Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

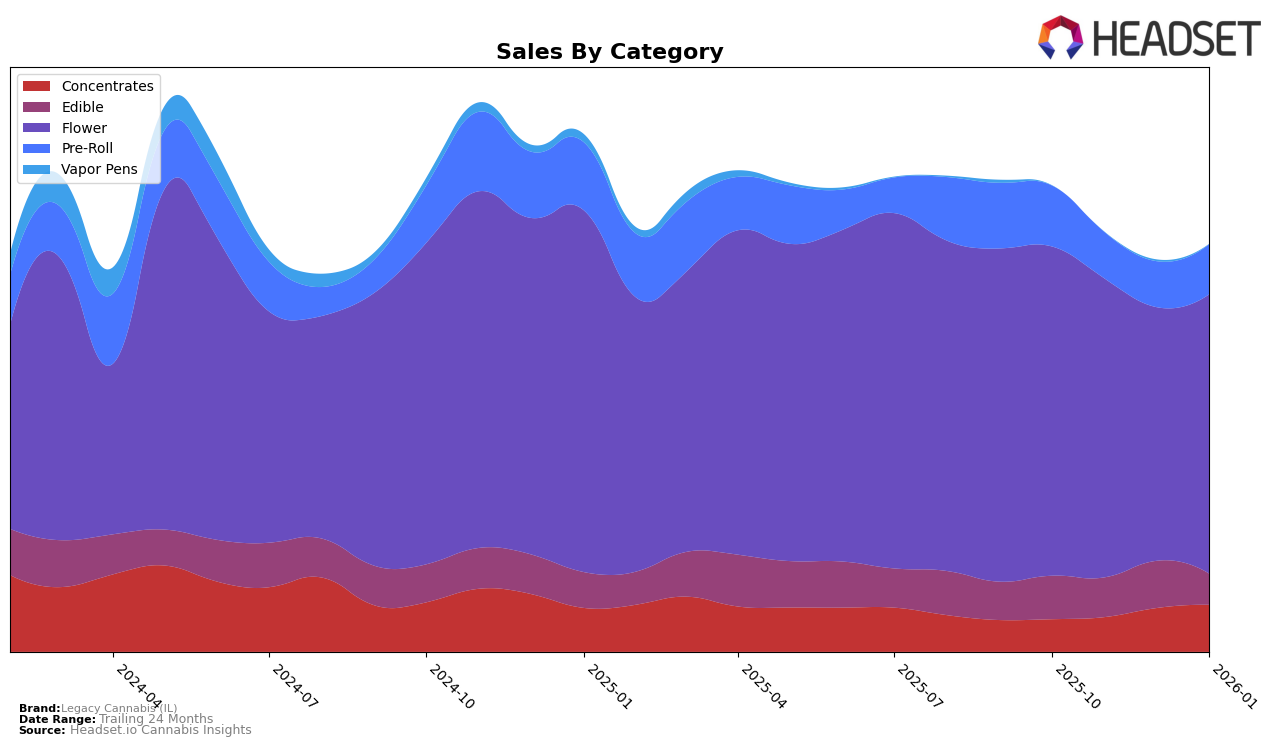

Legacy Cannabis (IL) has shown notable performance shifts across various product categories in Illinois. In the Concentrates category, the brand has seen a consistent upward trajectory, improving its rank from 20th in October 2025 to 15th by January 2026. This positive movement is complemented by a steady increase in sales figures, indicating growing consumer preference and market penetration. On the other hand, the Flower category has experienced some fluctuations, with Legacy Cannabis dropping from 19th in October to 26th in December, before recovering slightly to 23rd in January. This volatility suggests challenges in maintaining a stable market position amidst competition.

In contrast, the Edible category presents a mixed picture for Legacy Cannabis in Illinois. The brand hovered around the 33rd position for October and November 2025, briefly improving to 31st in December, only to fall to 36th in January 2026. This drop, coupled with a decrease in sales from December to January, highlights potential issues in product appeal or market strategy. Meanwhile, the Pre-Roll category has seen the brand maintaining a position within the top 30, albeit at the lower end, from 26th in October to 29th in January. This stability, despite not breaking into higher ranks, suggests a loyal consumer base within this segment.

Competitive Landscape

In the competitive landscape of the Flower category in Illinois, Legacy Cannabis (IL) experienced notable fluctuations in its ranking and sales performance from October 2025 to January 2026. Initially ranked 19th in October 2025, Legacy Cannabis (IL) saw a decline to 21st in November and further dropped out of the top 20 in December, indicating a challenging period for the brand. However, it rebounded slightly to 23rd in January 2026. Competitors such as Island maintained a more stable presence, consistently ranking within the top 23, while Tales & Travels demonstrated upward momentum, improving from 23rd in October to 21st by January. Meanwhile, IC Collective and Bedford Grow remained competitive, with Bedford Grow showing a consistent rise in sales despite fluctuating ranks. These dynamics suggest that while Legacy Cannabis (IL) faces stiff competition, there is potential for recovery and growth if strategic adjustments are made to capture market share from these key competitors.

Notable Products

In January 2026, the top-performing product for Legacy Cannabis (IL) was LSD (3.5g) in the Flower category, maintaining its number one rank from previous months with a notable sales figure of 1425 units. Stone Sour #9 Pre-Roll (1g) achieved the second position, marking its debut in the rankings. Candy Store (3.5g) secured the third spot in the Flower category, showing a strong entry. Face on Fire (3.5g) improved its standing to fourth place from fifth in December 2025. Sour Blue Razz Lemonade Distillate Gummies 10-Pack (100mg) rounded out the top five, marking its presence as a significant contender in the Edible category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.