Jun-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

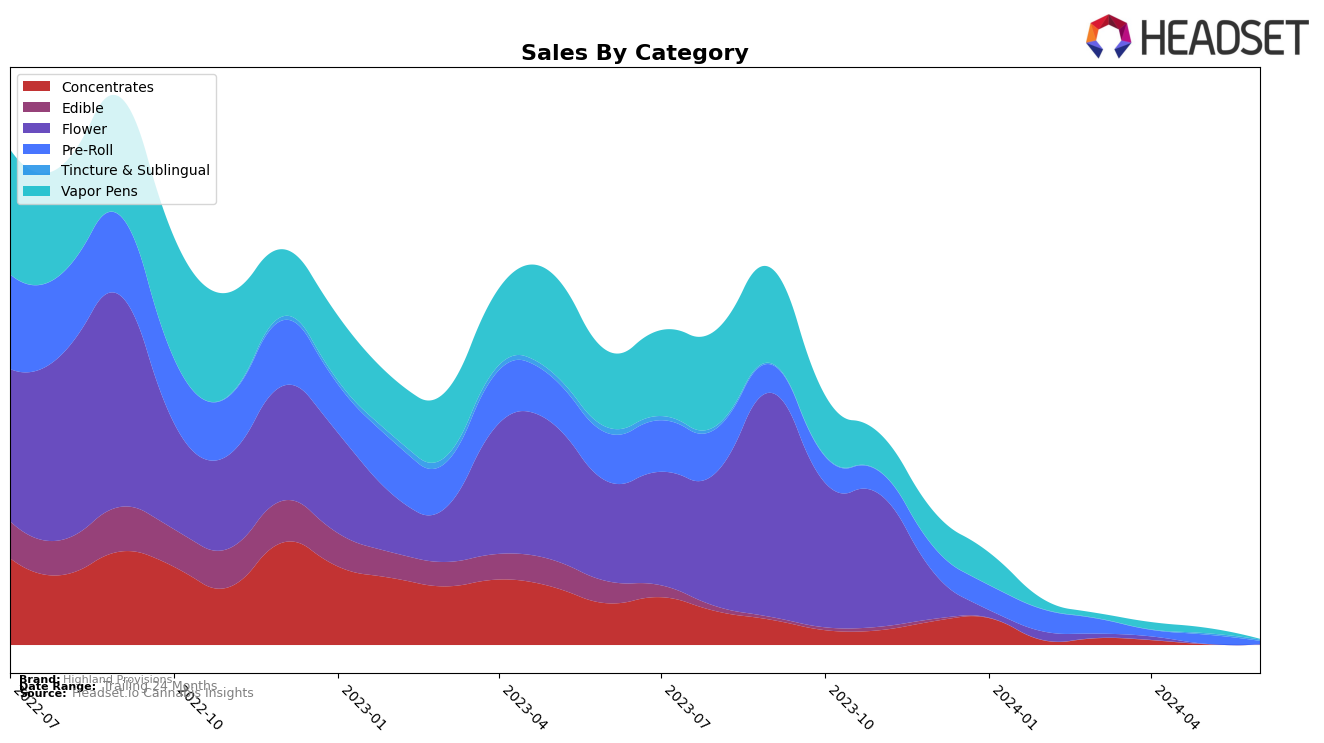

Highland Provisions has experienced fluctuating performance across various states and product categories in recent months. Notably, in the Oregon market, the brand's ranking in the Pre-Roll category has seen significant changes. In March 2024, Highland Provisions was positioned at 85th place but dropped out of the top 30 in April and May, before reappearing at 100th place in June. This inconsistent ranking highlights the brand's struggle to maintain a steady presence in the highly competitive Pre-Roll category within the state.

The absence of Highland Provisions from the top 30 rankings in April and May signals a challenging period for the brand. Despite re-entering the rankings in June, the overall trend suggests that Highland Provisions needs to address its market strategy to ensure more consistent performance. The drop in sales from March to May indicates a potential area of concern that may require strategic adjustments to regain and sustain market share. Understanding these movements can provide valuable insights into the competitive dynamics and consumer preferences within the Oregon cannabis market.

Competitive Landscape

In the competitive landscape of the Oregon Pre-Roll market, Highland Provisions has experienced notable fluctuations in its ranking and sales over recent months. Despite a promising start in March 2024 with a rank of 85, the brand did not maintain a top 20 position in April and June, only reappearing at rank 100 in May. This inconsistency contrasts sharply with competitors like Verdant Leaf Farms, which consistently held higher ranks (51 in March, 60 in April, and 66 in May) and demonstrated robust sales figures. Similarly, Doobies showed a steady performance, improving from rank 87 in March to 80 in April and maintaining a strong position at 82 in May. The fluctuating ranks and sales of Highland Provisions highlight the competitive pressure in the market, suggesting a need for strategic adjustments to regain and sustain a higher market position.

Notable Products

In June 2024, the top-performing product for Highland Provisions was Strawberries & Cream Pre-Roll (0.5g), which climbed to the number one spot with notable sales of $910. Pancakes x Rotten Fruit Cocktail Batter Infused Pre-Roll (1g) maintained a strong position at rank two, following its previous second-place ranking in May. Peach Cured Resin Tincture (250mg THC, 2oz) debuted impressively at rank three. Pancakes x Garlic Drip Rosin Infused Pre-Roll (1g) saw a significant drop to fourth place from its top position in May. Blueberry Acai Live Resin Tincture Drops (250mg THC, 2oz) entered the rankings at fifth place, indicating a growing interest in tincture products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.