performance, moving from the 15th to 14th rank in February 2026, highlighting a stable and potentially growing market presence in this state. Such movements across these states reveal the dynamic nature of Hedy's market penetration and the diverse challenges and opportunities it faces in different regions.

Competitive Landscape

In the competitive landscape of the edible cannabis category in New Jersey, Hedy has consistently maintained a mid-tier position, ranking 15th in November 2025, 14th in December 2025, and January 2026, and holding steady at 14th in February 2026. This stability in rank suggests a consistent market presence, although it trails behind competitors like Smokiez Edibles and BITS, which have shown higher rankings and sales. Notably, Smokiez Edibles climbed from 12th to 9th before dropping to 13th, indicating a volatile yet strong performance, while BITS consistently outperformed Hedy, ranking as high as 12th. Meanwhile, brands like Zzzonked and Hashables have fluctuated outside the top 20 at times, highlighting opportunities for Hedy to capitalize on their instability. Overall, while Hedy's sales have shown a slight upward trend from December 2025 to February 2026, the brand may need to innovate or enhance its offerings to climb higher in the competitive rankings.

Notable Products

In February 2026, the top-performing product from Hedy was Sour Watermelon Gummies 10-Pack (100mg), which climbed to the number one rank, achieving sales of 7092 units. Previously holding the third position in January, Sour Watermelon Gummies overtook Cherry Limeade Gummies 10-Pack (100mg), which dropped to second place despite consistently ranking first in the preceding months. Sour Green Apple Chews 10-Pack (100mg) maintained a steady third position, while Sour Peach Mango Gummies 10-Pack (100mg) debuted at fourth place. Fruity Crunch Cereal Treat (100mg) remained consistently at the fifth position, showing minor fluctuations in sales figures over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.