Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

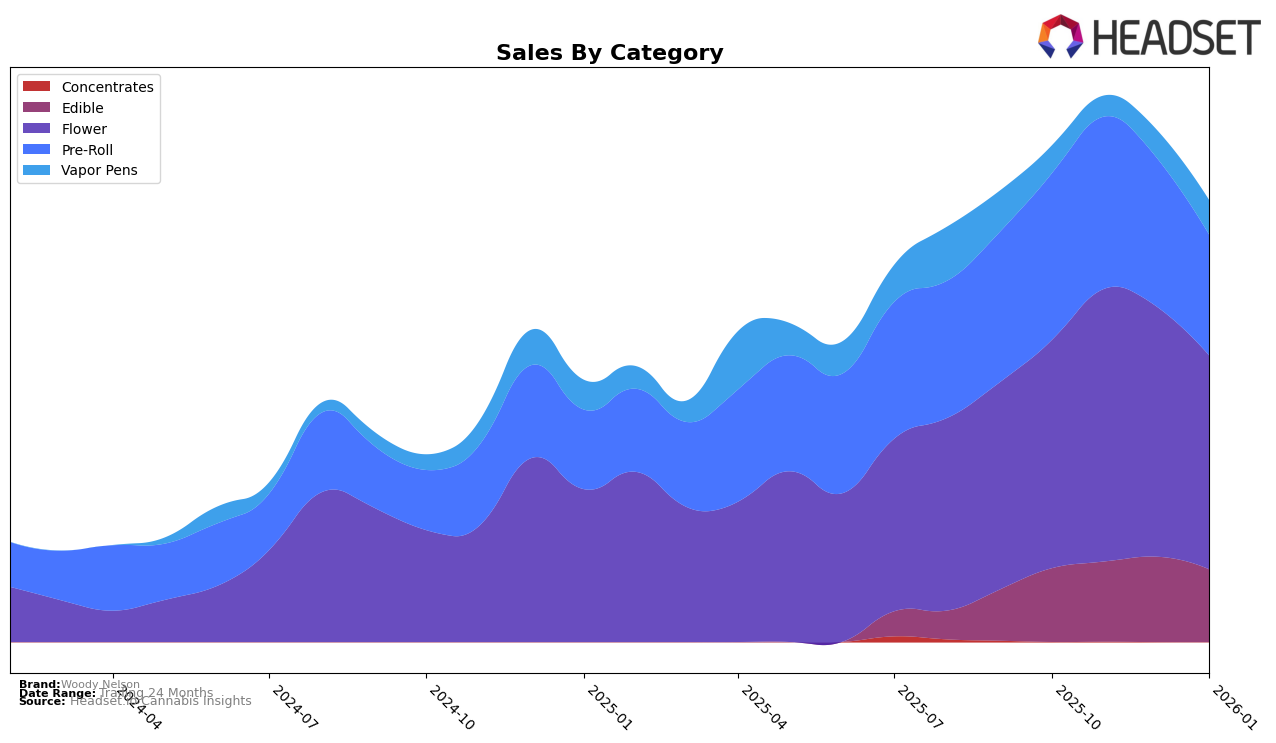

In British Columbia, Woody Nelson has shown varying performance across different cannabis categories. The brand's presence in the Edible category saw a slight decline, moving from a rank of 4 in October 2025 to 9 by January 2026. Meanwhile, their Flower category rankings experienced a more significant drop from 3 to 17 over the same period. This suggests a potential shift in consumer preference or increased competition within the province. Interestingly, the Vapor Pens category showed a positive trend, improving from an initial rank of 35 in October to 28 by January, indicating a growing acceptance or demand for this product line in the region.

In Ontario, Woody Nelson's performance also presents a mixed picture. The brand maintained a stable position in the Edible category, consistently ranking around 9th place from November 2025 to January 2026, which may suggest a loyal consumer base for these products. However, their Pre-Roll category faced challenges, as evidenced by a decline in rankings, slipping out of the top 30 by January 2026. The Vapor Pens category, similar to British Columbia, did not make it to the top 30, highlighting potential areas for growth or market penetration. Overall, these movements across categories and regions provide insights into the brand's market dynamics and consumer preferences in different territories.

Competitive Landscape

In the competitive landscape of the Flower category in Ontario, Woody Nelson has shown a gradual improvement in its ranking, moving from 28th in October 2025 to 26th by January 2026. This upward trend indicates a positive reception in the market, although it still trails behind competitors like EastCann and BLKMKT, which consistently ranked higher during the same period. Notably, Sixty Seven Sins experienced a decline, dropping from 22nd to 27th, which could potentially open up opportunities for Woody Nelson to capture more market share. Meanwhile, BC Smalls remained lower in rank, providing a buffer for Woody Nelson's position. Despite fluctuations in sales figures, Woody Nelson's consistent improvement in rank suggests a strengthening brand presence, positioning it well for future growth in Ontario's competitive Flower market.

Notable Products

In January 2026, the top-performing product from Woody Nelson was the Rocketeer Infused Pre-Roll (1g) in the Pre-Roll category, maintaining its consistent first-place ranking from previous months, although its sales dropped to 12,142 units. The Rainbow Driver Resin-Infused Fruit Chews 10-Pack (100mg) continued to secure the second position in the Edible category, closely following the leader with strong sales. The Rainbow Driver Pre-Roll 5-Pack (2.5g) held its steady third position in the Pre-Roll category, showing a slight decrease in sales. The Rainbow Driver (3.5g) in the Flower category remained in fourth place, with its sales showing a decline over the months. Lastly, the Mega Purple Gastro Pop Resin-Infused Gummies 10-Pack (100mg) maintained its fifth position in the Edible category, despite fluctuating sales figures in the previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.