Oct-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

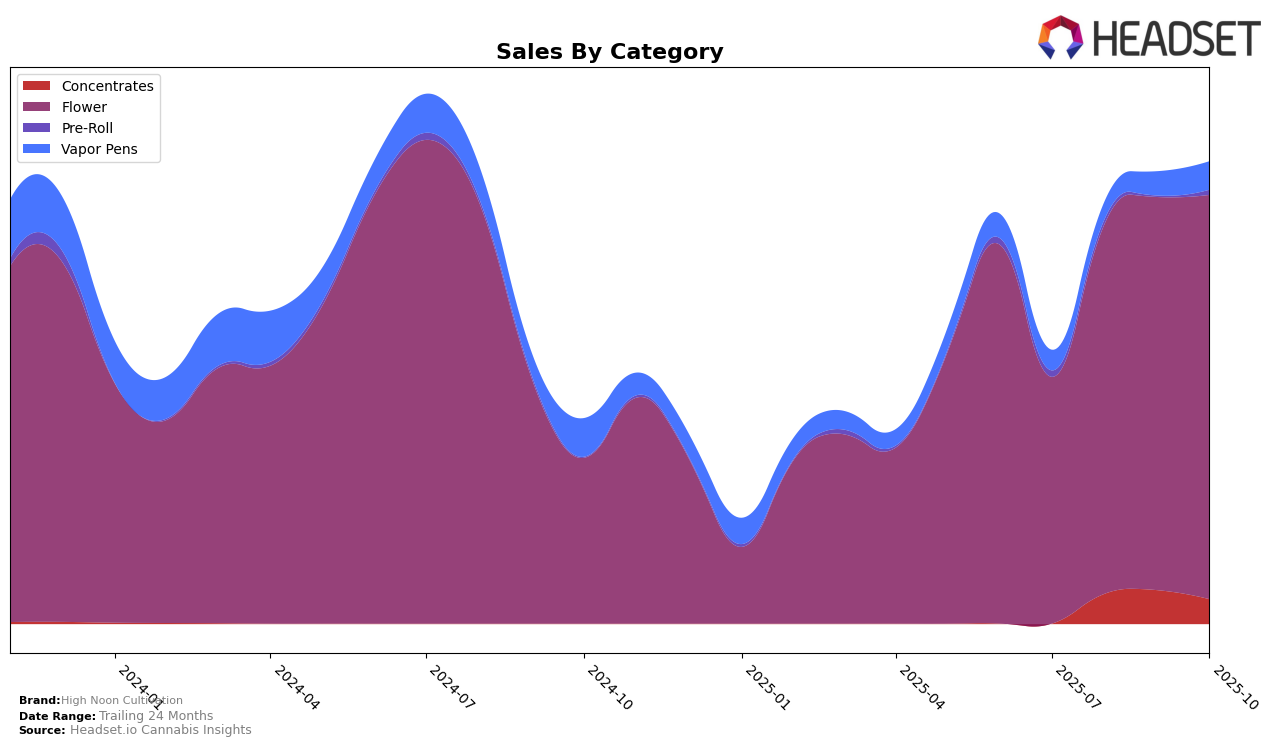

High Noon Cultivation has shown varied performance across different categories and states. In the Oregon market, their presence in the Concentrates category has been inconsistent, as evidenced by their rankings fluctuating from 62nd in August to 67th in October 2025, indicating they did not make it to the top 30 brands during these months. This suggests challenges in maintaining a strong position within this category. Their sales also reflected this volatility, peaking in August and then declining by October. This could indicate either strong competition or a need for strategic adjustments in their product offerings or marketing within the Concentrates category.

Conversely, High Noon Cultivation's performance in the Flower category in Oregon has been more promising. They achieved a significant leap from the 50th position in July to the 26th position by September 2025, before slightly dropping to 29th in October. This upward trend, despite the slight dip, suggests a strengthening market presence in the Flower category. Sales figures support this trend, with a notable increase from July to October, indicating growing consumer preference or successful marketing strategies. This upward trajectory in the Flower category could be an area for High Noon Cultivation to capitalize on to solidify their market position further.

Competitive Landscape

In the competitive landscape of the Oregon Flower category, High Noon Cultivation has shown a notable upward trajectory in recent months. Starting from a rank of 50 in July 2025, High Noon Cultivation climbed to the 26th position by September, before slightly dipping to 29th in October. This improvement in rank is indicative of a positive trend in sales, contrasting with competitors like Self Made Farm, which experienced a decline from 15th in July to 27th in October. Meanwhile, Focus North saw fluctuating ranks, peaking at 15th in August but falling to 30th by October. Thunder Farms and Alta Gardens also experienced varying ranks, with Thunder Farms improving to 28th in October and Alta Gardens dropping to 35th. These shifts highlight High Noon Cultivation's growing presence and competitiveness in the market, suggesting a strategic advantage that could be leveraged for further growth.

Notable Products

In October 2025, Blueberry Motor Oil (3.5g) from High Noon Cultivation retained its position as the top-selling product, maintaining its number one rank from September with impressive sales figures reaching 3085 units. Buckaroo (Bulk) emerged as the second best-seller, making its debut on the rankings this month. Sausalito (Bulk) dropped one position to third place compared to its second-place ranking in September, with sales figures of 944 units. Strawberry Sherb Cake (Bulk) and GMO (Bulk) rounded out the top five, ranking fourth and fifth respectively, both appearing in the rankings for the first time this month. Overall, the October rankings highlight a strong performance by Blueberry Motor Oil and notable entries by Buckaroo and Strawberry Sherb Cake.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.