Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

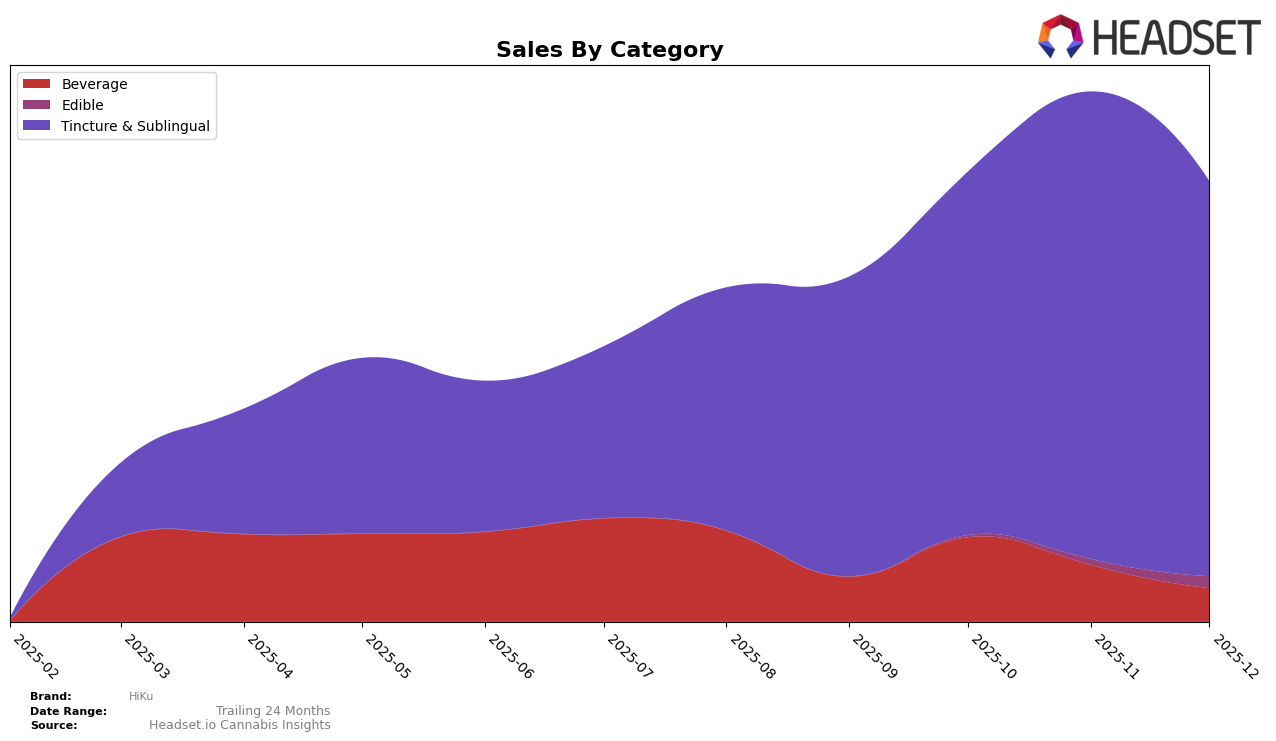

HiKu has demonstrated a strong performance in the Tincture & Sublingual category within Washington. Over the last few months of 2025, HiKu maintained a consistent presence in the top three rankings, moving from fourth place in September to third place from October through December. This steady position highlights HiKu's ability to compete effectively in a competitive market segment. Notably, HiKu's sales in this category saw a significant increase from October to November, indicating a successful strategy or product offering that resonated well with consumers during this period. However, the slight decline in sales from November to December suggests potential challenges or seasonal fluctuations that the brand may need to address to sustain its momentum.

While HiKu's performance in the Tincture & Sublingual category in Washington is commendable, the absence of rankings in other states or provinces within the top 30 could be a point of concern. This lack of presence in other markets might suggest limited geographical reach or varying competitive dynamics outside Washington. For a brand aiming for broader recognition and market share, expanding its footprint and improving visibility in other regions could be crucial. The data highlights the importance of strategic market expansion and adaptation to diverse consumer preferences across different regions.

Competitive Landscape

In the Washington Tincture & Sublingual category, HiKu has demonstrated a notable upward trend in its ranking over the last few months of 2025. Starting from a 4th place position in September, HiKu climbed to 3rd place by October and maintained this rank through December. This improvement in rank is indicative of a positive shift in consumer preference or effective marketing strategies, as HiKu surpassed Ceres, which dropped from 3rd to 4th place during the same period. Despite this progress, HiKu remains behind Fairwinds and Green Revolution, which have consistently held the 2nd and 1st positions, respectively. The sales figures for HiKu reflect a fluctuating yet generally upward trend, suggesting potential for further growth if the brand can continue to capitalize on its current momentum and address the competitive pressure from the leading brands.

Notable Products

In December 2025, the top-performing product from HiKu was the CBD/THC 1:4 Lavender Lemonade Distillate Drink Enhancer, maintaining its first-place position for the third consecutive month with sales of 2886. The CBG/THC 1:4 Strawberry Pineapple Rosin Drink Enhancer secured the second spot, consistently holding this rank since November. The THC/CBN 4:1 Passion Orange Guava Solventless Rosin Drink Enhancer climbed to the third position, marking a significant rise from its initial fifth place in September. The CBN/THC 1:4 Grape Punch Solventless Rosin Drink Enhancer moved up to fourth, improving from its fifth-place rank in November. The CBD/THC 1:4 Lavender Lemonade Rosin Drink Enhancer entered the rankings for the first time in December, debuting at fifth place.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.