Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

nuEra's performance in the Illinois cannabis market demonstrates a varied trajectory across different categories. In the Concentrates category, nuEra maintained a presence within the top 30 brands, though it experienced a gradual decline from 18th in October 2025 to 25th by January 2026. This downward trend in ranking correlates with a decrease in sales, from $76,895 in October to $53,231 in January. Conversely, in the Edible category, nuEra showed a slight improvement, moving up from 40th to 37th over the same period, indicating a more stable performance despite a dip in sales in January 2026. Notably, nuEra's Flower category saw a consistent drop in ranking, settling at 40th by January 2026, suggesting a need for strategic adjustments to regain market share.

In the Vapor Pens category, nuEra's rankings were not consistently available, as they were absent from the top 30 in November and December 2025, only reappearing at 85th in January 2026. This inconsistency highlights a potential area of concern for the brand, as maintaining a stable presence in this category could be crucial for future growth. The fluctuations in rankings across categories suggest that while nuEra has a foothold in the Illinois market, there is a need for targeted strategies to address the challenges in certain segments. The absence from the top 30 in some months, particularly in Vapor Pens, underscores the competitive nature of the market and the importance of innovation and customer engagement to sustain and improve brand performance.

Competitive Landscape

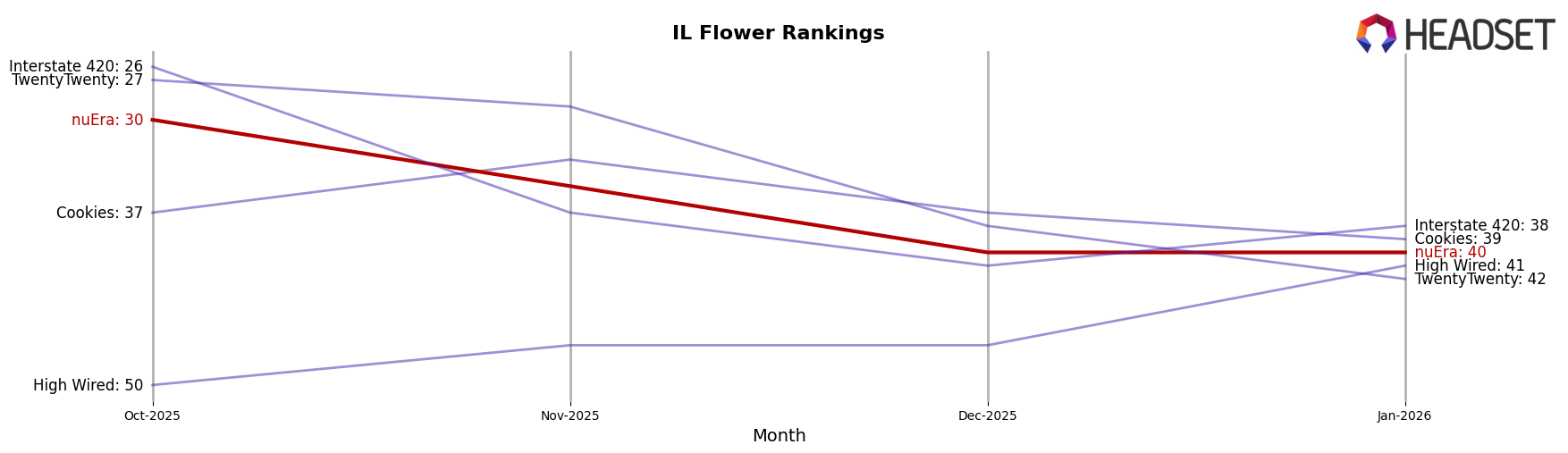

In the competitive landscape of the Illinois Flower category, nuEra has experienced notable fluctuations in its market position from October 2025 to January 2026. Initially ranked 30th in October, nuEra's rank dropped to 35th in November and further to 40th by December and January. This decline in rank is mirrored by a downward trend in sales over the same period. In contrast, Cookies maintained a relatively stable position, hovering around the mid-30s in rank, while Interstate 420 and TwentyTwenty showed more variability, with ranks fluctuating but generally staying ahead of nuEra. Notably, High Wired improved its rank from 50th to 41st, indicating a positive sales trend. These dynamics suggest that while nuEra faces challenges in maintaining its competitive edge, other brands are either stabilizing or improving their market positions, which could impact nuEra's strategy moving forward.

Notable Products

In January 2026, Garlic Mash (3.5g) emerged as the top-performing product for nuEra, securing the number one rank with sales of 906 units. The Sativa Lemon Live Resin Gummies 10-Pack moved up to the second position from fifth place in December 2025, indicating a significant increase in popularity. Green Apple Live Resin Gummies 10-Pack maintained a strong presence, ranking third, slightly dropping from its previous fourth position in December. Indica Blueberry Live Resin Gummies 10-Pack experienced a decline, moving from second to fourth place, reflecting a decrease in sales compared to prior months. Don Shula (3.5g) entered the rankings at fifth place, indicating a new addition to the top-performing products lineup for January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.