Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

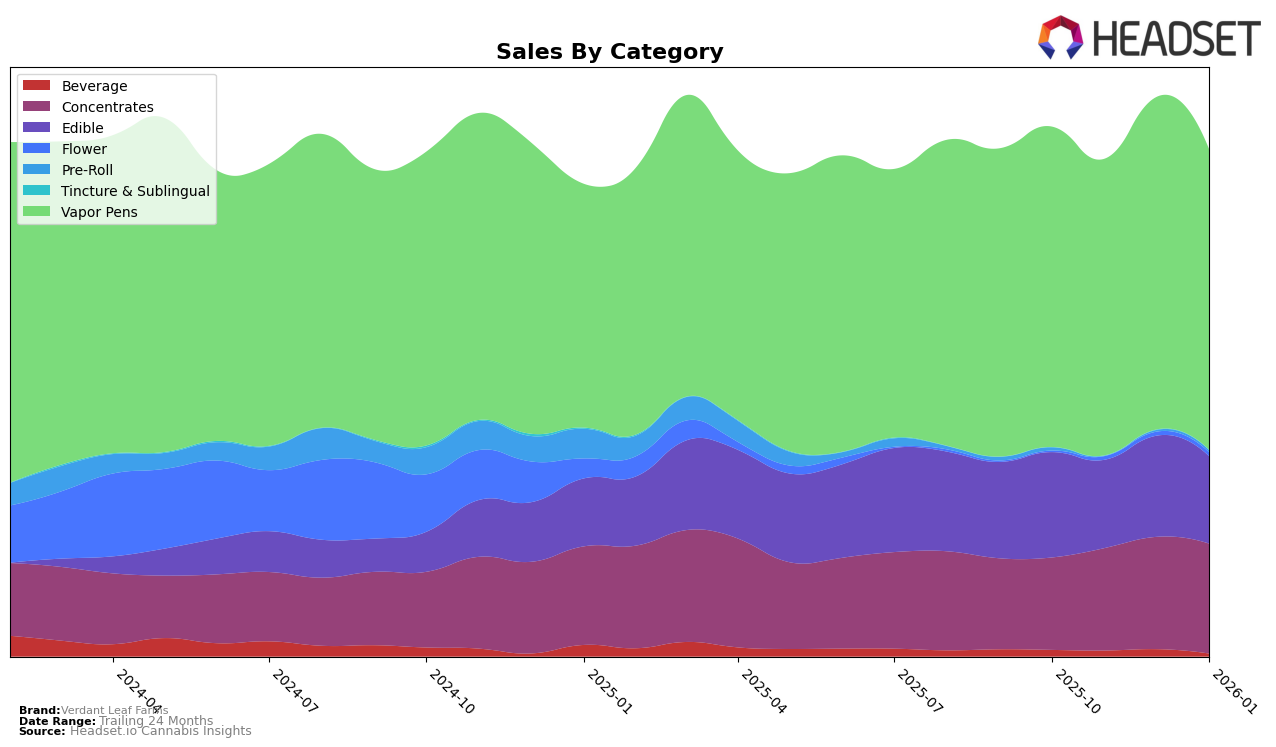

Verdant Leaf Farms has shown a varied performance across different categories in the state of Oregon. In the Concentrates category, the brand has demonstrated a generally upward trend, improving its rank from 13th in October 2025 to 8th by December 2025, before settling at 10th in January 2026. This suggests a strong market presence and potential growth in this category. However, the Edible category tells a different story; the brand fell from 7th in October 2025 to 11th in November and maintained this position into January 2026, indicating potential challenges or increased competition in this market segment.

In the Vapor Pens category, Verdant Leaf Farms maintained a relatively stable presence, fluctuating slightly between 13th and 15th place over the months observed. Although the brand's rank in this category did not improve significantly, it consistently remained within the top 15, suggesting a steady demand for their products. Notably, the absence of Verdant Leaf Farms from the top 30 in any other state or province could imply either a focus on the Oregon market or challenges in expanding their footprint beyond this region. This information provides a glimpse into the brand's current market dynamics and potential areas for strategic focus.

Competitive Landscape

In the competitive landscape of vapor pens in Oregon, Verdant Leaf Farms has experienced notable fluctuations in its market position from October 2025 to January 2026. Initially ranked 14th in October 2025, Verdant Leaf Farms saw a slight dip to 15th in November, a recovery to 13th in December, and then a return to 15th in January 2026. This variability in rank reflects a dynamic market environment where competitors like Sessions Cannabis Extract and Gem Carts have also shown shifts in their standings, with Sessions Cannabis Extract dropping from 13th to 16th in December before rising to 14th in January, and Gem Carts improving from 16th in October to 13th in January. Despite these changes, Verdant Leaf Farms maintained a competitive edge in sales, consistently outperforming Altered Alchemy and Boujee Blendz throughout the period. This suggests that while rank fluctuations are present, Verdant Leaf Farms' sales performance remains robust, indicating a strong brand presence in Oregon's vapor pen market.

Notable Products

In January 2026, Verdant Leaf Farms saw its top-performing products led by Crimson Tide Live Rosin & Cured Resin Cartridge (1g) and Sunny Breeze Live Rosin & Cured Resin Cartridge (1g), both securing the first rank with sales of 2385 units each. Following closely was Sugar Summit Live Rosin & Cured Resin Cartridge (1g) in the second position, with sales figures reaching 2143 units. The Cherry Live Rosin Gummy (100mg) emerged as a popular edible, ranking third with notable sales of 2110 units. Cherry Delight Live Rosin & Cured Resin Cartridge (1g) completed the top four, indicating a strong preference for vapor pens among consumers. Compared to previous months, these products have maintained consistent popularity, with no ranking data available for the prior months indicating a possible introduction or re-evaluation of their positions in January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.