Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

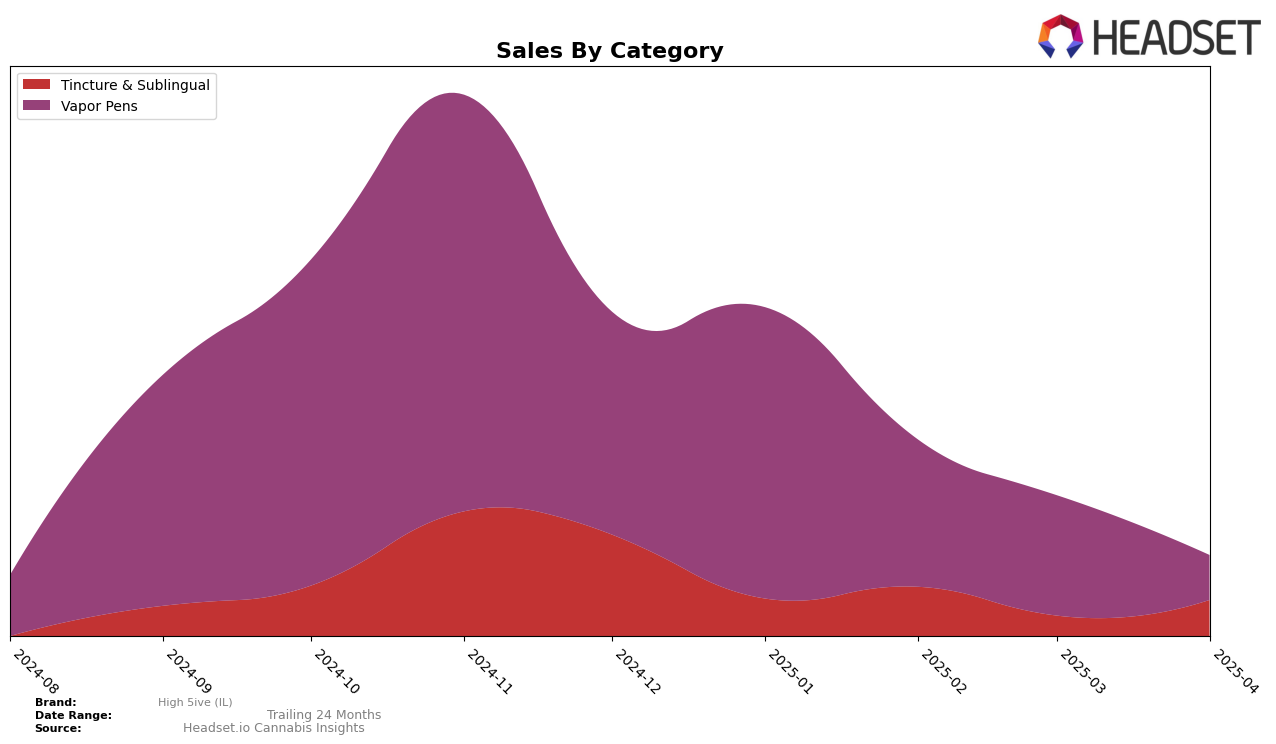

High 5ive (IL) has shown a notable presence in the cannabis market, particularly in the state of Illinois. Analyzing their performance in the Vapor Pens category, it's evident that they did not secure a spot in the top 30 rankings from January to April 2025. This absence from the top tier could be seen as a challenge for the brand, indicating an opportunity for growth and increased market penetration. Despite this, their January sales figure of $14,064 suggests a foundation upon which they could build future success, especially if they strategize to enhance their brand visibility and consumer engagement within the state.

Across other states and categories, High 5ive (IL) did not make it into the top 30 rankings, highlighting a potential area for improvement and expansion. The absence of rankings in these areas suggests that while the brand has a foothold in Illinois, it may need to explore strategies to boost its presence in other markets or diversify its product offerings. This could involve innovations in product development, targeted marketing campaigns, or strategic partnerships to elevate their brand recognition and appeal to a broader audience. The data points to a promising yet challenging landscape for High 5ive (IL), with significant room for growth outside their current stronghold.

Competitive Landscape

In the Illinois Vapor Pens category, High 5ive (IL) has faced significant competitive pressure, particularly from brands like nuEra and Legacy Cannabis (IL). High 5ive (IL) entered the top rankings in January 2025 at the 73rd position, but it did not maintain its presence in the top 20 in subsequent months, indicating a need for strategic adjustments to enhance its market position. In contrast, nuEra, despite a downward trend from 56th to 71st place from January to March 2025, has consistently outperformed High 5ive (IL) in terms of sales. Meanwhile, Legacy Cannabis (IL) emerged in March 2025 at the 68th position, surpassing High 5ive (IL) and suggesting a growing competitive threat. These dynamics highlight the importance for High 5ive (IL) to innovate and differentiate its offerings to capture greater market share in a competitive landscape.

Notable Products

In April 2025, High 5ive (IL) saw the Sour Alien Distillate Cartridge (0.5g) as the top performer, maintaining its number one rank from March with sales at 86 units. Energy Watermelon Sublingual Strips 10-Pack (100mg) climbed to the second spot from fifth place in March, indicating a strong resurgence in popularity. Blueberry Sublingual Strips 10-Pack (100mg) debuted in the rankings at third place, showing a promising start. The Tropical Cake Distillate Cartridge (0.5g) remained steady in fourth place, although its sales decreased compared to previous months. The CBG/THC 1:1 Recovery Mango Guava Sublingual Strip 10-Pack (100mg CBG, 100mg THC) entered the rankings in fifth place, highlighting a growing interest in balanced cannabinoid products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.