Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

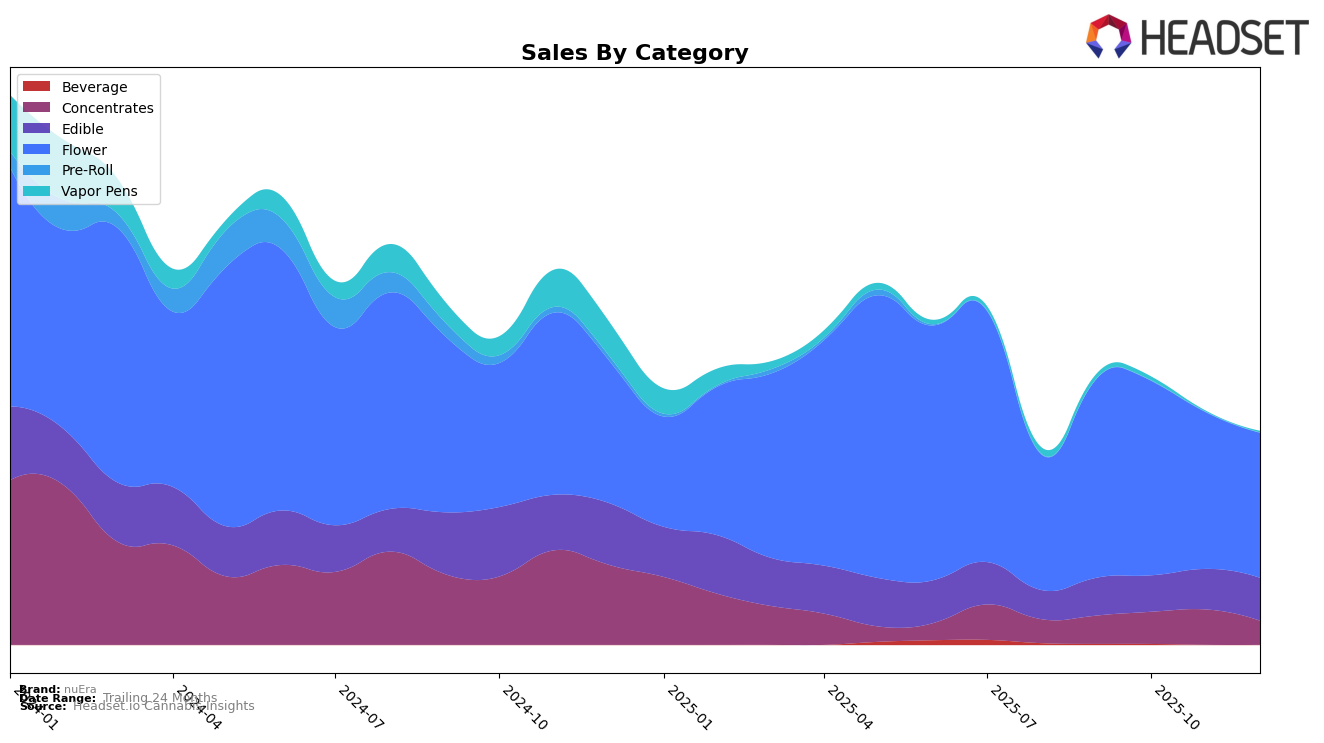

nuEra's performance in the Illinois market across various categories shows a dynamic and shifting landscape. In the Concentrates category, nuEra experienced a notable fluctuation in rankings, starting at 23rd in September and improving to 18th by November, before dropping to 25th in December. This volatility might indicate a competitive market space or changes in consumer preferences. Meanwhile, the Edible category saw more stability, with nuEra maintaining a position just outside the top 30, peaking at 33rd in both November and December. The steadiness in ranking, coupled with a steady increase in sales, suggests a growing consumer base or successful product offerings in this segment.

In contrast, the Flower category has been challenging for nuEra, with a consistent decline in rankings from 28th in September to 38th in December. This downward trend could be indicative of increased competition or shifting consumer trends towards other product types. The sales figures reflect this movement, with a marked decrease over the months. It’s important to note that nuEra's absence from the top 30 in some categories might signal areas for potential growth or a need for strategic adjustments. Overall, while some categories show promise, others highlight the competitive nature of the Illinois cannabis market.

Competitive Landscape

In the competitive landscape of the Illinois flower category, nuEra has experienced a notable shift in its market position from September to December 2025. Starting at rank 28 in September, nuEra's position has gradually declined to rank 38 by December. This downward trend in rank is mirrored by a decrease in sales over the same period, indicating potential challenges in maintaining market share. In contrast, brands like Cookies have shown resilience, maintaining a consistent rank of 36 in September and December, with a peak at 31 in November, alongside increasing sales figures. Similarly, TwentyTwenty has fluctuated but generally maintained a stronger position than nuEra, ending December at rank 37. Meanwhile, Interstate 420 also saw a decline, dropping from rank 24 in September to 41 in December, indicating a broader competitive pressure in the market. These dynamics suggest that while nuEra faces challenges, there is an opportunity to strategize and reclaim its position amidst shifting consumer preferences and competitive movements.

Notable Products

In December 2025, Black Inferno (3.5g) maintained its top position as the leading product for nuEra, continuing its strong performance from the previous month with sales of $1,860. Indica Blueberry Live Resin Gummies 10-Pack (100mg) climbed to the second spot, showing consistent demand with a slight decrease in sales to $1,427 from November. Stella Blue (3.5g) returned to the rankings, securing the third position with stable sales figures. Green Apple Live Resin Gummies 10-Pack (100mg) held steady at fourth place, reflecting consistent consumer interest. Sativa Lemon Live Resin Gummies 10-Pack (100mg) entered the top five for the first time, indicating a growing preference for this new product.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.