Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

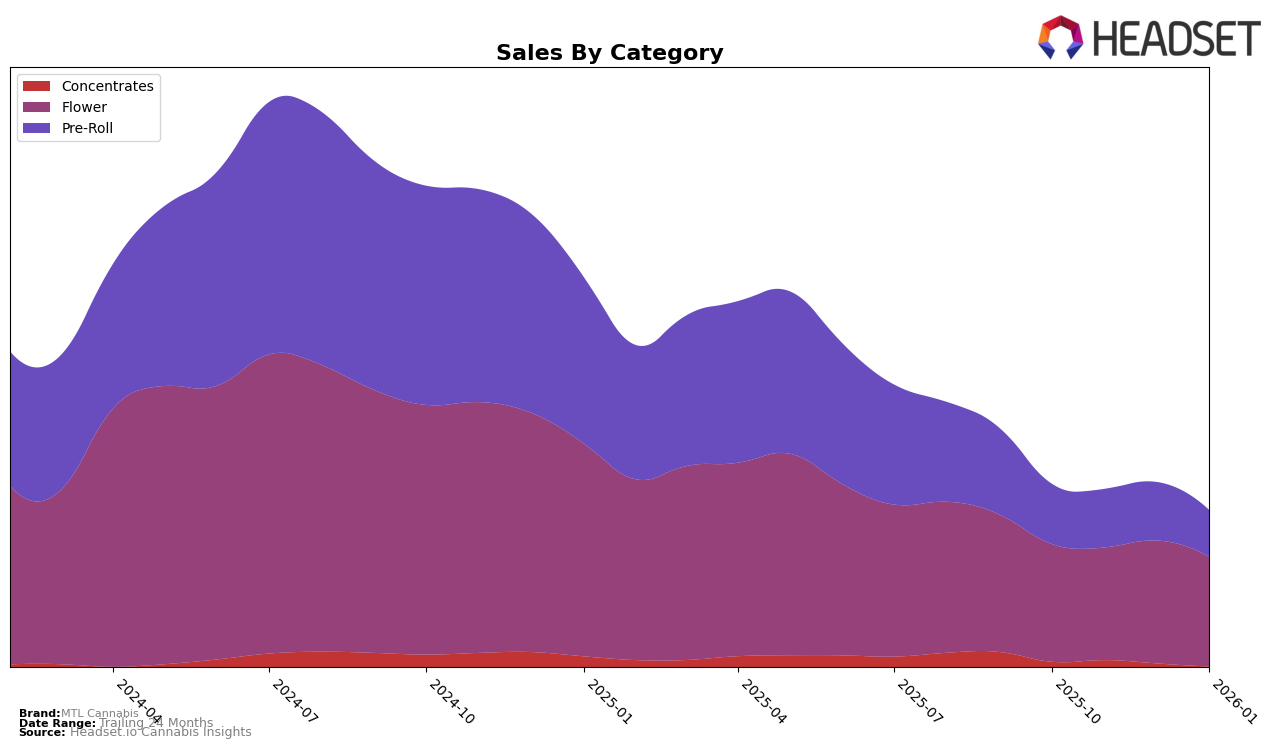

MTL Cannabis has shown varied performance across different categories and provinces. In Alberta, the brand's Flower category has seen a downward trend, with its ranking slipping from 48th in October 2025 to 55th by January 2026. This decline is mirrored in sales, which decreased from approximately $104,980 to $75,935 over the same period. Conversely, in British Columbia, MTL Cannabis's Flower category initially improved, reaching 35th in December 2025, before dropping to 42nd in January 2026. Meanwhile, the Pre-Roll category in British Columbia has shown consistent improvement, moving from not being in the top 30 in October 2025 to 41st by January 2026, indicating a positive trend in consumer preference.

In Ontario, MTL Cannabis has maintained a strong presence in the Concentrates category, holding a top 10 position throughout the observed months, despite a gradual decline in sales. The Flower category remains robust, with the brand ranking consistently around the 18th position, suggesting a stable demand. However, the Pre-Roll category in Ontario has seen a decline, dropping from 26th to 36th from October 2025 to January 2026. In Saskatchewan, MTL Cannabis's performance in the Flower category has fluctuated slightly, but it has managed to regain its 16th position by January 2026. The Pre-Roll category also shows resilience, maintaining a strong position within the top 15, indicating a steady consumer base in the province.

Competitive Landscape

In the competitive landscape of the Flower category in Ontario, MTL Cannabis has shown a modest improvement in its ranking from 19th in November 2025 to 17th by January 2026. Despite this positive movement, MTL Cannabis remains behind competitors such as 1964 Supply Co, which consistently held a rank between 14th and 15th, and FIGR, which maintained a steady 16th position throughout the same period. Notably, Potluck, despite a decline in sales in January 2026, managed to stay ahead of MTL Cannabis until the last month of the period. The sales trajectory for MTL Cannabis indicates a recovery in January 2026, yet it still trails behind these competitors, suggesting a need for strategic initiatives to boost its market presence and sales performance in the coming months.

Notable Products

In January 2026, the top-performing product from MTL Cannabis was the Sage N Sour Pre-Roll 3-Pack (1.5g) in the Pre-Roll category, maintaining its number one rank for four consecutive months with sales of 8750 units. The Wes' Coast Kush Hash (2g) Concentrates held steady in second place, showing consistent performance since October 2025. The Jungl' Cake Pre-Roll 7-Pack (3.5g) appeared in the rankings for the first time, debuting at the third position. The Strawberry N' Mintz Pre-Roll 3-Pack (1.5g) slipped from second in December 2025 to fourth in January 2026, indicating a decrease in sales figures. Lastly, the Sage N Sour (3.5g) Flower dropped to fifth place, showing a downward trend from its fourth position in December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.