Sep-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

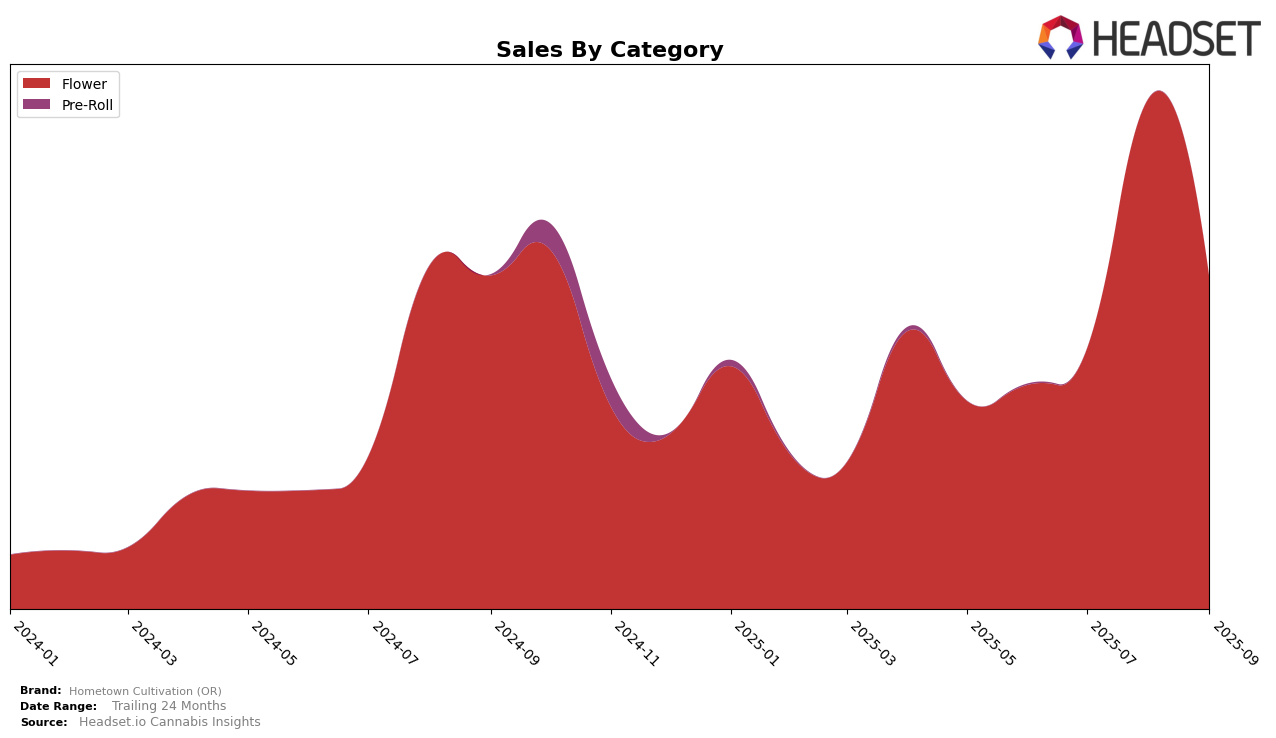

Hometown Cultivation (OR) has demonstrated noticeable shifts in its performance across the Flower category in the state of Oregon. Over the summer months of 2025, the brand climbed from not being in the top 30 in June to securing a notable position by August, where it peaked at rank 22. This upward movement indicates a strong performance and growing market presence in Oregon's Flower category. However, by September, the brand experienced a slight decline, moving to rank 30, which still represents a significant improvement from its position earlier in the summer. This fluctuation suggests that while Hometown Cultivation (OR) has made impressive gains, maintaining a consistent top ranking remains a challenge in the competitive Oregon market.

In terms of sales, Hometown Cultivation (OR) saw a substantial increase from June to August, with sales more than doubling during this period. This growth suggests a successful strategy in capturing consumer interest and expanding its market share within the Flower category. However, the subsequent dip in sales in September, although still above June levels, points to potential volatility in consumer demand or market conditions. The brand's performance trajectory highlights the dynamic nature of the cannabis market in Oregon, where brands must continuously adapt to maintain their competitive edge. As Hometown Cultivation (OR) continues to navigate these challenges, its ability to sustain and build upon its recent gains will be crucial for future success.

