Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

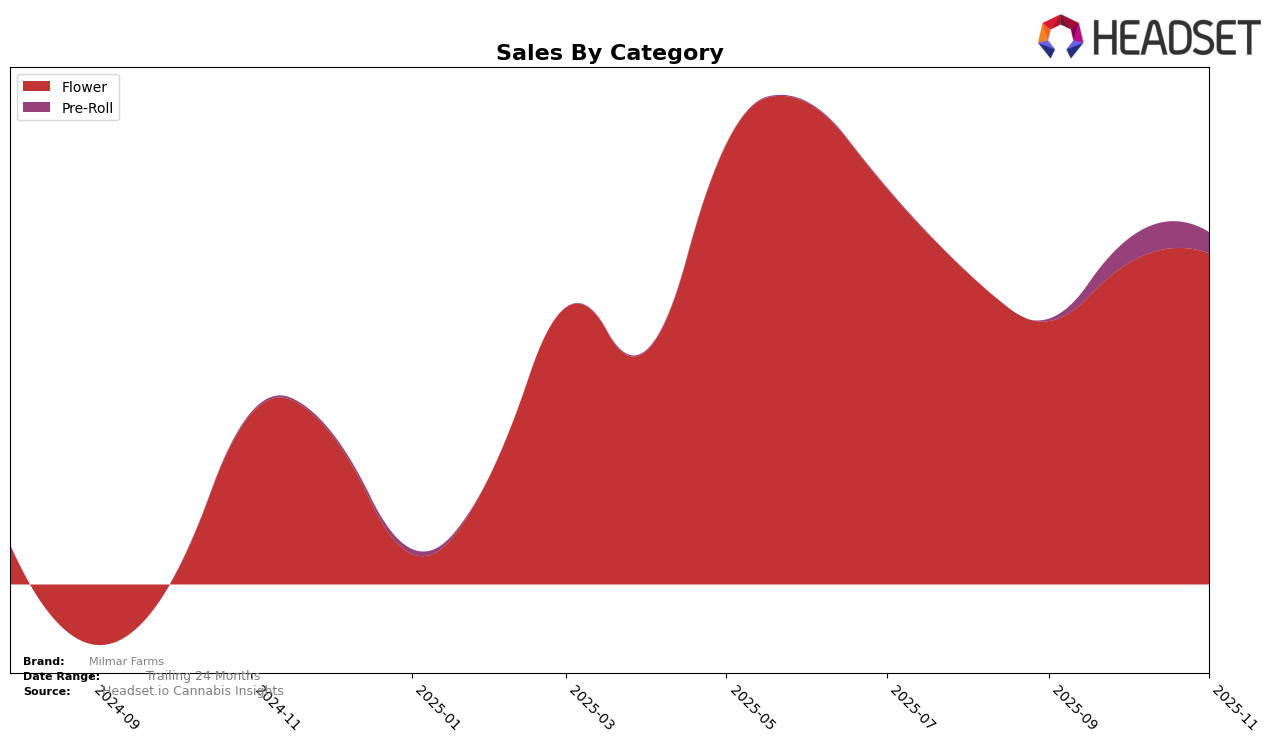

Milmar Farms has shown a noteworthy performance in the Oregon market, particularly in the Flower category. Over the past few months, the brand has exhibited a positive trajectory, climbing from the 28th rank in September 2025 to the 20th rank by November 2025. This upward movement in the rankings coincides with a steady increase in sales, with November figures reaching $243,701. This suggests that the brand is gaining a stronger foothold in the Flower category within Oregon, potentially due to factors such as product quality or effective distribution strategies. However, it's important to note that Milmar Farms was not ranked in the top 30 for the Pre-Roll category until October and November, indicating a relatively weaker presence or a late entry into this segment.

The Pre-Roll category presents a mixed picture for Milmar Farms in Oregon. Despite not being in the top 30 rankings in the earlier months, the brand made its entry at the 78th position in October, slightly improving to 75th in November. While this movement is positive, it highlights the challenges the brand faces in establishing itself in this category compared to its performance in Flower. The sales figures for Pre-Rolls, although improving, remain modest compared to the Flower category. This could indicate an area of opportunity for Milmar Farms to explore further strategies to enhance its market presence and consumer appeal in the Pre-Roll segment.

Competitive Landscape

In the competitive landscape of the Oregon flower market, Milmar Farms has demonstrated a notable upward trajectory in its ranking and sales performance from August to November 2025. Starting at rank 23 in August, Milmar Farms improved to rank 20 by November, indicating a positive shift in market position. This improvement is significant when compared to competitors such as Self Made Farm, which fluctuated between ranks 24 and 38, and Focus North, which saw a decline from rank 15 to 18 over the same period. Additionally, Midnight Fruit Company and The Crop Shop also experienced rank volatility, with the former moving from 25 to 19 and the latter from 57 to 22. Despite these fluctuations, Milmar Farms' consistent sales growth, particularly in October and November, suggests a strong market presence and effective competitive strategy, positioning it favorably against its peers.

Notable Products

In November 2025, Milmar Farms' top-performing product was the Frozen Black Cherry Pre-Roll (1g) in the Pre-Roll category, maintaining its leading position with sales reaching 7678 units. The Jealousy Pre-Roll 2-Pack (1.5g) also held steady in second place, showing a significant increase in sales from previous months. The Amnesia Haze (28g) emerged as a strong contender in the Flower category, debuting at third place with notable sales figures. Joker (1g) and Yellow Cake (Bulk) followed closely in fourth and fifth positions, respectively, indicating a robust performance in the Flower category. The rankings for these products have been consistent since their introduction, with no changes in their positions from October to November 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.