Aug-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

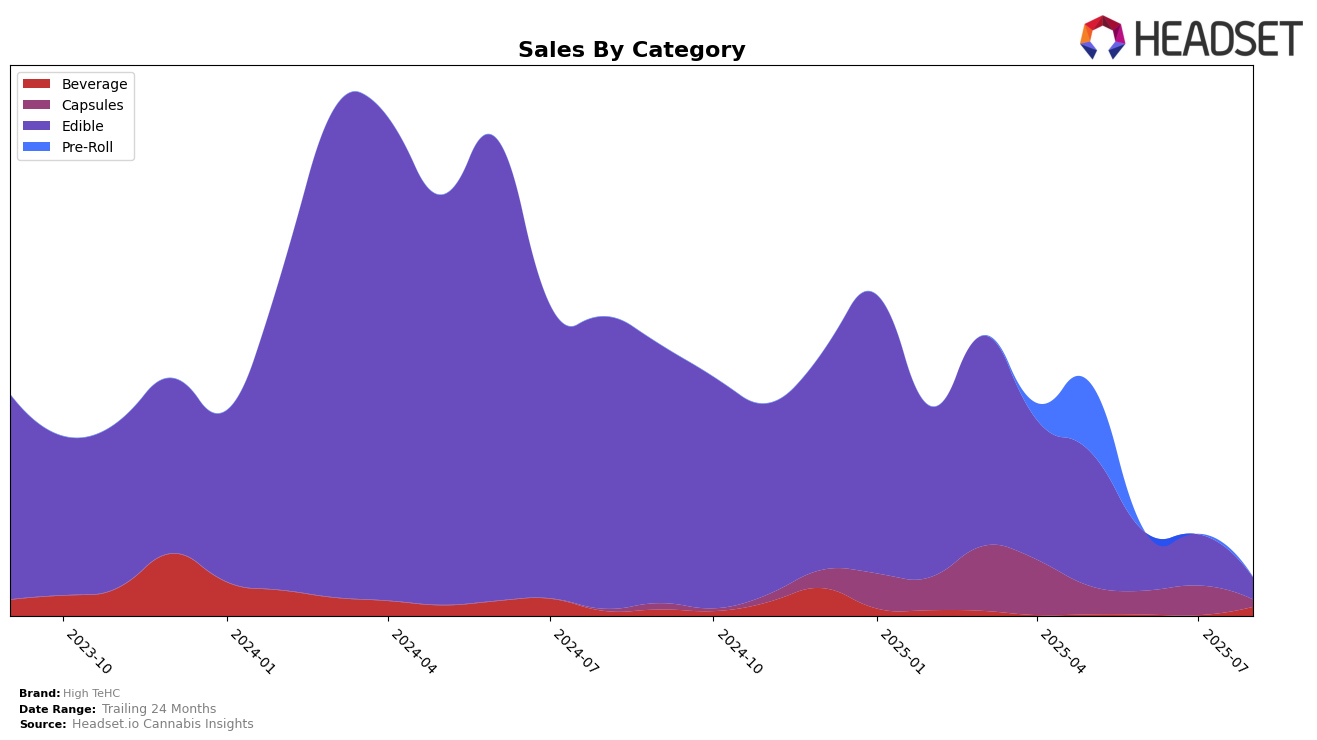

High TeHC's presence in the Michigan market, specifically in the Edible category, has seen some significant fluctuations in recent months. In May 2025, the brand was ranked 76th, which indicates a relatively modest position. However, by June 2025, they dropped to 96th place, showing a decline in their market standing. Notably, in July and August of the same year, High TeHC was not in the top 30 brands in Michigan's Edible category, which suggests a further slip in their competitive position. This absence from the top rankings could be a cause for concern, indicating potential challenges in maintaining market share or consumer interest.

Despite these challenges in Michigan, High TeHC's sales figures for May and June 2025 reveal an interesting trend. While there was a decrease in sales from May to June, the brand still managed to generate over $11,000 in June, which signifies a resilient consumer base despite the drop in ranking. The lack of data for July and August rankings makes it difficult to assess their current trajectory, but the earlier decline suggests that High TeHC may need to strategize to regain visibility and enhance its performance in the Edible category. Overall, while the brand has faced setbacks, the underlying sales figures hint at the potential for recovery and growth with the right market strategies.

Competitive Landscape

In the Michigan edible cannabis market, High TeHC has experienced a notable decline in its competitive standing, as evidenced by its drop in rank from 76th in May 2025 to 96th in June 2025, and its absence from the top 20 in subsequent months. This decline is mirrored by a sharp decrease in sales from May to June. In contrast, competitors like Muha Meds and Hippies have maintained more stable positions, with Muha Meds consistently ranking in the 40s and 50s, and Hippies improving its rank from 93rd in May to 80th by July. The consistent presence of these brands in the rankings suggests a more robust market strategy or consumer loyalty, which High TeHC may need to address to regain its competitive edge. High TeHC's decline in rank and sales highlights the importance of strategic adjustments to capture market share in this dynamic sector.

Notable Products

In August 2025, the top-performing product for High TeHC was the Sleep - THC/CBN 1:2 Wildberry Drift Chamomile Gummies 20-Pack, leading the sales with a notable figure of 215 units sold. The Meri Melon Sugar Free Gummies 20-Pack followed closely, climbing to the second position from its previous third place in July. Loco Cocoa Mix 10-Pack made its debut in the rankings at third place, indicating a strong entry into the top products for August. Unflavored N'Fuse Powder also entered the rankings at fourth place, showing significant sales traction. Meanwhile, the Sleep - CBN/THC Vanilla Spearmint Tic Tech Tablets 40-Pack slipped to the fifth position, a drop from its second-place ranking in July.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.