Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

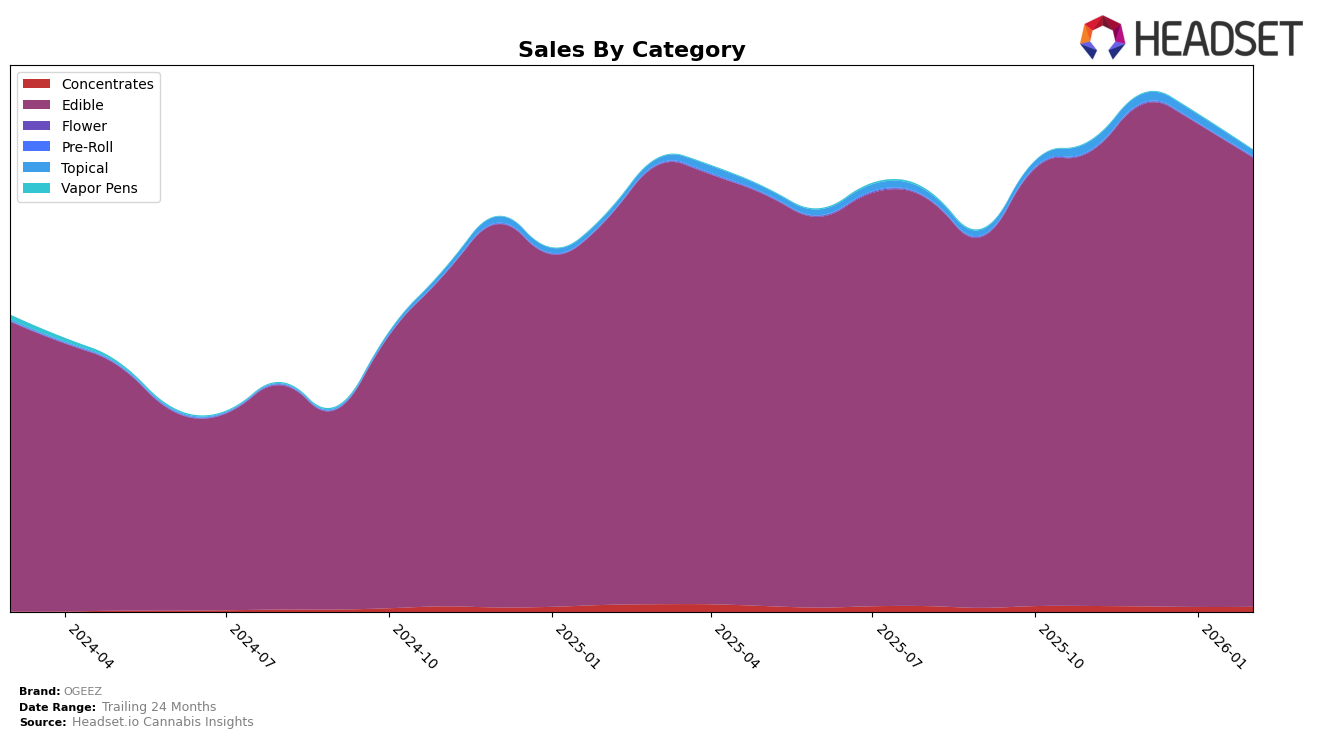

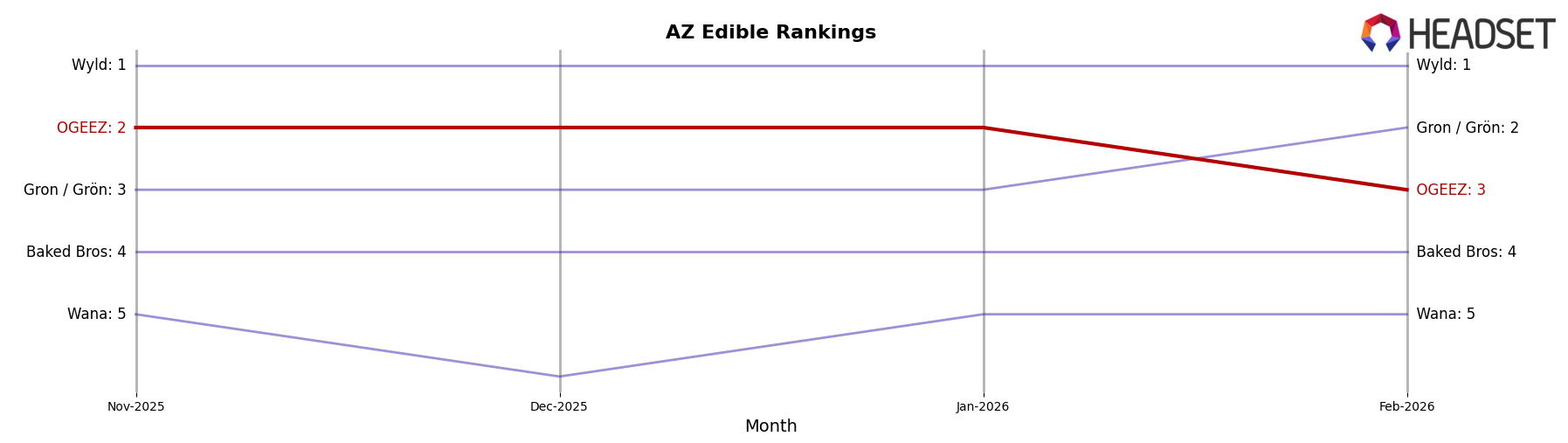

OGEEZ has shown a notable presence in the Arizona edibles market, maintaining a strong position as the second-ranked brand from November 2025 through January 2026, before slipping to third in February 2026. This slight dip in ranking suggests increased competition or a shift in consumer preferences within the state. Despite this, the brand's sales figures indicate a robust performance, with a peak in December 2025. In contrast, in Illinois, OGEEZ has consistently hovered around the 20th position, showing a slight improvement from 22nd in December 2025 to 20th by February 2026. This upward movement, albeit modest, indicates a gradual strengthening of their market presence in Illinois.

In New Jersey, OGEEZ has consistently performed well in the edibles category, securing the 5th position from November 2025 through January 2026, and slightly improving to 4th in February 2026. This upward movement reflects a positive reception and possibly an expanding consumer base in the state. The brand's consistent top-five ranking highlights its competitive edge and potential for further growth within New Jersey's market. It is worth noting that OGEEZ's absence from the top 30 rankings in any other states or provinces suggests areas where the brand might explore opportunities for expansion or where it faces significant competition.

Competitive Landscape

