Jan-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

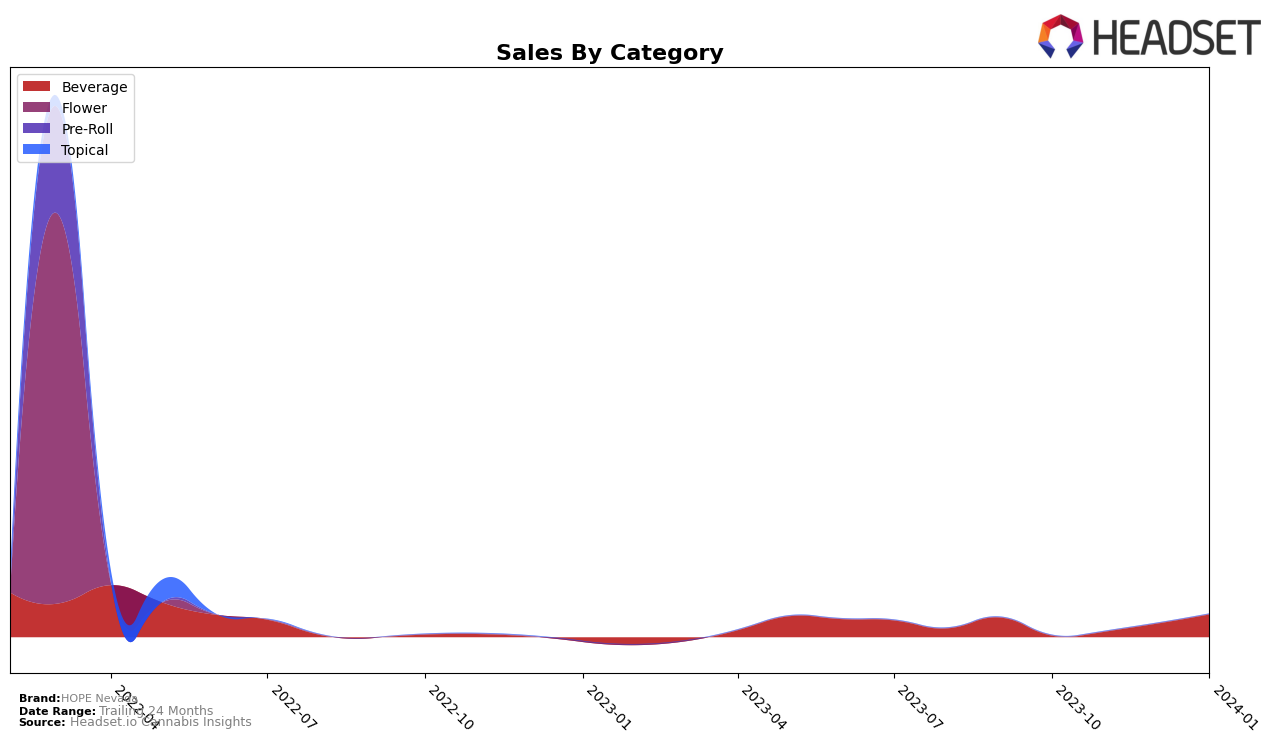

In the competitive cannabis market of Nevada, HOPE Nevada has shown a noteworthy performance in the Beverage category over the last few months. Starting from not being ranked in the top 20 brands in October 2023, the brand made a significant leap into the rankings by November, securing the 21st position. This upward trajectory continued through December and January, with rankings improving to 19th and then to an impressive 15th place, respectively. Such a consistent improvement in rankings is indicative of a growing consumer preference and possibly an effective strategy in brand positioning and product offerings. The sales figures bolster this narrative, with a notable increase from 386 units sold in November to 1689 units by January 2024, showcasing a robust growth in demand.

While the detailed performance of HOPE Nevada across other categories and states remains unexplored here, the data from Nevada's Beverage category alone suggests a positive momentum for the brand. The absence from the top 20 rankings in October followed by a strong finish at 15th place by January 2024 highlights not only the brand's significant market penetration but also its potential for sustainability and growth in a competitive landscape. This performance trajectory could serve as a microcosm of the brand's overall strategy and potential in broader markets, though further analysis would be required to paint a comprehensive picture. The sharp increase in sales volume over just a three-month period is particularly noteworthy and could imply successful marketing efforts, product quality, consumer satisfaction, or a combination of these factors.

Competitive Landscape

In the competitive landscape of the beverage category in Nevada, HOPE Nevada has shown a notable upward trajectory in terms of rankings and sales, despite not being ranked in October 2023. By January 2024, HOPE Nevada climbed to the 15th position, indicating a significant improvement in its market presence. This rise is particularly impressive when compared to Keef Cola, which experienced a decline from the 9th to the 17th rank over the same period, and Two Roots Brewing Co., which also saw a decrease in rank, ending at 16th position in January 2024. Conversely, WYLD and Pamos have maintained more stable positions, with WYLD moving up to the 13th position by January 2024 and Pamos slightly improving to the 14th. The sales growth and improved ranking of HOPE Nevada amidst these dynamics suggest a growing consumer interest and potential for further market penetration, positioning it as a brand to watch in the Nevada beverage sector.

Notable Products

In January 2024, HOPE Nevada's top-performing product was Hope Infused Lemonade (100mg) within the Beverage category, securing the first rank with notable sales figures of 77 units. Following in rank, Pina Colada Drink (100mg) took the second position, showcasing a slight decline from its leading status in October 2023 but maintaining strong performance throughout the period. Cannabrew Infused Iced Tea (100mg) emerged as the third top product, demonstrating consistent growth from not being ranked initially to holding a significant place in January. The Blueberry Lemonade (100mg) came in fourth, indicating a slight dip from its previous top positions in November and December 2023. These rankings highlight HOPE Nevada's dynamic market presence and the fluctuating consumer preferences within the Beverage category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.