Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

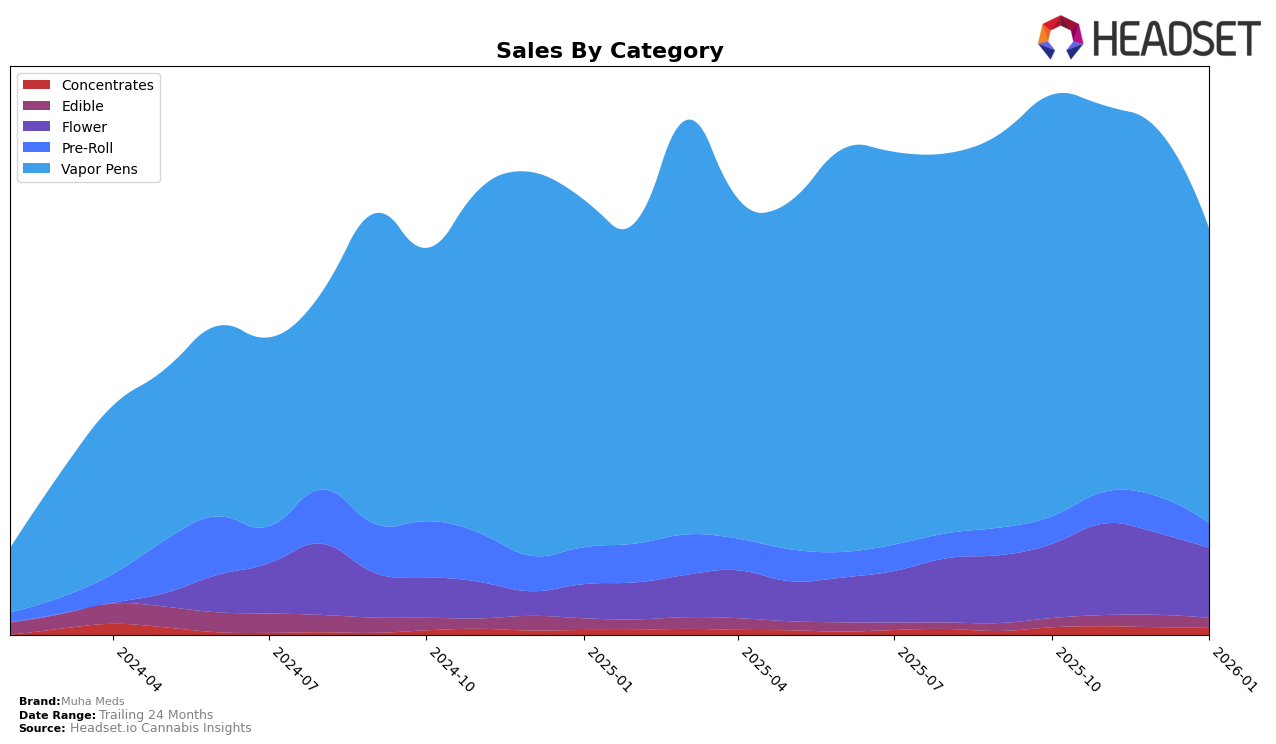

Muha Meds has demonstrated a varied performance across different categories and states, with notable movements in rankings and sales. In California, their presence in the Vapor Pens category has been relatively stable, maintaining a position in the top 30, although there was a slight dip from 20th to 22nd place between December 2025 and January 2026. This stability is marked by fluctuations in sales, which peaked in December 2025. However, in Michigan, their performance in the Edible category was less prominent, as they did not rank in the top 30 until January 2026, where they entered at 38th place. This indicates a potential area for growth or a reflection of a competitive market landscape.

In Michigan, Muha Meds has shown a strong foothold in the Vapor Pens category, consistently ranking in the top three from October 2025 through January 2026. Despite a gradual decline in sales over these months, their high ranking suggests a solid consumer base and brand loyalty. Conversely, in the Pre-Roll category, Muha Meds experienced more volatility, with rankings ranging from 22nd to 38th place, highlighting potential challenges in maintaining a steady market position. The Flower category also saw a slight dip in rankings from 16th to 17th place by January 2026, suggesting a need for strategic adjustments to sustain or improve their standing in this competitive segment.

Competitive Landscape

In the competitive landscape of vapor pens in Michigan, Muha Meds has experienced notable fluctuations in its market position from October 2025 to January 2026. Initially ranked 2nd in October 2025, Muha Meds saw a decline to 3rd place by November and maintained this position through January 2026. This shift is significant as it highlights the competitive pressure from brands like MKX Oil Company, which consistently held the 2nd rank, and Mitten Extracts, the market leader throughout this period. Despite a decrease in sales over these months, Muha Meds remains a strong contender, outperforming brands like Platinum Vape and Drip (MI), which have consistently ranked lower. This competitive dynamic underscores the importance for Muha Meds to innovate and adapt its strategies to regain its higher market position and counter the sales momentum of its competitors.

Notable Products

In January 2026, the top-performing product from Muha Meds was the Cherry Grapefruit Distillate Cartridge (1g) in the Vapor Pens category, maintaining its number one rank from December 2025 with sales of 16,813 units. The Bahama Berry Distillate Cartridge (1g) climbed to the second position, improving from a fourth-place rank in December. Blue Slushie Distillate V3 Disposable (2g) slipped from second to third place, experiencing a decline in sales to 14,615 units. Strawberry Kiwi Kush Distillate Cartridge (1g) also saw a drop, moving from third to fourth place. Notably, the Blue Slushie Distillate Cartridge (1g) entered the top five for the first time, securing the fifth position.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.