Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

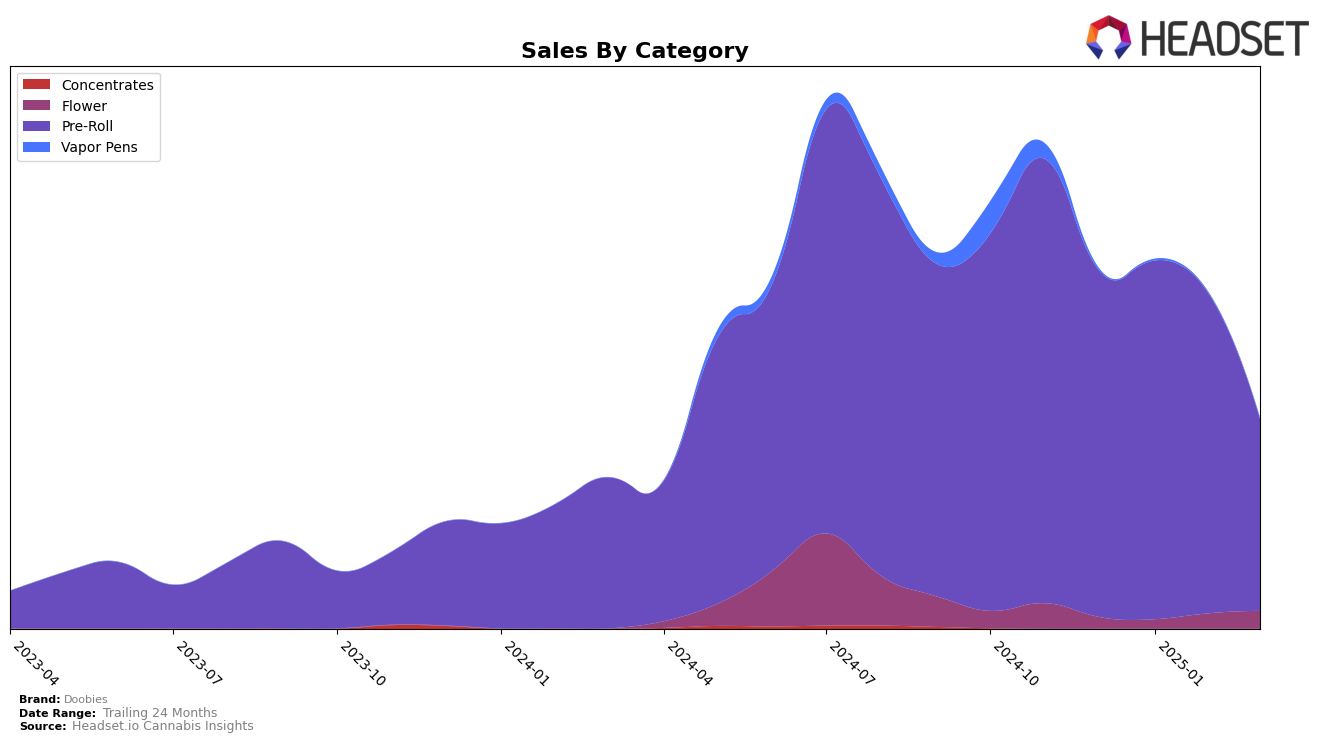

Doobies has experienced varied performance across states and categories in recent months. In Michigan, the brand has seen a notable decline in its Pre-Roll category ranking, dropping from 9th place in December 2024 to 17th place by March 2025. This downward trend is accompanied by a significant decrease in sales, from over $965,000 in December to just under $477,000 by March. Such a decline suggests potential challenges in maintaining market share or increased competition within the state. Conversely, in New York, Doobies was not ranked in the top 30 in December 2024 or January 2025 but made a notable entry into the rankings by February 2025, reaching 81st place and improving further to 56th place by March. This upward movement indicates a growing presence and possibly an effective market strategy in New York.

The performance of Doobies in the Pre-Roll category highlights the brand's varying success in different markets. The brand's consistent presence in Michigan's top 10 through February suggests a strong foothold, although the drop in March is a point of concern. Meanwhile, the brand's emergence in New York's rankings from February to March is a positive sign of expansion and increased consumer recognition. The absence of rankings in the earlier months in New York reflects the initial struggle to penetrate the market but also underscores the brand's potential for growth as it gains traction. The contrasting trends between these states offer insights into the brand's strategic focus and market dynamics, pointing to potential areas for improvement and opportunity.

Competitive Landscape

In the competitive landscape of the Michigan Pre-Roll category, Doobies experienced notable fluctuations in its ranking and sales from December 2024 to March 2025. Initially ranked 9th in December, Doobies improved to 8th place in January and February, but experienced a significant drop to 17th in March. This decline coincided with a decrease in sales, highlighting potential challenges in maintaining market share. In contrast, Seed Junky Genetics showed a positive trend, moving from outside the top 20 to 15th place by March, with a corresponding increase in sales. Similarly, Swisher made a remarkable leap from 49th in December to 16th in March, indicating a strong upward trajectory. Meanwhile, Goldkine and Top Smoke also experienced variable rankings, but their sales remained relatively stable. These dynamics suggest that while Doobies has been a strong contender, emerging competitors are gaining ground, emphasizing the need for strategic adjustments to sustain its competitive edge in the Michigan market.

Notable Products

In March 2025, the top-performing product from Doobies was the Apple Fritter Pre-Roll (1g), which secured the number one rank in the Pre-Roll category with sales of 28,240. Superboof Pre-Roll (1g) climbed back to the second position after slipping to fifth in February, showing a strong recovery. Strawberry Runtz Pre-Roll (1g) maintained a solid performance, ranking third, having previously held the second spot. Platinum Lemon Cherry Gelato Pre-Roll (1g) entered the top five for the first time, securing the fourth position. Stoned Jabrone Pre-Roll (1g) rounded out the top five, marking its debut in the rankings this month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.