Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

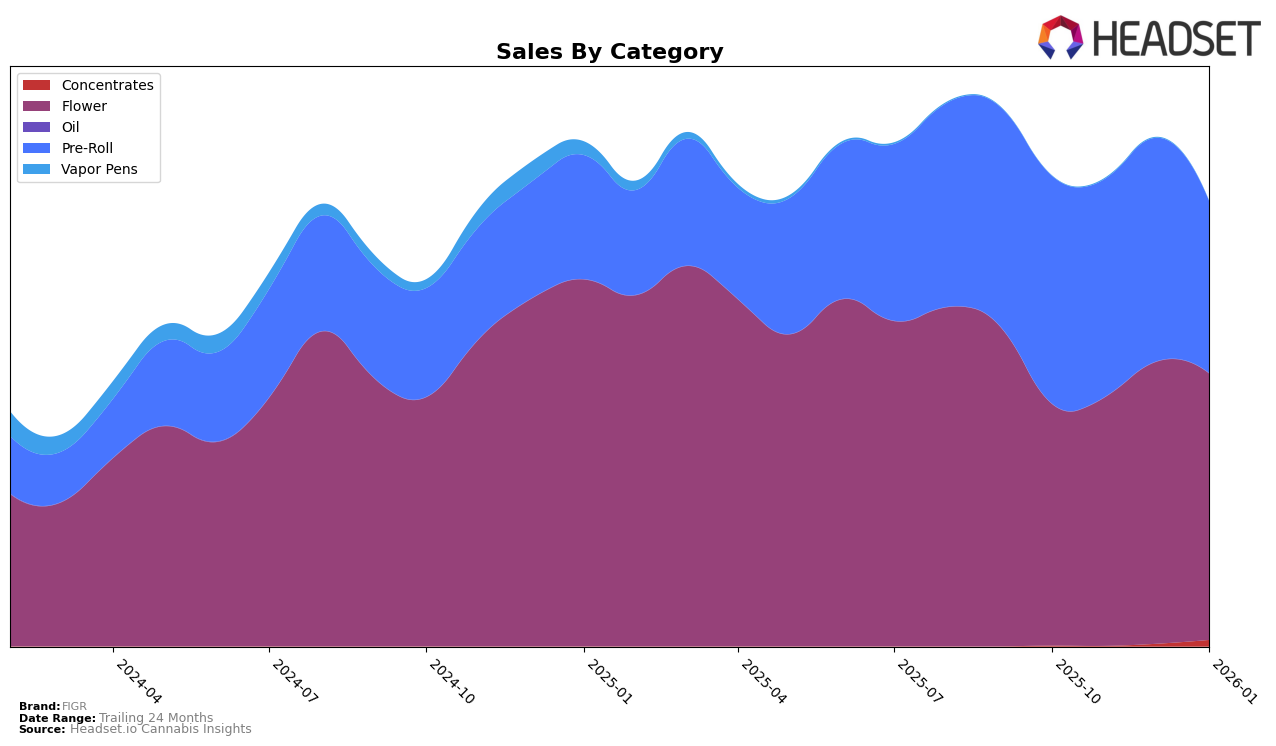

In the Alberta market, FIGR's performance in the Flower category has shown a consistent presence, maintaining a steady ranking around the 11th to 13th position from October 2025 to January 2026. Despite a slight drop in January, this stability suggests a solid foothold in the market. However, the Pre-Roll category tells a different story, with FIGR slipping from 24th to 38th over the same period, indicating potential challenges in maintaining their market share or perhaps a shift in consumer preferences. This downward trend in Pre-Rolls might require strategic adjustments to regain traction in the market.

In British Columbia, FIGR's trajectory in the Flower category is noteworthy. Starting outside the top 30, the brand climbed to 20th by January 2026, highlighting significant growth and increased consumer interest. Meanwhile, in Ontario, FIGR has demonstrated remarkable consistency in the Flower category, holding steady at 16th place across four months. The Pre-Roll category in Ontario shows an upward trend, maintaining a top 10 position since December 2025, which is a positive indicator of FIGR's strong market presence. However, in Saskatchewan, FIGR's Flower ranking was absent in January 2026, suggesting a potential drop in visibility or sales within that province.

Competitive Landscape

In the competitive landscape of the flower category in Ontario, FIGR has consistently held the 16th rank from October 2025 to January 2026. Despite maintaining its position, FIGR faces stiff competition from brands like 1964 Supply Co and Good Supply, which have shown slightly more dynamic rank changes, with both brands maintaining higher ranks than FIGR throughout the period. Notably, Good Supply experienced a downward trend from 12th to 14th, while 1964 Supply Co improved its rank in December 2025. FIGR's sales figures show a positive trend in December 2025, but they remain lower than those of its competitors, indicating a need for strategic initiatives to boost brand visibility and sales. Meanwhile, MTL Cannabis and Potluck trail behind FIGR, with both brands experiencing fluctuations in their rankings, suggesting potential opportunities for FIGR to strengthen its market position by capitalizing on these competitors' inconsistencies.

Notable Products

In January 2026, FIGR's top-performing product was Jungle Fumes Pre-Roll 10-Pack (3.5g), maintaining its number one rank from previous months with a sales figure of 12,575. Mellow Man Pre-Roll 10-Pack (3.5g) consistently held its second position, followed by Chatty Kathy Pre-Roll 10-Pack (3.5g) in third place. Kandy Cake Pre-Roll 10-Pack (3.5g) remained in the fourth position, showing stability in its rankings. Notably, Mellow Man (14g) debuted in January 2026 at the fifth spot, indicating a successful entry into the market despite no prior sales data. This consistency in rankings for the top four products suggests a strong customer preference for these pre-roll offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.