In the competitive landscape of the edible cannabis market in Arizona, OGEEZ has maintained a strong presence, consistently ranking within the top three brands from November 2025 to February 2026. Despite a slight dip from second to third place in February 2026, OGEEZ has shown robust sales performance, indicating resilience in a competitive market. The brand has been trailing closely behind Gron / Grön, which climbed from third to second place, and remains a formidable competitor. Meanwhile, Wyld continues to dominate the market, holding the top position consistently. OGEEZ's ability to maintain high sales figures amidst these strong competitors highlights its competitive edge and potential for growth, even as it faces pressure from the likes of Baked Bros and Wana, which are also significant players in the Arizona edible market.

Notable Products

In February 2026, the top-performing product from OGEEZ was the Sleep - THC/CBN 2:1 Indica Aqua Berry Gummies 10-Pack, which maintained its number one rank for the fourth consecutive month with sales reaching 27,227 units. Peg's Big - Raspberry Orange RSO Gummies 10-Pack held steady at the second spot, although its sales figures saw a decrease compared to previous months. Big Peg's Raspberry Orange RSO Gummy remained consistently in third place, while Big Happy - CBD/THC 1:1 Strawberries & Cream Gummies moved up to fourth, surpassing The Fruits - Indica Mellow Gummies, which dropped to fifth. Notably, the top three products have maintained their rankings since November 2025, highlighting their strong market presence. The shift in rankings for the fourth and fifth positions reflects competitive dynamics within the Edible category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.