Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

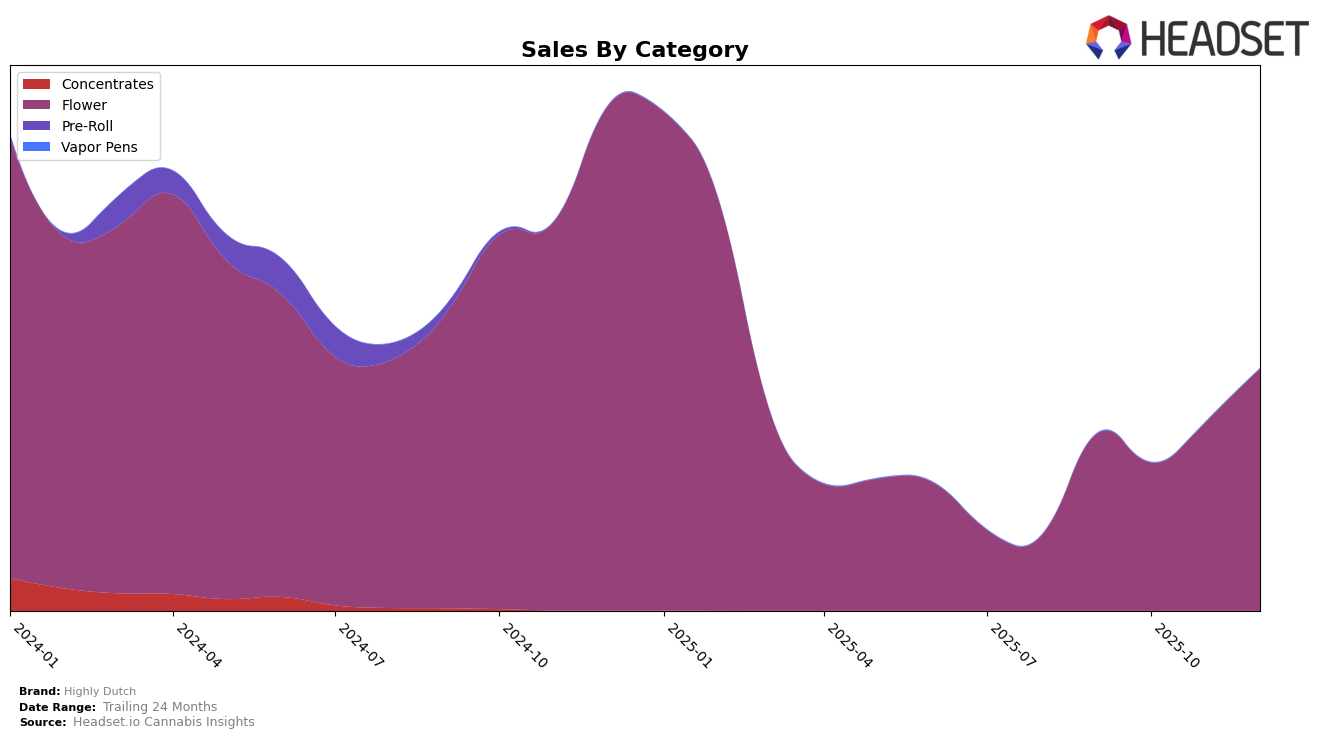

In the competitive cannabis market, Highly Dutch has shown notable progress across various provinces in Canada, particularly in the Flower category. In Alberta, the brand has made a steady climb, moving from a rank of 62 in September 2025 to 51 by December 2025. This upward trajectory is a positive indicator of the brand's growing presence and acceptance in the market. The sales figures in Alberta reflect this momentum, with a significant increase from 58,132 CAD in September to 98,169 CAD in December. Meanwhile, in British Columbia, Highly Dutch experienced a dip in October, dropping to rank 51, but quickly rebounded to rank 25 by December. This fluctuation suggests a volatile yet promising market position in British Columbia.

In Ontario, Highly Dutch has consistently improved its rank, moving from 43 in September to 35 in December 2025. This consistent improvement in ranking, coupled with a steady rise in sales, indicates a strengthening foothold in Ontario's Flower category. Interestingly, the brand's rank in British Columbia in October was notably outside the top 30, which could be seen as a temporary setback or an opportunity for strategic adjustments. Such movements highlight the dynamic nature of the cannabis market and the importance of maintaining adaptability to consumer preferences and market conditions.

Competitive Landscape

In the competitive landscape of the Flower category in Ontario, Highly Dutch has shown a positive trajectory in its market position over the last few months of 2025. Notably, Highly Dutch improved its rank from 43rd in September to 35th by December, indicating a consistent upward trend in its market presence. This is in contrast to brands like Tweed, which experienced a decline, dropping from 27th to 32nd in the same period, and Dime Bag (Canada), which fluctuated but ultimately improved to 37th. Meanwhile, Tuck Shop saw a significant leap from 46th to 33rd, suggesting a competitive push in the market. Highly Dutch's sales growth also reflects this positive momentum, with a notable increase in sales each month, culminating in a strong December performance. This upward movement in both rank and sales highlights Highly Dutch's growing influence and competitive edge in the Ontario Flower market, positioning it as a brand to watch in the coming months.

Notable Products

In December 2025, the top-performing product for Highly Dutch was Amsterdam Sativa (28g) in the Flower category, maintaining its first-place ranking since September with a notable sales figure of 2948 units. Rotterdam Indica (28g), also in the Flower category, consistently held the second position throughout the same period. Organic Cherry Mints (28g) showed a stable performance, securing the third rank for December, improving from its fourth-place ranking in September and October. Durban Gorilla (28g) ended December in fourth place, slightly improving from its fifth position in October. Organic Butter Cookies x Organic NYC Juggernaut (28g) maintained the fifth rank in December, despite a slight dip in sales from the previous month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.