Competitive Landscape

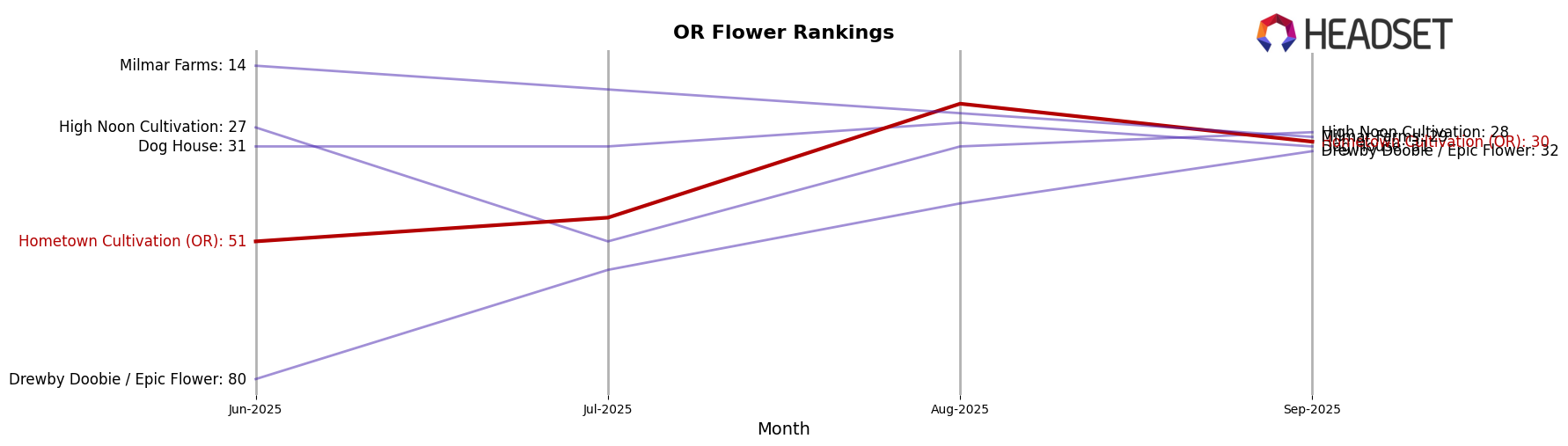

In the competitive landscape of the Oregon flower market, Hometown Cultivation (OR) has experienced notable fluctuations in its ranking over recent months. Starting from a rank of 51 in June 2025, the brand made a significant leap to 22 in August before settling at 30 in September. This volatility suggests a dynamic market presence, potentially driven by strategic marketing or product launches. In contrast, competitors like Milmar Farms have shown a more consistent presence, albeit with a downward trend from 14 in June to 29 in September. Meanwhile, High Noon Cultivation displayed a similar pattern of fluctuation, peaking at 27 in June and dropping to 51 in July before recovering to 28 in September. The sales data indicates that while Hometown Cultivation (OR) saw a peak in August, it remains behind Milmar Farms in terms of overall sales volume, suggesting room for growth in market share. These insights highlight the competitive pressures and opportunities for Hometown Cultivation (OR) to capitalize on its upward momentum in the Oregon flower market.

Notable Products

In September 2025, the top-performing product for Hometown Cultivation (OR) was Silver Hawk OG (Bulk) in the Flower category, achieving the number one rank with sales of 2,923 units. Following closely was Durban Poison (Bulk), which maintained a strong position at rank two, despite a slight decline from its top position in July. Blue Dream (Bulk) held the third spot, experiencing a drop from its second-place ranking in August. Jam Jam (Bulk) ranked fourth, consistent with its position in August, showing stability in its sales performance. Raspberry Parade (Bulk) entered the top five for the first time, securing the fifth position and indicating a potential rise in popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.